Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Post with decision trees and calculator inputs A project with an up-front cost at t=0 of $1500 is being considered by Nakionwide Pharmaceutical Corporation (NPC).

Post with decision trees and calculator inputs

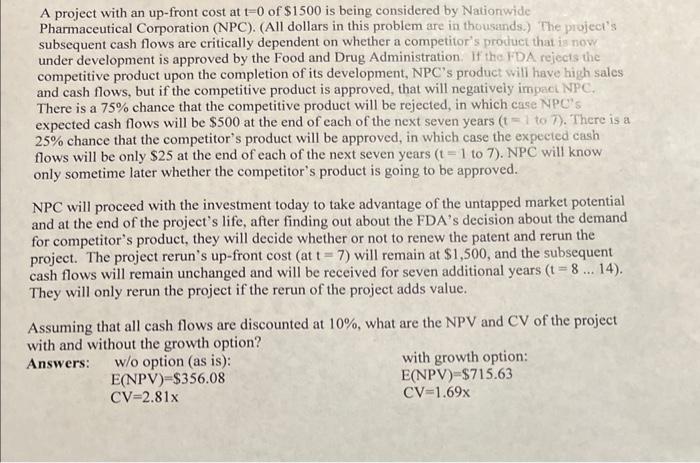

A project with an up-front cost at t=0 of $1500 is being considered by Nakionwide Pharmaceutical Corporation (NPC). (All dollars in this problem are in thousands.) 'The project's subsequent cash flows are critically dependent on whether a competitor's product that is now? under development is approved by the Food and Drug Administration. If the FDA rejects the competitive product upon the completion of its development, NPC's product will have high sales and cash flows, but if the competitive product is approved, that will negatively impaet NPC. There is a 75% chance that the competitive product will be rejected, in which case NPC. expected cash flows will be $500 at the end of each of the next seven years (t=1 to 7). There is a 25% chance that the competitor's product will be approved, in which case the expected cash flows will be only $25 at the end of each of the next seven years ( t=1 to 7 ). NPC will know only sometime later whether the competitor's product is going to be approved. NPC will proceed with the investment today to take advantage of the untapped market potential and at the end of the project's life, after finding out about the FDA's decision about the demand for competitor's product, they will decide whether or not to renew the patent and rerun the project. The project rerun's up-front cost (att=7) will remain at $1,500, and the subsequent cash flows will remain unchanged and will be received for seven additional years (t=814). They will only rerun the project if the rerun of the project adds value. Assuming that all cash flows are discounted at 10%, what are the NPV and CV of the project with and without the growth option? Answers: w/o option (as is): with growth option: E(NPV)=$356.08 CV=2.81x E(NPV)=$715.63 CV=1.69x

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started