PP, Inc. acquires 90 percent of the 20,000 shares of SS Company's Outstanding common stock on December 31,2019. Of the acquisition-date fair value, it

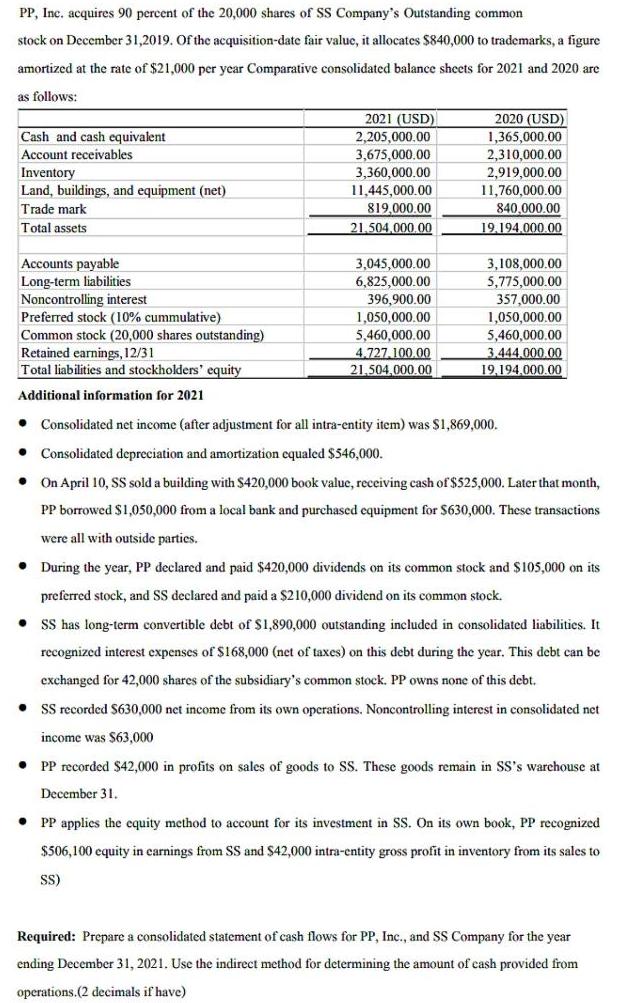

PP, Inc. acquires 90 percent of the 20,000 shares of SS Company's Outstanding common stock on December 31,2019. Of the acquisition-date fair value, it allocates $840,000 to trademarks, a figure amortized at the rate of $21,000 per year Comparative consolidated balance sheets for 2021 and 2020 are as follows: 2021 (USD) 2020 (USD) 1,365,000.00 2,310,000,00 2,919,000.00 Cash and cash equivalent 2,205,000.00 3,675,000.00 3,360,000.00 11,445,000.00 Account receivables Inventory Land, buildings, and equipment (net) 11,760,000.00 Trade mark 819,000.00 840,000.00 Total assets 21.504,000.00 19.194.000.00 Accounts payable Long-term liabilities Noncontrolling interest Preferred stock (10% cummulative) Common stock (20,000 shares outstanding) Retained earnings, 12/31 Total liabilities and stockholders' equity 3,045,000.00 6,825,000.00 396,900.00 1,050,000.00 3,108,000.00 5,775,000.00 357,000.00 1,050,000.00 5,460,000.00 5,460,000.00 4.727.100.00 3.444.000.00 21,504,000.00 19,194.000.00 Additional information for 2021 Consolidated net income (after adjustment for all intra-entity item) was $1,869,000. Consolidated depreciation and amortization cqualed $546,000. On April 10, SS sold a building with $420,000 book value, receiving cash of $525,000. Later that month, PP borrowed $1,050,000 from a local bank and purchased equipment for $630,000. These transactions were all with outside parties. During the year, PP declared and paid $420,000 dividends on its common stock and $105,000 on its preferred stock, and SS declared and paid a $210,000 dividend on its common stock. SS has long-term convertible debt of $1,890,000 outstanding included in consolidated liabilities. It recognized interest expenses of $168,000 (net of taxes) on this debt during the year. This debt can be exchanged for 42,000 shares of the subsidiary's common stock. PP owns none of this debt. SS recorded $630,000 net income from its own operations. Noncontrolling interest in consolidated net income was S63,000 PP recorded $42,000 in profits on sales of goods to SS. These goods remain in SS's warchouse at December 31. PP applies the equity method to account for its investment in SS. On its own book, PP recognized $506,100 equity in carnings from SS and $42,000 intra-entity gross profit in inventory from its sales to S) Required: Prepare a consolidated statement of cash flows for PP, Inc., and SS Company for the year ending December 31, 2021. Use the indirect method for determining the amount of eash provided from operations.(2 decimals if have)

Step by Step Solution

3.42 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Consolidated statement of cash flows for PP Inc and SS Company for the year ending December 31 2021 ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started