Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PPlease help ABCD All information is provided Use Binomial Tree, Exercise price is not given. Kangaroo inc is a U.S. company whose shares are listed

PPlease help ABCD

PPlease help ABCD

All information is provided

Use Binomial Tree, Exercise price is not given.

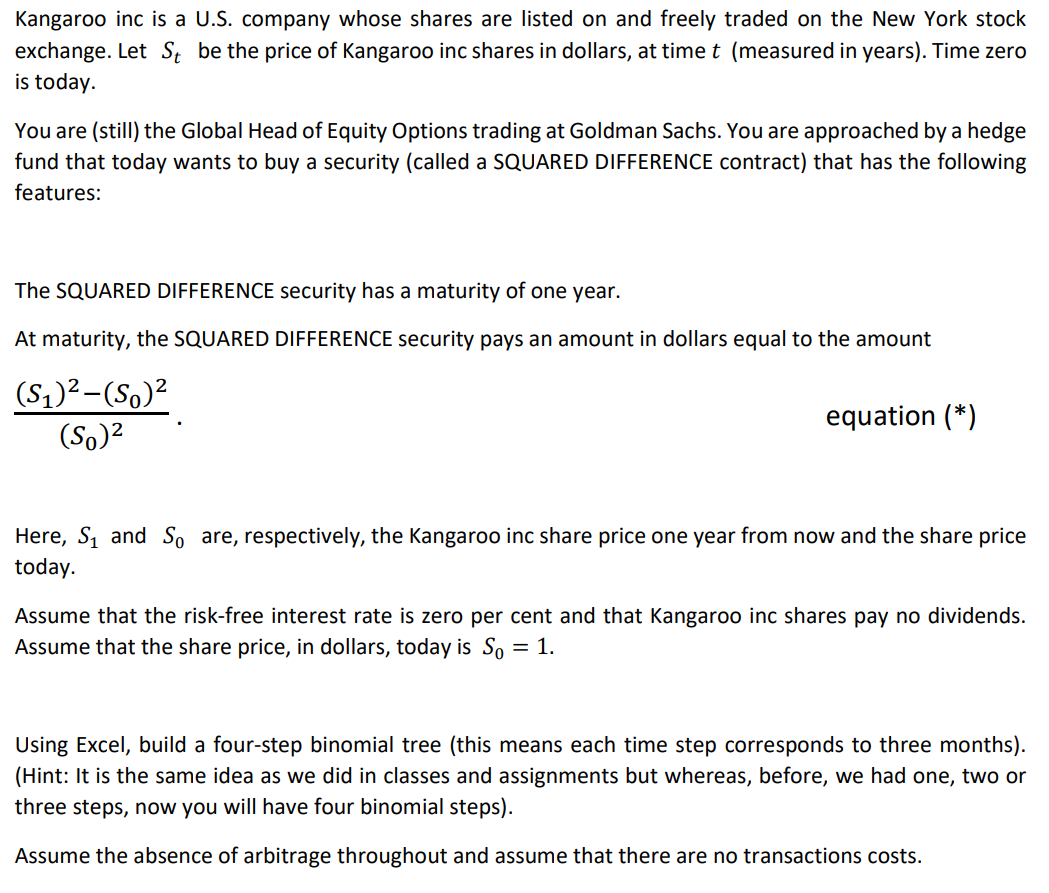

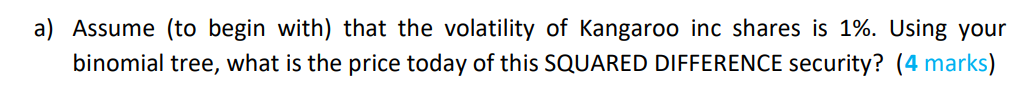

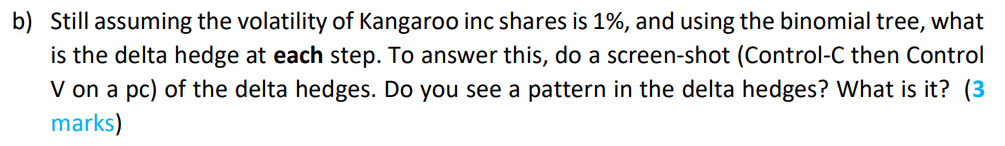

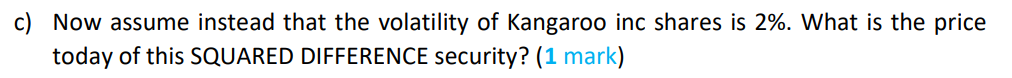

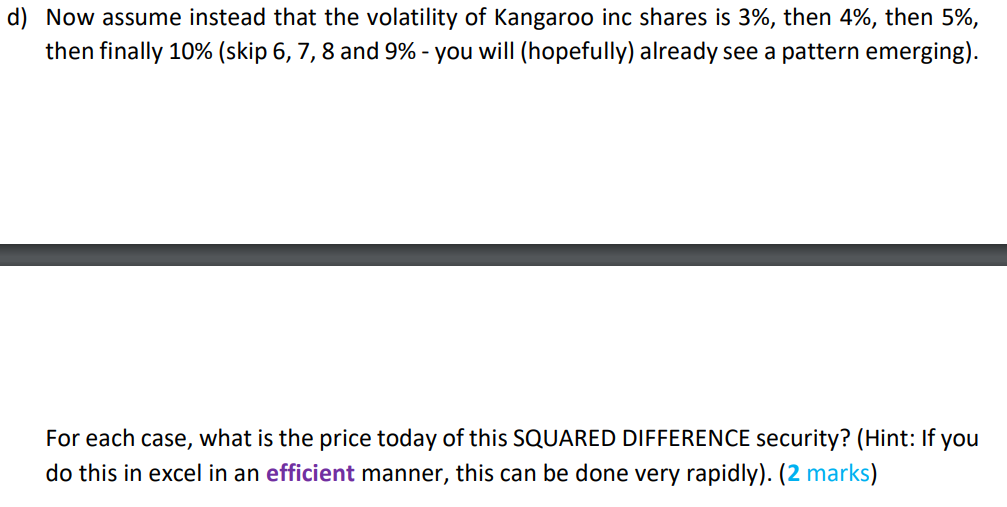

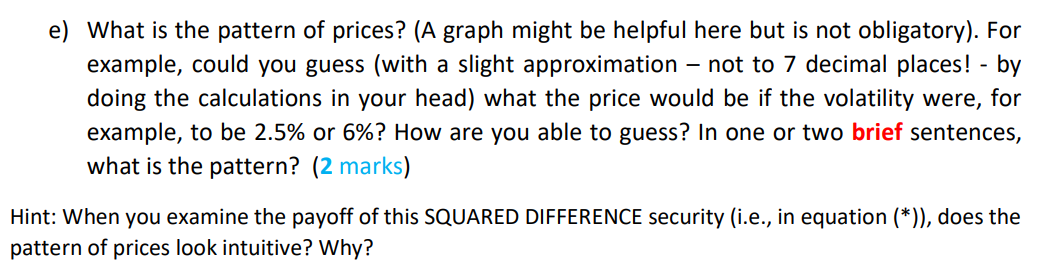

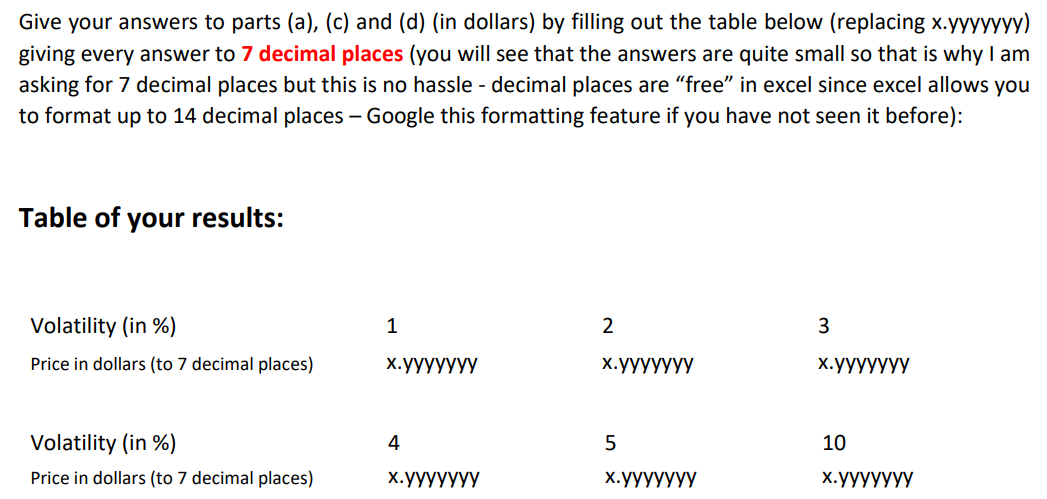

Kangaroo inc is a U.S. company whose shares are listed on and freely traded on the New York stock exchange. Let St be the price of Kangaroo inc shares in dollars, at time t (measured in years). Time zero is today. You are (still) the Global Head of Equity Options trading at Goldman Sachs. You are approached by a hedge fund that today wants to buy a security (called a SQUARED DIFFERENCE contract) that has the following features: The SQUARED DIFFERENCE security has a maturity of one year. At maturity, the SQUARED DIFFERENCE security pays an amount in dollars equal to the amount (51)2-(S.)2 (S.)2 equation (*) Here, S1 and So are, respectively, the Kangaroo inc share price one year from now and the share price today. Assume that the risk-free interest rate is zero per cent and that Kangaroo inc shares pay no dividends. Assume that the share price, in dollars, today is So = 1. Using Excel, build a four-step binomial tree (this means each time step corresponds to three months). (Hint: It is the same idea as we did in classes and assignments but whereas, before, we had one, two or three steps, now you will have four binomial steps). Assume the absence of arbitrage throughout and assume that there are no transactions costs. a) Assume (to begin with) that the volatility of Kangaroo inc shares is 1%. Using your binomial tree, what is the price today of this SQUARED DIFFERENCE security? (4 marks) b) Still assuming the volatility of Kangaroo inc shares is 1%, and using the binomial tree, what is the delta hedge at each step. To answer this, do a screen-shot (Control-C then Control V on a pc) of the delta hedges. Do you see a pattern in the delta hedges? What is it? (3 marks) the price c) Now assume instead that the volatility of Kangaroo inc shares is 2%. What today of this SQUARED DIFFERENCE security? (1 mark) d) Now assume instead that the volatility of Kangaroo inc shares is 3%, then 4%, then 5%, then finally 10% (skip 6, 7, 8 and 9% - you will (hopefully) already see a pattern emerging). For each case, what is the price today of this SQUARED DIFFERENCE security? (Hint: If you do this in excel in an efficient manner, this can be done very rapidly). (2 marks) e) What is the pattern of prices? (A graph might be helpful here but is not obligatory). For example, could you guess (with a slight approximation - not to 7 decimal places! - by doing the calculations in your head) what the price would be if the volatility were, for example, to be 2.5% or 6%? How are you able to guess? In one or two brief sentences, what is the pattern? (2 marks) Hint: When you examine the payoff of this SQUARED DIFFERENCE security (i.e., in equation (*)), does the pattern of prices look intuitive? Why? Give your answers to parts (a), (c) and (d) (in dollars) by filling out the table below (replacing x.yyyyyyy) giving every answer to 7 decimal places (you will see that the answers are quite small so that is why I am asking for 7 decimal places but this is no hassle - decimal places are free in excel since excel allows you to format up to 14 decimal places - Google this formatting feature if you have not seen it before): Table of your results: Volatility (in %) 1 2 3 Price in dollars (to 7 decimal places) x.yyyyyyy x.yyyyyyy 4 5 10 Volatility (in %) Price in dollars (to 7 decimal places)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started