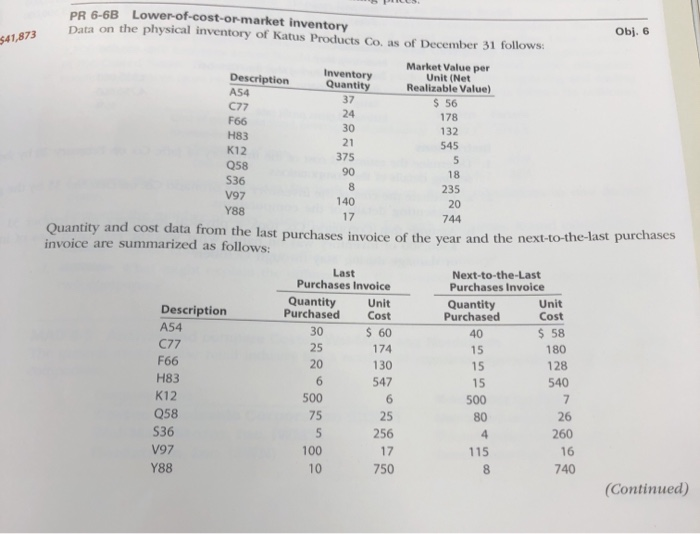

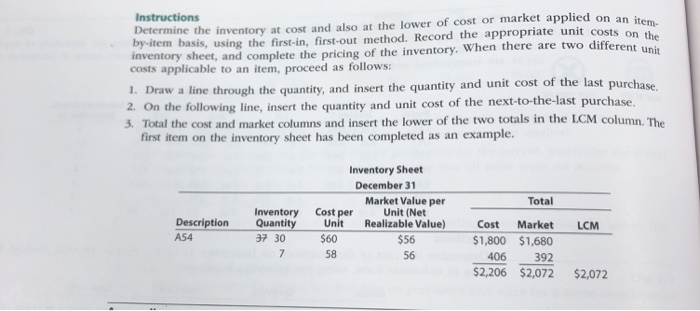

PR 6-6B Lower-of-cost-ormarket inventory Data on the physical inventory of Katus Products Co. as of December 31 follows: Obj. 6 $41,873 178 30 Market Value per Description Inventory Unit (Net Quantity Realizable Value) A54 077 $ 56 F66 132 H83 545 K12 375 5 Q58 18 S36 235 V97 140 20 Y88 744 Quantity and cost data from the last purchases invoice of the year and the next-to-the-last purch invoice are summarized as follows: 90 Description A54 C77 F66 H83 K12 Last Purchases Invoice Quantity Unit Purchased Cost $ 60 174 130 547 Next-to-the-Last Purchases Invoice Quantity Unit Purchased Cost 40 $ 58 180 15 128 20 15 540 Q58 500 80 256 536 V97 Y88 115 260 16 740 (Continued) Instructions Determine the inventory at cost and also at the lower of cost or market applied on an ite by-item basis, using the first-in, first-out method. Record the appropriate unit costs on inventory sheet, and complete the pricing of the inventory. When there are two different costs applicable to an item, proceed as follows: 1. Draw a line through the quantity, and insert the quantity and unit cost of the last purchase 2. On the following line, insert the quantity and unit cost of the next-to-the-last purchase, 3. Total the cost and market columns and insert the lower of the two totals in the LCM column. The first item on the inventory sheet has been completed as an example. Total Inventory Sheet December 31 Market Value per Cost per Unit (Net Unit Realizable Value) $60 $56 56 Inventory Quantity 37 30 Description A54 LCM 58 Cost Market $1,800 $1,680 406 392 $2,206 $2,072 $2,072 PR 6-6B Lower-of-cost-ormarket inventory Data on the physical inventory of Katus Products Co. as of December 31 follows: Obj. 6 $41,873 178 30 Market Value per Description Inventory Unit (Net Quantity Realizable Value) A54 077 $ 56 F66 132 H83 545 K12 375 5 Q58 18 S36 235 V97 140 20 Y88 744 Quantity and cost data from the last purchases invoice of the year and the next-to-the-last purch invoice are summarized as follows: 90 Description A54 C77 F66 H83 K12 Last Purchases Invoice Quantity Unit Purchased Cost $ 60 174 130 547 Next-to-the-Last Purchases Invoice Quantity Unit Purchased Cost 40 $ 58 180 15 128 20 15 540 Q58 500 80 256 536 V97 Y88 115 260 16 740 (Continued) Instructions Determine the inventory at cost and also at the lower of cost or market applied on an ite by-item basis, using the first-in, first-out method. Record the appropriate unit costs on inventory sheet, and complete the pricing of the inventory. When there are two different costs applicable to an item, proceed as follows: 1. Draw a line through the quantity, and insert the quantity and unit cost of the last purchase 2. On the following line, insert the quantity and unit cost of the next-to-the-last purchase, 3. Total the cost and market columns and insert the lower of the two totals in the LCM column. The first item on the inventory sheet has been completed as an example. Total Inventory Sheet December 31 Market Value per Cost per Unit (Net Unit Realizable Value) $60 $56 56 Inventory Quantity 37 30 Description A54 LCM 58 Cost Market $1,800 $1,680 406 392 $2,206 $2,072 $2,072