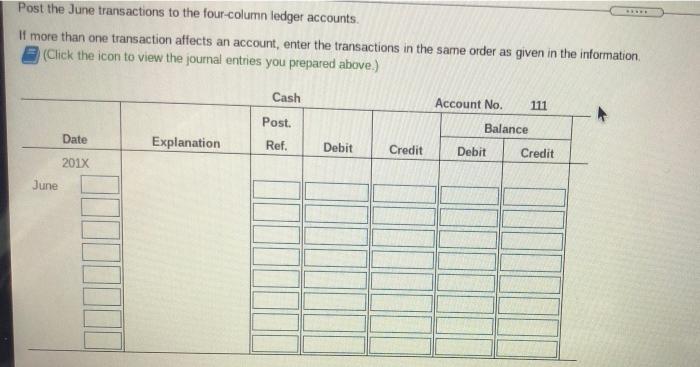

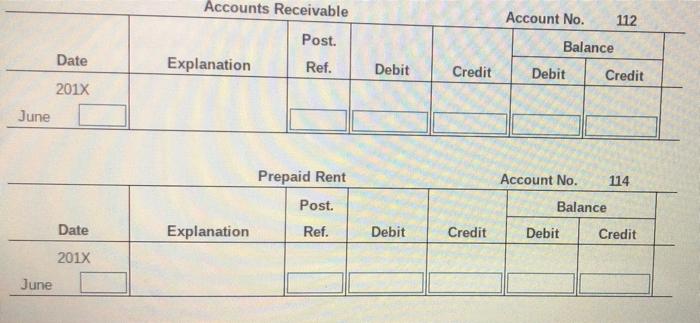

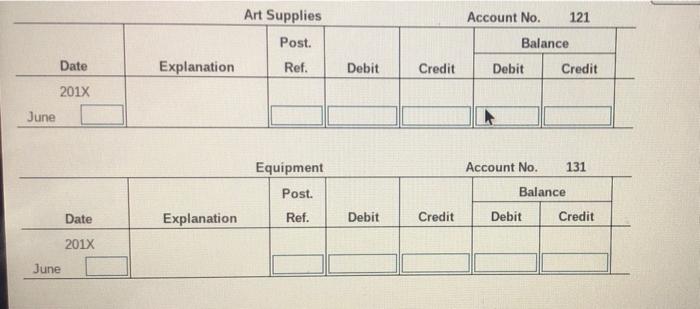

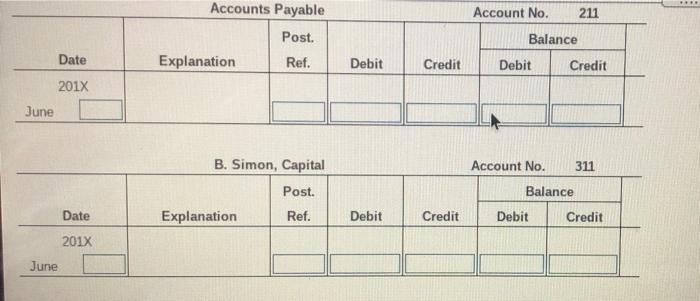

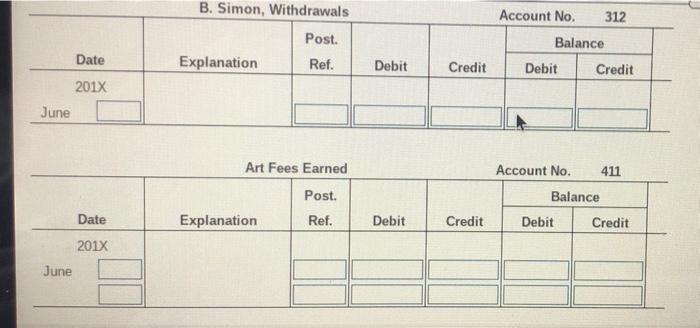

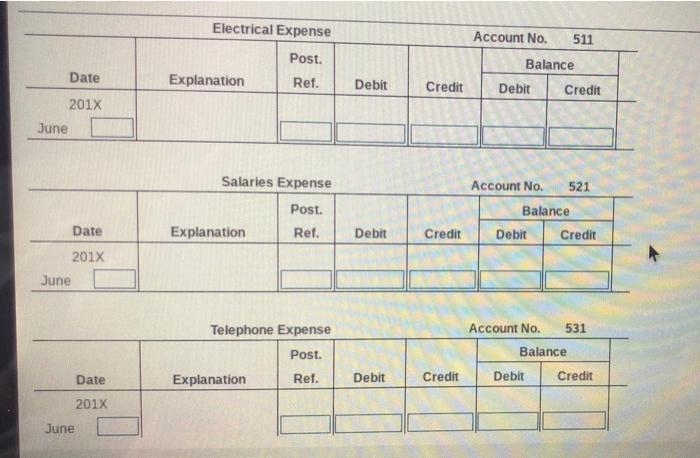

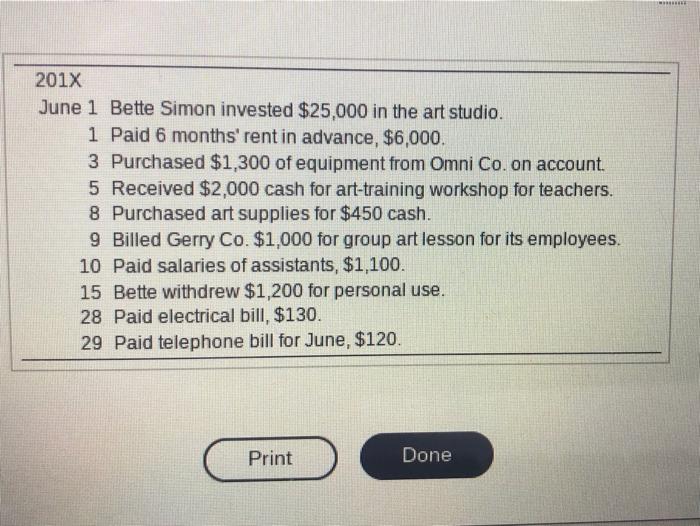

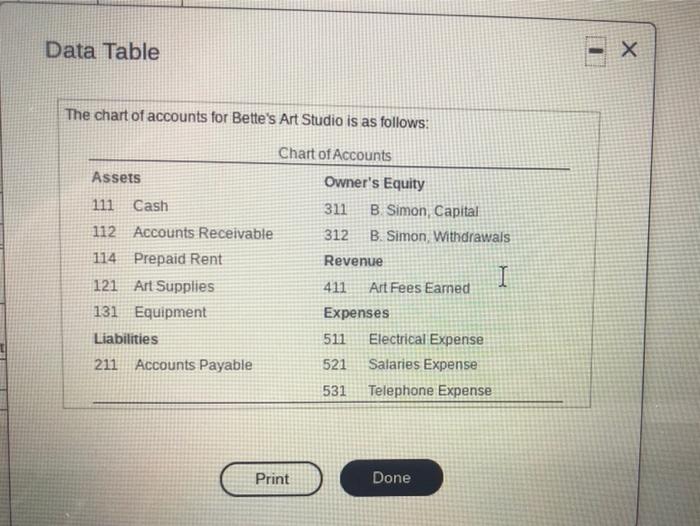

Post the June transactions to the four-column ledger accounts. If more than one transaction affects an account, enter the transactions in the same order as given in the information (Click the icon to view the journal entries you prepared above.) Cash Account No. 111 Post. Balance Date Explanation Ref. Debit Credit Debit Credit 201X June Account No. 112 Accounts Receivable Post. Explanation Ref. Balance Date 2017 Debit Credit Debit Credit June Prepaid Rent Account No. 114 Post. Balance Date Explanation Ref. Debit Credit Debit Credit 2018 June Account No. 121 Art Supplies Post. Balance Date Explanation Ref. Debit Credit Debit Credit 2017 June Equipment Account No. 131 Post. Balance Date Explanation Ref. Debit Credit Debit Credit 201X June Accounts Payable Account No. 211 Post. Balance Date Explanation Ref. Debit Credit Debit Credit 2017 June B. Simon, Capital Account No. 311 Balance Post. Ref. Date Explanation Debit Credit Debit Credit 2013 June B. Simon, Withdrawals Account No. 312 Post. Balance Date Explanation Ref. Debit Credit Debit Credit 2017 June Art Fees Earned Post. Explanation Ref. Account No. 411 Balance Debit Credit Date Debit Credit 2018 June Electrical Expense Account No. 511 Post. Balance Date Explanation Ref. Debit Credit Debit Credit 2018 June Salaries Expense Account No. 521 Balance Post. Ref. Date Explanation Debit Credit Debit Credit 2018 June Telephone Expense Account No. 531 Post. Balance Date Explanation Ref. Debit Credit Debit Credit 2018 June 201X June 1 Bette Simon invested $25,000 in the art studio. 1 Paid 6 months' rent in advance, $6,000. 3 Purchased $1,300 of equipment from Omni Co. on account. 5 Received $2,000 cash for art-training workshop for teachers. 8 Purchased art supplies for $450 cash. 9 Billed Gerry Co. $1,000 for group art lesson for its employees. 10 Paid salaries of assistants, $1,100. 15 Bette withdrew $1,200 for personal use. 28 Paid electrical bill, $130. 29 Paid telephone bill for June, $120. Print Done Data Table - X The chart of accounts for Bette's Art Studio is as follows: Chart of Accounts Assets Owner's Equity 111 Cash 311 B Simon Capital 112 Accounts Receivable 312 B. Simon Withdrawals 114 Prepaid Rent Revenue I 121 Art Supplies 411 Art Fees Eamed 131 Equipment Expenses Liabilities 511 Electrical Expense 211 Accounts Payable 521 Salaries Expense 531 Telephone Expense Print Done