Question: Powder Mountain (PM) ski resort is currently using a Skidata barcode ticketing system. PM purchased the system three years ago for $1 million. The

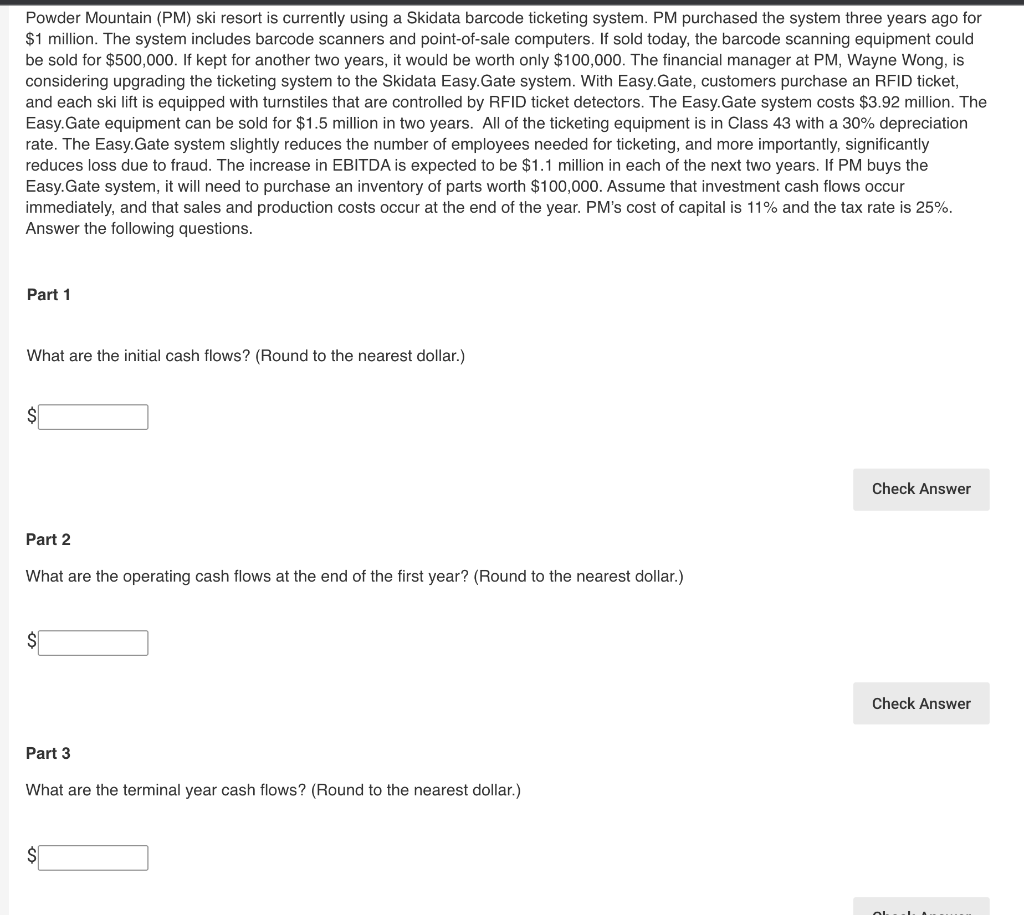

Powder Mountain (PM) ski resort is currently using a Skidata barcode ticketing system. PM purchased the system three years ago for $1 million. The system includes barcode scanners and point-of-sale computers. If sold today, the barcode scanning equipment could be sold for $500,000. If kept for another two years, it would be worth only $100,000. The financial manager at PM, Wayne Wong, is considering upgrading the ticketing system to the Skidata Easy.Gate system. With Easy.Gate, customers purchase an RFID ticket, and each ski lift is equipped with turnstiles that are controlled by RFID ticket detectors. The Easy.Gate system costs $3.92 million. The Easy.Gate equipment can be sold for $1.5 million in two years. All of the ticketing equipment is in Class 43 with a 30% depreciation rate. The Easy.Gate system slightly reduces the number of employees needed for ticketing, and more importantly, significantly reduces loss due to fraud. The increase in EBITDA is expected to be $1.1 million in each of the next two years. If PM buys the Easy.Gate system, it will need to purchase an inventory of parts worth $100,000. Assume that investment cash flows occur immediately, and that sales and production costs occur at the end of the year. PM's cost of capital is 11% and the tax rate is 25%. Answer the following questions. Part 1 What are the initial cash flows? (Round to the nearest dollar.) Part 2 What are the operating cash flows at the end of the first year? (Round to the nearest dollar.) Part 3 What are the terminal year cash flows? (Round to the nearest dollar.) S Check Answer Check Answer

Step by Step Solution

There are 3 Steps involved in it

Lets solve each part step by step Part 1 Initial Cash Flows The initial cash flows include the cost of the new system the sale of the old system and t... View full answer

Get step-by-step solutions from verified subject matter experts