Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PPP Company has one division that performs machining operations on parts that are sold to contractors. A group of machines have an aggregate cost

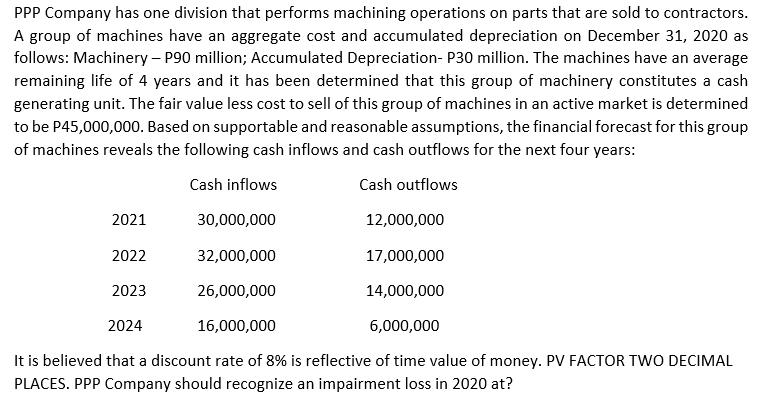

PPP Company has one division that performs machining operations on parts that are sold to contractors. A group of machines have an aggregate cost and accumulated depreciation on December 31, 2020 as follows: Machinery - P90 million; Accumulated Depreciation- P30 million. The machines have an average remaining life of 4 years and it has been determined that this group of machinery constitutes a cash generating unit. The fair value less cost to sell of this group of machines in an active market is determined to be P45,000,000. Based on supportable and reasonable assumptions, the financial forecast for this group of machines reveals the following cash inflows and cash outflows for the next four years: Cash inflows Cash outflows 2021 2022 12,000,000 32,000,000 17,000,000 26,000,000 14,000,000 2024 16,000,000 6,000,000 It is believed that a discount rate of 8% is reflective of time value of money. PV FACTOR TWO DECIMAL PLACES. PPP Company should recognize an impairment loss in 2020 at? 30,000,000 2023

Step by Step Solution

★★★★★

3.55 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Year Cash Inflows Cash Outflows PV of Cash Inflows PV of Cash Outflows 1 12000000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started