Question

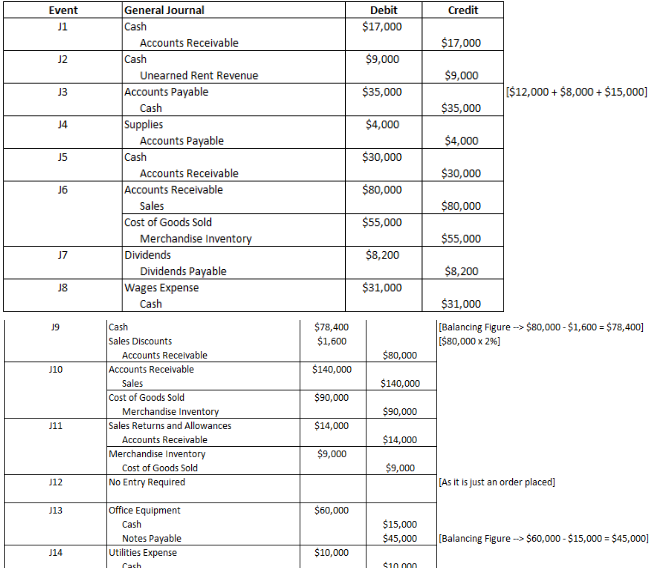

Post these entries to the general ledger. In the general ledger the first two columns are used to post the applicable debit or credit amount

Post these entries to the general ledger. In the general ledger the first two columns are used to post the applicable debit or credit amount from the journal entry. The second debit and credit columns are balance columns that show the balance of the applicable account. In the post ref (reference) column of the general ledger, use the journal entry number as the reference for each entry. J1 for the first entry, J2 for the second entry and so on. Explanations are not required in the general ledger, but are recommend for customer name or vendor name for Accounts Receivable and Accounts Payable accounts, respectively.

General Journal Cash Event Debit Credit $17,000 $9,000 $35,000 $4,000 $30,000 $80,000 $55,000 $8,200 $31,000 Accounts Receivable 17,000 $9,000 35,000 $4,000 $30,000 80,000 $55,000 $8,200 31,000 J2 Unearned Rent Revenue 13 Accounts Payable $12,000+ $8,000+ $15,000)] Cash J4 Supplies Accounts Payable Accounts Receivable Accounts Receivable Sales Cost of Goods Sold Merchandise Invento Dividends U7 Dividends Payable Wages Expense J8 Cash $78,400 [Balancing Figure--> $80,000-$1,600-$78,400] $80,000 x 29%] Sales Discounts $1,600 $140,000 90,000 14,000 $9,000 $80,000 $140,000 90,000 14,000 Accounts Receivable Accounts Receivable U10 Cost of Goods Sold Merchandise Inventory Sales Returns and Allowances J11 Accounts Recervable Cost of Goods Sold J12 As it is just an order placed] No Entry Required Office Equipment Notes Payable U13 60,000 $15,000 45,000Balancing Figure->$60,000 $15,000 $45,000] J14 Utilities Expense $10,000 General Journal Cash Event Debit Credit $17,000 $9,000 $35,000 $4,000 $30,000 $80,000 $55,000 $8,200 $31,000 Accounts Receivable 17,000 $9,000 35,000 $4,000 $30,000 80,000 $55,000 $8,200 31,000 J2 Unearned Rent Revenue 13 Accounts Payable $12,000+ $8,000+ $15,000)] Cash J4 Supplies Accounts Payable Accounts Receivable Accounts Receivable Sales Cost of Goods Sold Merchandise Invento Dividends U7 Dividends Payable Wages Expense J8 Cash $78,400 [Balancing Figure--> $80,000-$1,600-$78,400] $80,000 x 29%] Sales Discounts $1,600 $140,000 90,000 14,000 $9,000 $80,000 $140,000 90,000 14,000 Accounts Receivable Accounts Receivable U10 Cost of Goods Sold Merchandise Inventory Sales Returns and Allowances J11 Accounts Recervable Cost of Goods Sold J12 As it is just an order placed] No Entry Required Office Equipment Notes Payable U13 60,000 $15,000 45,000Balancing Figure->$60,000 $15,000 $45,000] J14 Utilities Expense $10,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started