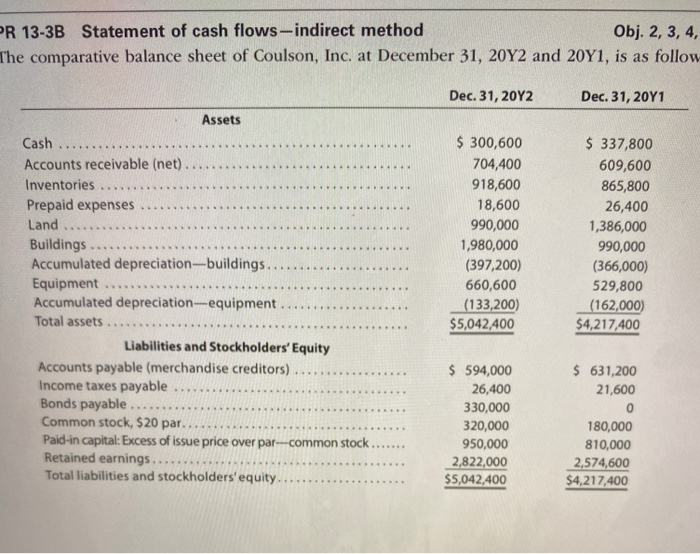

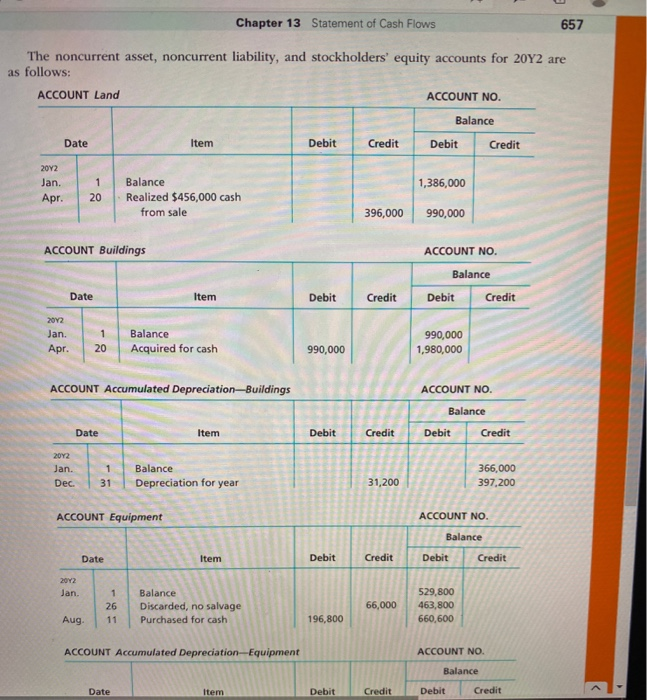

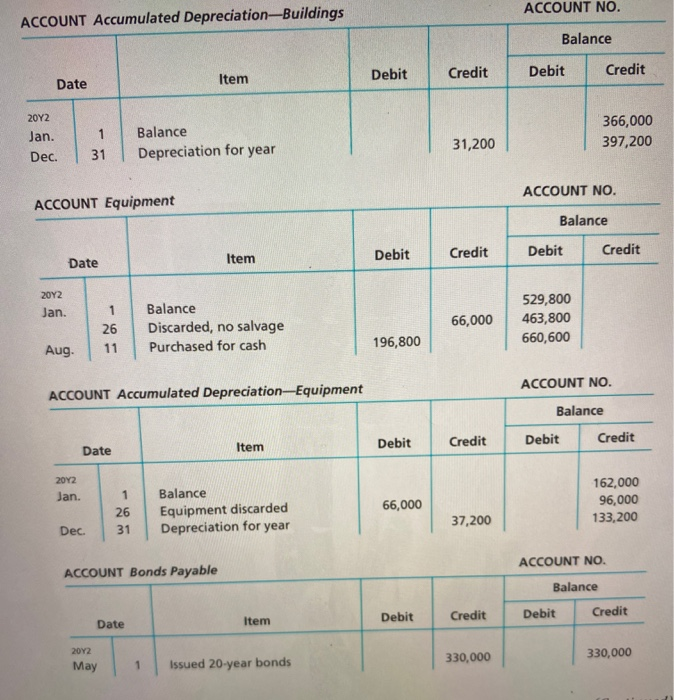

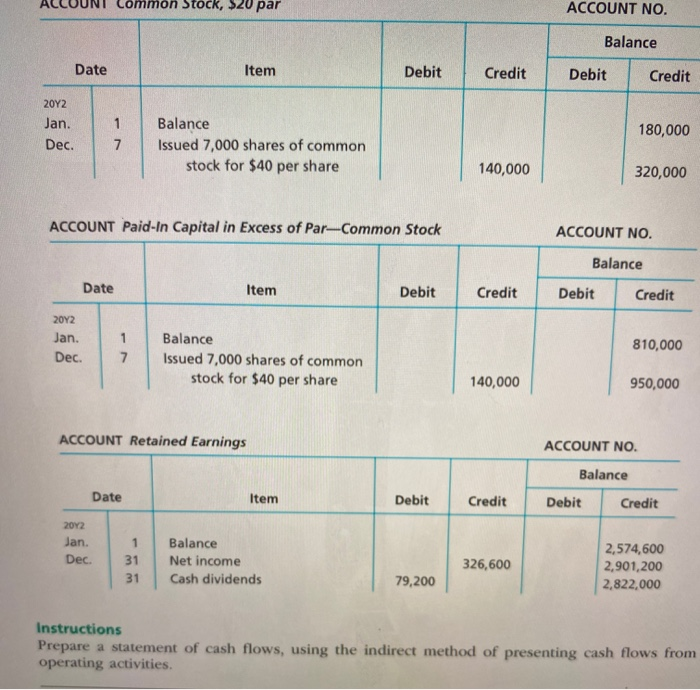

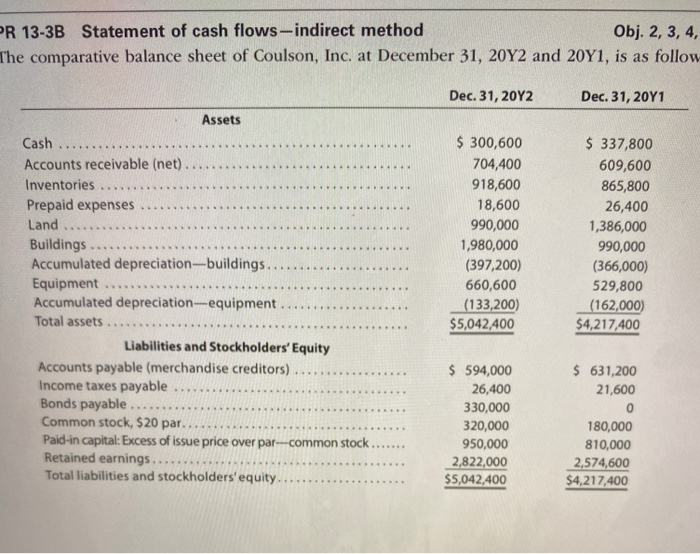

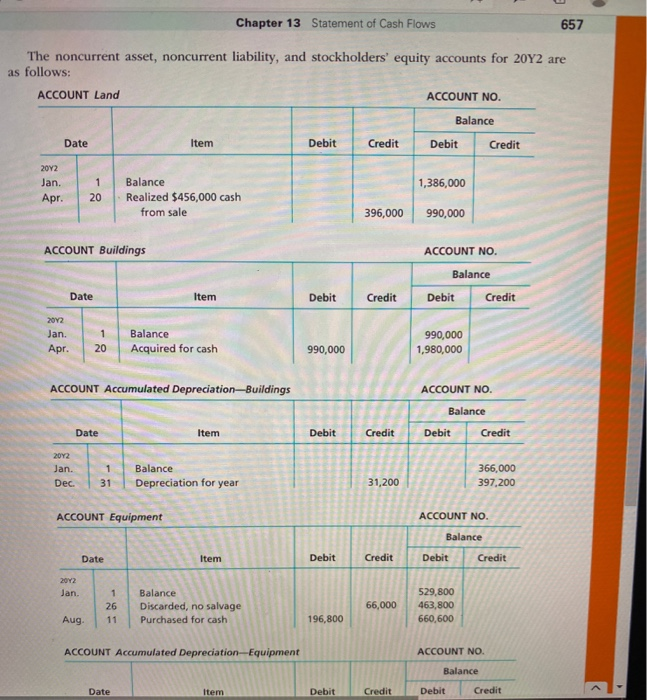

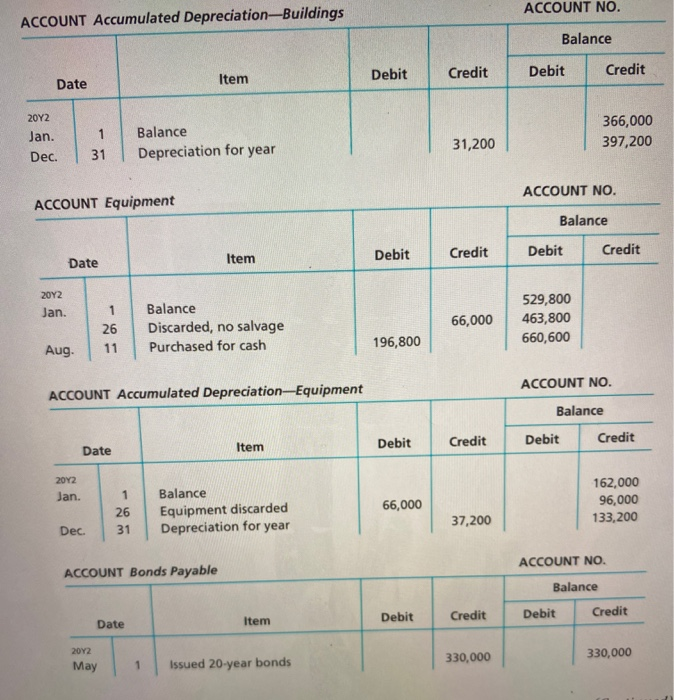

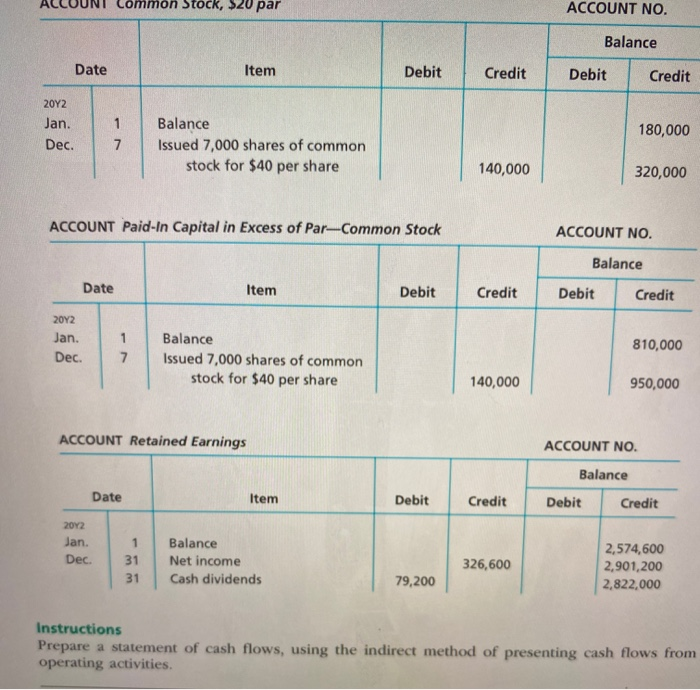

PR 13-3B Statement of cash flows-indirect method Obj. 2, 3, 4, The comparative balance sheet of Coulson, Inc. at December 31, 20Y2 and 2041, is as follow Dec. 31, 2012 Dec. 31, 20Y1 .. Assets Cash Accounts receivable (net). Inventories Prepaid expenses Land Buildings Accumulated depreciation-buildings. Equipment ... Accumulated depreciation-equipment Total assets Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) Income taxes payable Bonds payable .. Common stock, $20 par. Paid-in capital:Excess of issue price over par--common stock Retained earnings.... Total liabilities and stockholders' equity. $ 300,600 704,400 918,600 18,600 990,000 1,980,000 (397,200) 660,600 (133,200) $5,042,400 $ 337,800 609,600 865,800 26,400 1,386,000 990,000 (366,000) 529,800 (162,000) $4,217,400 *** $ 594,000 26,400 330,000 320,000 950,000 2,822,000 $5,042,400 $631,200 21,600 0 180,000 810,000 2,574,600 $4,217,400 *** Chapter 13 Statement of Cash Flows 657 The noncurrent asset, noncurrent liability, and stockholders' equity accounts for 20Y2 are as follows: ACCOUNT Land ACCOUNT NO. Balance Date Item Debit Credit Debit Credit 2012 Jan. Apr. 1 1,386,000 20 Balance Realized $456,000 cash from sale 396,000 990,000 ACCOUNT Buildings ACCOUNT NO. Balance Debit Credit Date Item Debit Credit 2012 Jan. Apr. 1 Balance Acquired for cash 990,000 1,980,000 20 990,000 ACCOUNT Accumulated Depreciation-Buildings ACCOUNT NO. Balance Date Item Debit Credit Debit Credit 2012 Jan. Dec. 1 31 Balance Depreciation for year 366,000 397,200 31,200 ACCOUNT Equipment ACCOUNT NO. Balance Date Item Debit Credit Debit Credit 2012 Jan. 1 26 11 Balance Discarded, no salvage Purchased for cash 66,000 529,800 463,800 660,600 Aug 196,800 ACCOUNT Accumulated Depreciation Equipment ACCOUNT NO. Balance Date Item Debit Credit Debit Credit ACCOUNT NO. ACCOUNT Accumulated Depreciation-Buildings Balance Debit Credit Debit Item Credit Date 20Y2 Jan. Dec. 1 Balance Depreciation for year 366,000 397,200 31,200 31 ACCOUNT NO. ACCOUNT Equipment Balance Debit Credit Debit Item Credit Date 2012 Jan. 1 Balance Discarded, no salvage Purchased for cash 66,000 529,800 463,800 660,600 26 11 196,800 Aug. ACCOUNT NO. ACCOUNT Accumulated Depreciation Equipment Balance Debit Credit Debit Credit Date Item 2012 Jan. 66,000 1 26 31 Balance Equipment discarded Depreciation for year 162,000 96,000 133,200 37,200 Dec. ACCOUNT NO. ACCOUNT Bonds Payable Balance Debit Credit Debit Credit Date Item 2012 May 330,000 330,000 1 Issued 20-year bonds Common Stock, $20 par ACCOUNT NO. Balance Date Item Debit Credit Debit Credit 20Y2 1 Jan. Dec. 180,000 7 Balance Issued 7,000 shares of common stock for $40 per share 140,000 320,000 ACCOUNT Paid-In Capital in Excess of Par-Common Stock ACCOUNT NO. Balance Date Item Debit Credit Debit Credit 2012 Jan. Dec. 1 810,000 7 Balance Issued 7,000 shares of common stock for $40 per share 140,000 950,000 ACCOUNT Retained Earnings ACCOUNT NO. Balance Date Item Debit Credit Debit Credit 2012 Jan. Dec 1 31 31 Balance Net income Cash dividends 326,600 2,574,600 2,901,200 2,822,000 79,200 Instructions Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities