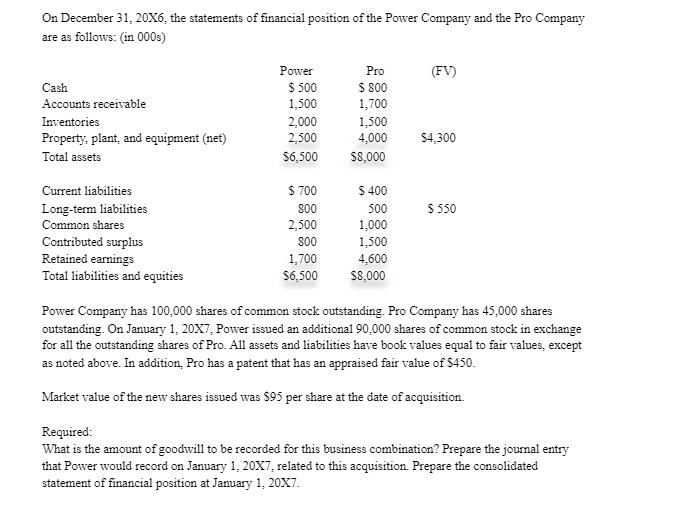

On December 31, 20X6, the statements of financial position of the Power Company and the Pro Company are as follows: (in 000s) Power Pro

On December 31, 20X6, the statements of financial position of the Power Company and the Pro Company are as follows: (in 000s) Power Pro (FV) $ 500 1,500 2,000 2,500 Cash S 800 Accounts receivable 1,700 Inventories 1,500 4,000 Property, plant, and equipment (net) $4,300 Total assets $6,500 $8,000 Current liabilities S 700 $ 400 Long-term liabilities Common shares s0 500 $ 550 2,500 1,000 Contributed surplus Retained earnings Total liabilities and equities 800 1,500 1,700 4,600 $6,500 $8,000 Power Company has 100,000 shares of common stock outstanding. Pro Company has 45,000 shares outstanding. On January 1, 20X7, Power issued an additional 90,000 shares of common stock in exchange for all the outstanding shares of Pro. All assets and liabilities have book values equal to fair values, except as noted above. In addition, Pro has a patent that has an appraised fair value of $450. Market value of the new shares issued was $95 per share at the date of acquisition. Required: What is the amount of goodwill to be recorded for this business combination? Prepare the journal entry that Power would record on January 1, 20X7, related to this acquisition. Prepare the consolidated statement of financial position at January 1, 20X7.

Step by Step Solution

3.28 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Part1 FV of consideration 90000 shares 95 8550 Consideration received F...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started