Question

Poynton Carpets Ltd sells floor coverings and runs a small fleet of vans for the firms carpet fitters. The vans are depreciated on the straight-line

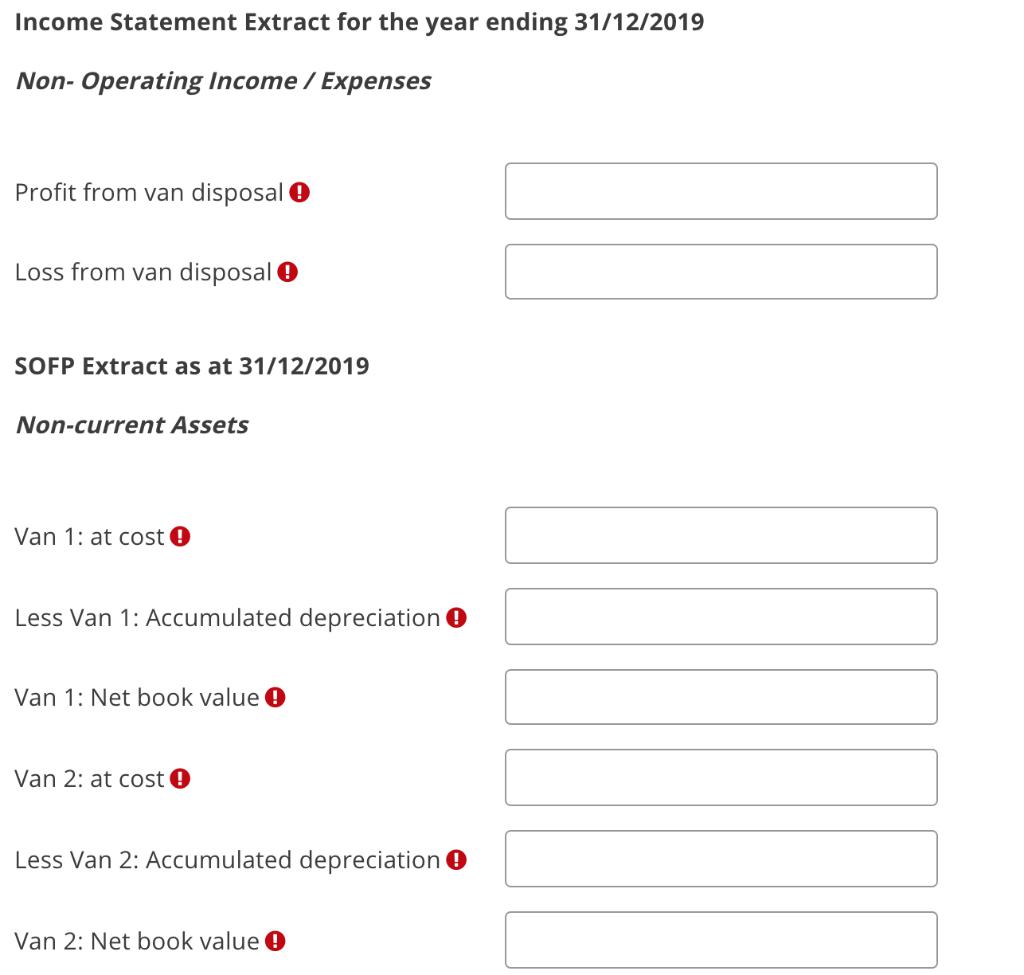

Poynton Carpets Ltd sells floor coverings and runs a small fleet of vans for the firm’s carpet fitters. The vans are depreciated on the straight-line basis over 4 years to a standard residual value of £4,000, after which it is a normal company policy to sell the vans and replace them. The company charges a full year’s depreciation in the year of acquisition and of disposal. During the year to 31st December 2019 two vans were disposed of as follows: 1. Van 1 was bought on 21st January 2016 for £20,000 and was sold on 1st December 2019 for £6,500. 2. Van 2 was bought on 9th January 2017 for £22,000 but after an accident, during the year it was decided to dispose of it earlier than normal. It was sold on 15th December 2019 for £7,000. Your task: (a) Record the van disposals using the expanded accounting equation. (b) Prepare I/S and SOFP extracts for the year ending 31/12/2019 with the relevant figures in relation to the van disposal.

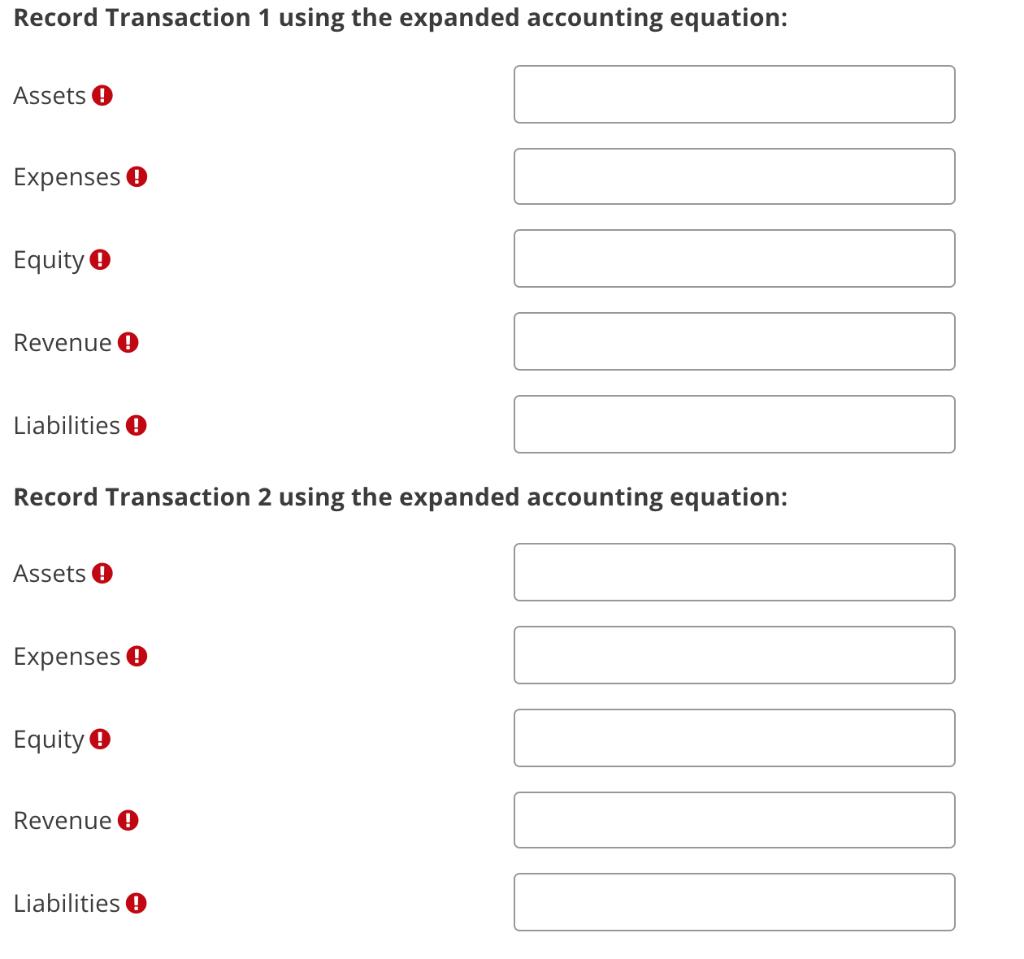

Record Transaction 1 using the expanded accounting equation: Assets O Expenses Equity O Revenue 0 Liabilities O Record Transaction 2 using the expanded accounting equation: Assets 0 Expenses Equity O Revenue Liabilities O

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Transaction1 Assets 65008000 1500 Expenses 8000 8000 Equity 0 0 Revenue 6500 6500 Laibilities 0 0 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started