Question

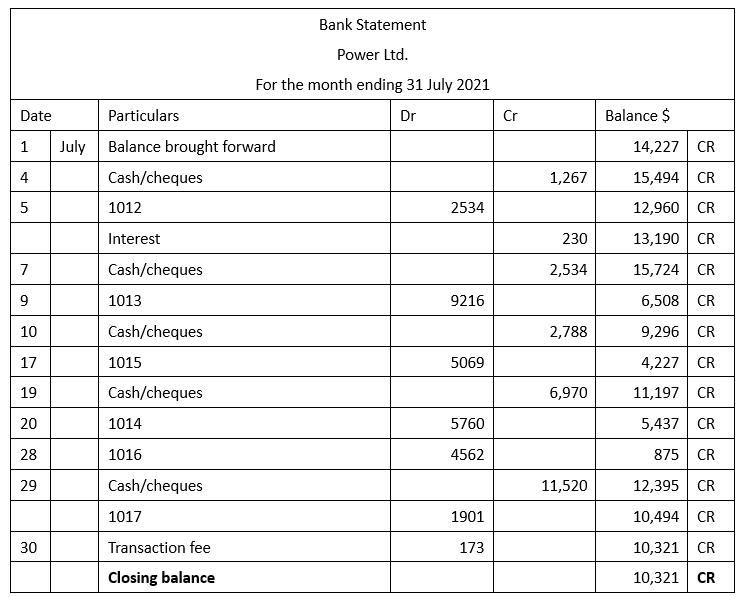

Power Ltd. received its bank statement for the month ended 31 July 2021. It shows a credit balance of $10,321, while the firms cash at

Power Ltd. received its bank statement for the month ended 31 July 2021. It shows a credit balance of $10,321, while the firm’s cash at the bank ledger shows a different balance from its bank statement. It has a debit balance of $3,014 at the end of the month. At the beginning of July, its cash at the bank ledger had a debit balance of $14,227.

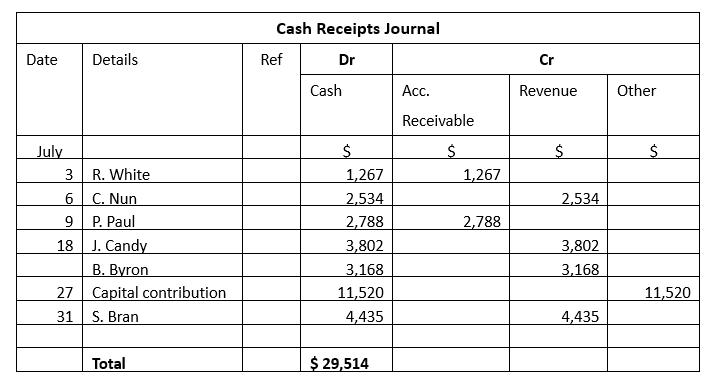

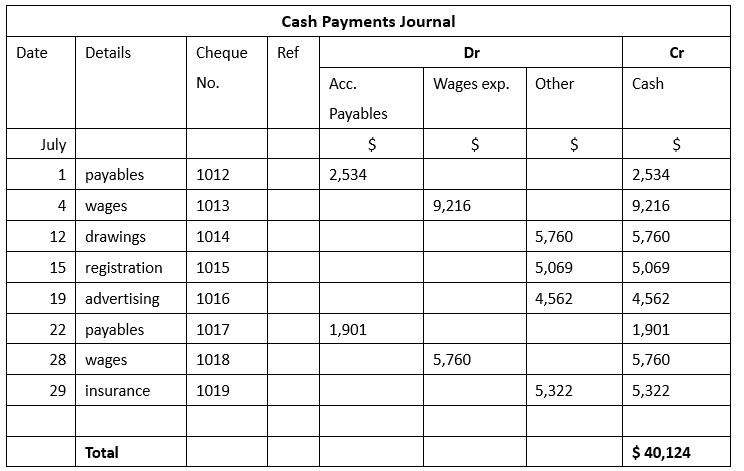

The business’s cash receipts and cash payments journals and the Bank Statement for the month are provided below:

Required

a. Update the cash receipts and cash payments journals by entering the necessary adjustments and total the cash receipts and payments in the journals for the month.

b. Post the total cash receipts and cash payments to the Cash at Bank ledger account and balance the account (using the running balance format for the ledger account).

c. Prepare a bank reconciliation statement for the month ended 31 July 2021.

d. What is the amount of cash that should be reported on the balance sheet prepared as at 31 July 2021, and what is the beginning cash balance that will be shown on the next month’s bank statement?

Date July 3 6 9 18 27 31 Details R. White C. Nun P. Paul J. Candy B. Byron Capital contribution S. Bran Total Cash Receipts Journal Ref Dr Cash $ 1,267 2,534 2,788 3,802 3,168 11,520 4,435 $ 29,514 Acc. Receivable 1,267 2,788 Cr Revenue $ 2,534 3,802 3,168 4,435 Other 11,520

Step by Step Solution

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Question a Date Jul 31 Jul 31 Date Details Jul 31 Jul 31 B...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started