Answered step by step

Verified Expert Solution

Question

1 Approved Answer

POTUS Corp. purchased 100% of Space Force Corp. on January 1, 2020 for the following consideration: $10,000,000 of cash 1,000,000 POTUS Corp. shares that

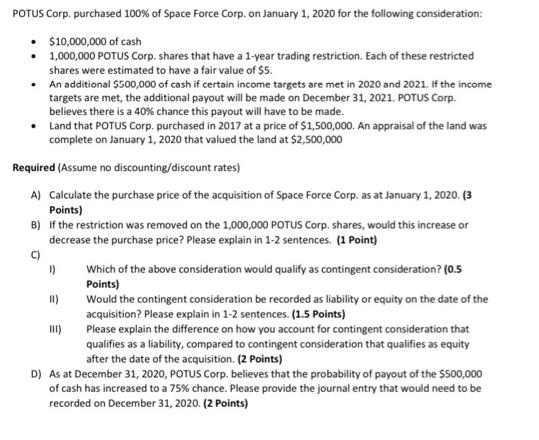

POTUS Corp. purchased 100% of Space Force Corp. on January 1, 2020 for the following consideration: $10,000,000 of cash 1,000,000 POTUS Corp. shares that have a 1-year trading restriction. Each of these restricted shares were estimated to have a fair value of $5. An additional $500,000 of cash if certain income targets are met in 2020 and 2021. If the income targets are met, the additional payout will be made on December 31, 2021. POTUS Corp. believes there is a 40 % chance this payout will have to be made. Land that POTUS Corp. purchased in 2017 at a price of $1,500,000. An appraisal of the land was complete on January 1, 2020 that valued the land at $2,500,000 Required (Assume no discounting/discount rates) A) Calculate the purchase price of the acquisition of Space Force Corp. as at January 1, 2020. (3 Points) B) If the restriction was removed on the 1,000,000 POTUS Corp. shares, would this increase or decrease the purchase price? Please explain in 1-2 sentences. (1 Point) C) 1) 11) III) Which of the above consideration would qualify as contingent consideration? (0.5 Points) Would the contingent consideration be recorded as liability or equity on the date of the acquisition? Please explain in 1-2 sentences. (1.5 Points) Please explain the difference on how you account for contingent consideration that qualifies as a liability, compared to contingent consideration that qualifies as equity after the date of the acquisition. (2 Points) D) As at December 31, 2020, POTUS Corp. believes that the probability of payout of the $500,000 of cash has increased to a 75% chance. Please provide the journal entry that would need to be recorded on December 31, 2020. (2 Points)

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

A B c i C ii Calculation of Purchase Consideration Cash Equity Shares at Fair Value of 5 10000005 Co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started