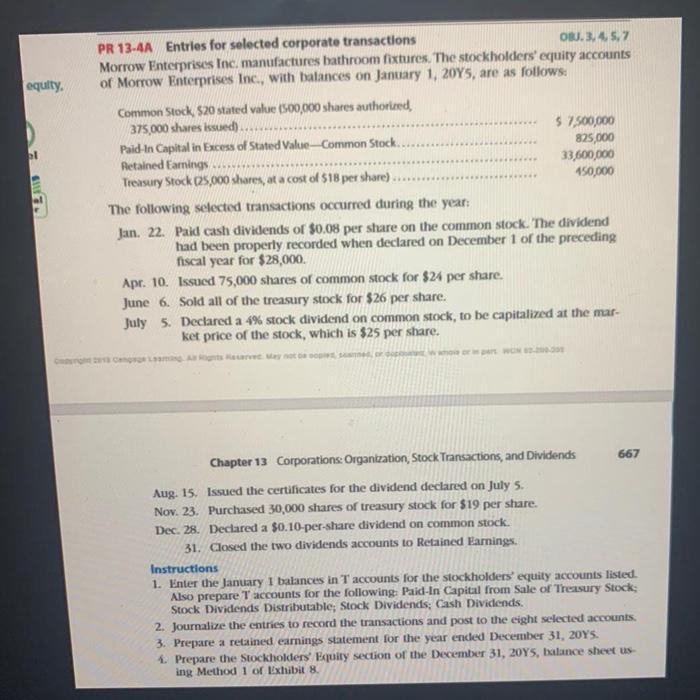

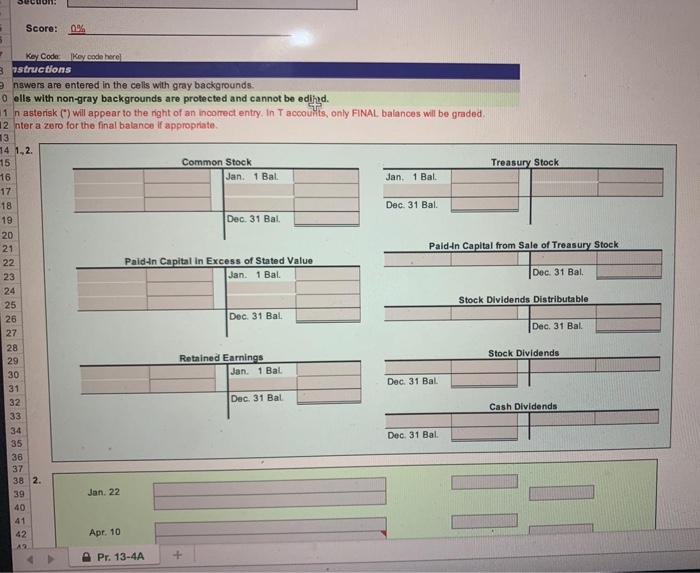

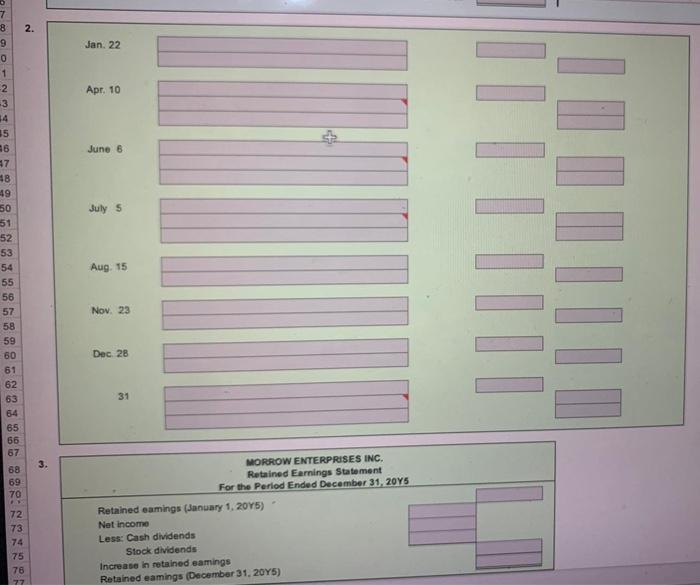

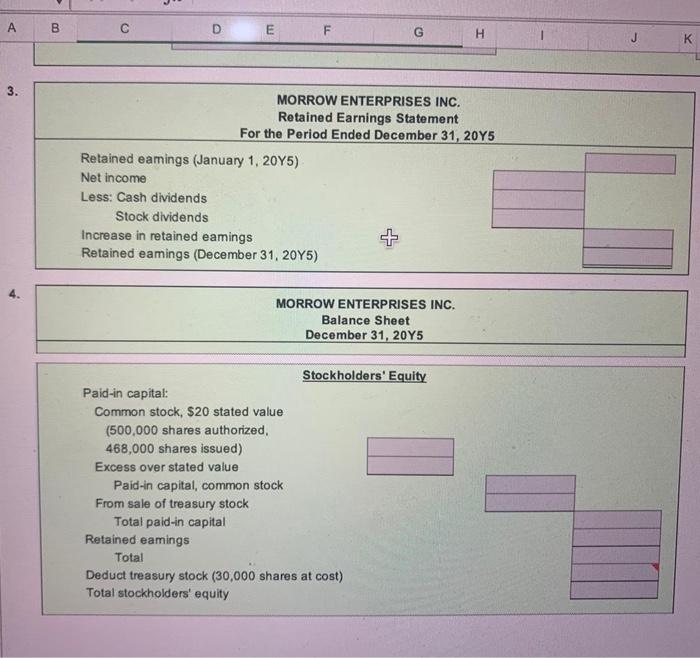

PR 13.4A Entries for selected corporate transactions ORU. 3.4.5,7 Morrow Enterprises Inc, manufactures bathroom fixtures. The stockholders' equity accounts equity. of Morrow Enterprises Inc., with balances on January 1, 2045, are as follows: Common Stock, $20 stated value (500,000 shares authorized 375,000 shares issued) $ 7.500,000 Paid in Capital in Excess of Stated Value-Common Stock.. 825,000 Retained Earnings 33,600,000 Treasury Stock125.000 shares, at a cost of 518 per share) 150,000 The following selected transactions occurred during the year: Jan. 22. Paid cash dividends of $0.08 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for $28,000. Apr. 10. Issued 75,000 shares of common stock for $24 per share. June 6. Sold all of the treasury stock for $26 per share. July 5. Declared a 4% stock dividend on common stock, to be capitalized at the mar- ket price of the stock, which is $25 per share. COM Chapter 13 Corporations: Organization, Stock Transactions, and Dividends 667 Aug. 15. Issued the certificates for the dividend declared on July 5. Nov. 23. Purchased 30,000 shares of treasury stock for $19 per share. Dec. 28. Declared a $0.10-per-share dividend on common stock. 31. Closed the two dividends accounts to Retained Earnings Instructions 1. Enter the January 1 balances in T accounts for the stockholders' equity accounts listed. Also prepare T accounts for the following: Paid-In Capital from Sale of Treasury Stock Stock Dividends Distributable; Stock Dividends: Cash Dividends. 2. Journalive the entries to record the transactions and post to the eight selected accounts. 3. Prepare a retained earnings statement for the year ended December 31, 20Y5. 1. Prepare the stockholders' Equity section of the December 31, 2045, balance sheet us ing Method 1 or Exhibit 8 Secuons 19 Score: 5 Key Code Meycode here 37structions nswers are entered in the cells with gray backgrounds. 0 ells with non-gray backgrounds are protected and cannot be edind. 1 In asterisk (*) will appear to the night of an incorrect entry In Tacoouvesonly FINAL balances will be graded. 2 nter a zero for the final balance if appropriate 13 74 1.2. 15 Common Stock Treasury Stock 16 Jan. 1 Bal Jan. 1 Bal. 17 18 Dec. 31 Bal. Dec 31 Bal 20 21 Pald-In Capital from Sale of Treasury Stock 22 Paidan Capital In Excess of Stated Value 23 Jan. 1 Bal Dec. 31 Bal. 24 25 Stock Dividends Distributable 26 Dec 31 Bal 27 Dec 31 Bal 28 29 Retained Earnings Stock Dividends 30 Jan. 1 Bal 31 Dec 31 Bal 32 Dec. 31 Bal 33 Cash Dividends 34 35 Dec 31 Bal 36 37 38 2. 39 Jan. 22 40 41 42 Apr, 10 Pr. 13-4A + 7 8 9 2. Jan. 22 Apr. 10 0 1 -2 3 14 35 36 37 SB 49 50 51 June 6 IIILILLE July 5 52 Aug. 15 Nov. 23 53 54 55 56 57 58 59 60 61 62 63 64 65 65 67 Dec. 28 31 3. 68 69 70 MORROW ENTERPRISES INC. Retained Earnings Statement For the Period Ended December 31, 2015 72 73 74 75 Retained eamings (January 1, 2015) Net income Less: Cash dividends Stock dividends Increase in retained eamings Retained eamings (December 31, 2045) 77 A B E F H K 3. MORROW ENTERPRISES INC. Retained Earnings Statement For the Period Ended December 31, 2045 Retained eamings (January 1, 2045) Net income Less: Cash dividends Stock dividends Increase in retained eamings Retained eamings (December 31, 2045) MORROW ENTERPRISES INC. Balance Sheet December 31, 2045 Stockholders' Equity Paid-in capital: Common stock, $20 stated value (500,000 shares authorized, 468,000 shares issued) Excess over stated value Paid-in capital, common stock From sale of treasury stock Total paid-in capital Retained eamings Total Deduct treasury stock (30,000 shares at cost) Total stockholders' equity