Answered step by step

Verified Expert Solution

Question

1 Approved Answer

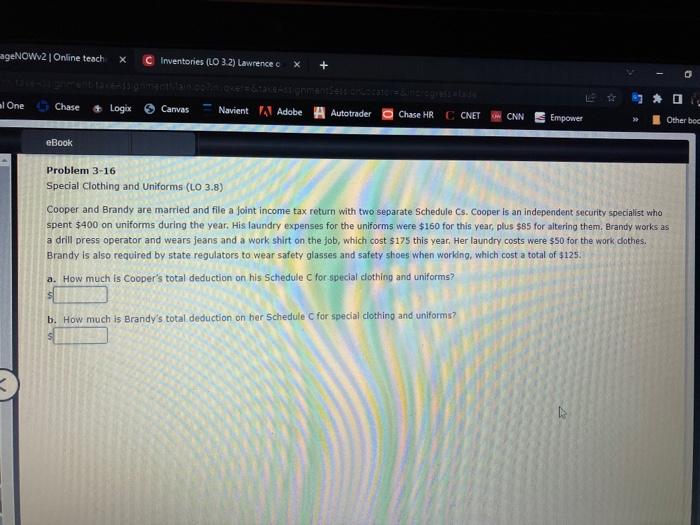

PR 3-16 Special Clothing and Uniforms (LO 3.8) Cooper and Brandy are married and file a foint income tax return with two separate Schedule Cs.

PR 3-16

Special Clothing and Uniforms (LO 3.8) Cooper and Brandy are married and file a foint income tax return with two separate Schedule Cs. Cooper is an independent security specialist who spent $400 on uniforms during the year. His laundry expenses for the uniforms were $160 for this year, plus $85 for altering them, Brandy works as a drill press operator and wears jeans and a work shirt on the job, which cost $175 this year, Her laundry costs were $50 for the work clathes. Brandy is also required by state regulators to wear safety glasses and safety shoes when working, which cost a total of $125. a. How much is Cooper's total deduction on his Schedule C for special elothing and uniforms? b. How much is Brandy's total deduction on ber schedule C for special dothing and uniforms

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started