Answered step by step

Verified Expert Solution

Question

1 Approved Answer

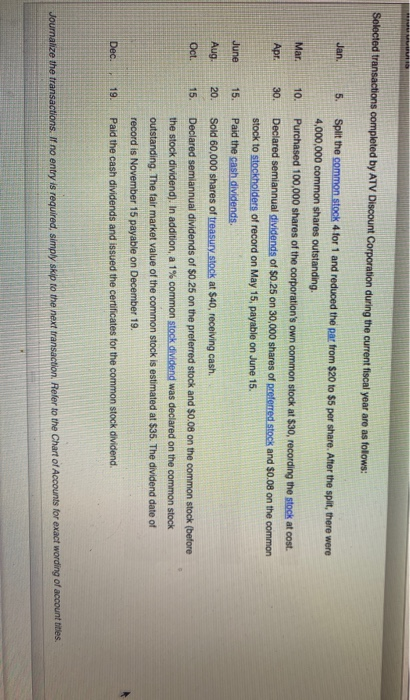

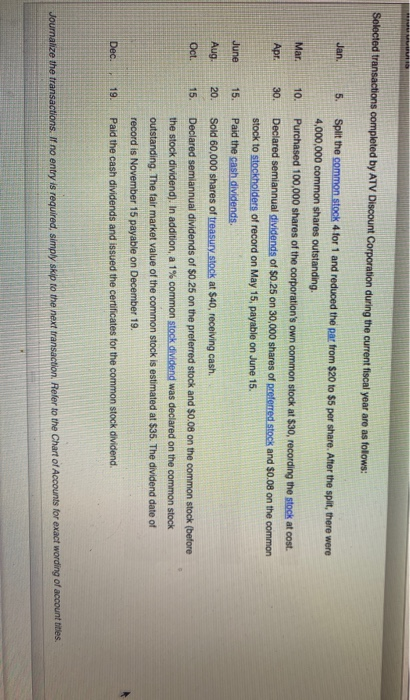

Pr-13-05A Blanksheet Selected transactions completed by ATV Discount Corporation during the current fiscal year are as folows: Jan 5. Mar. 10. Apr. 30. June 15.

Pr-13-05A Blanksheet

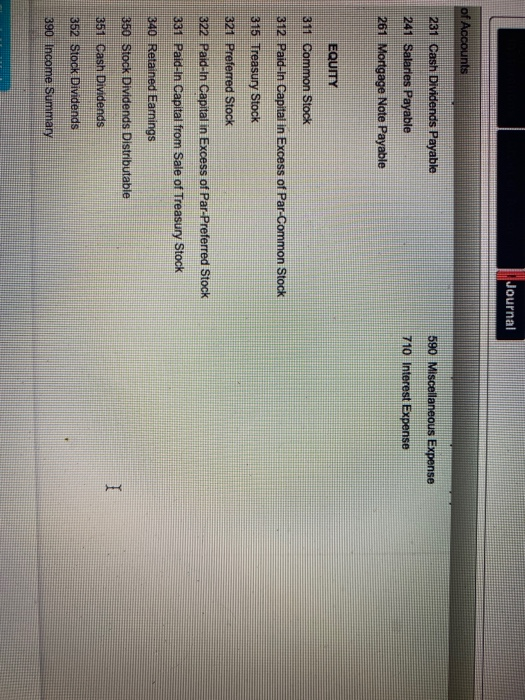

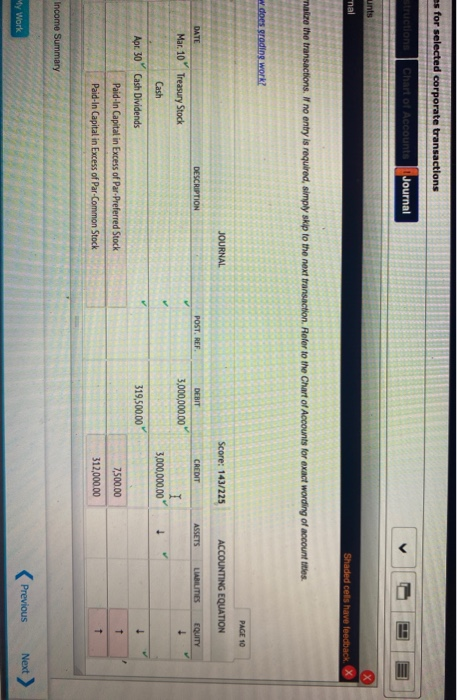

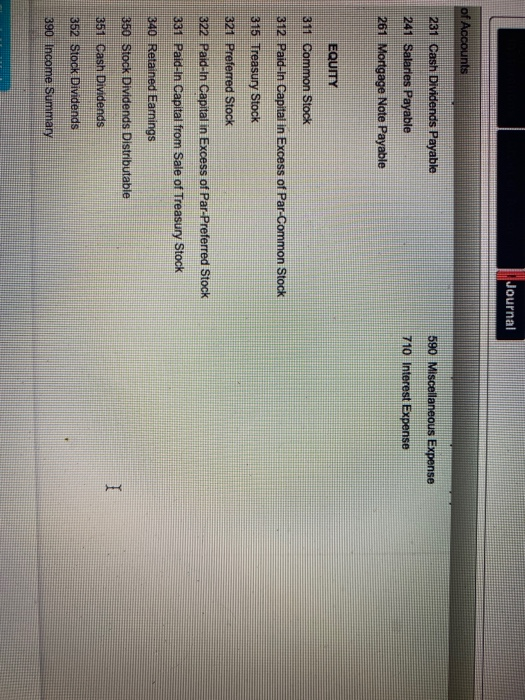

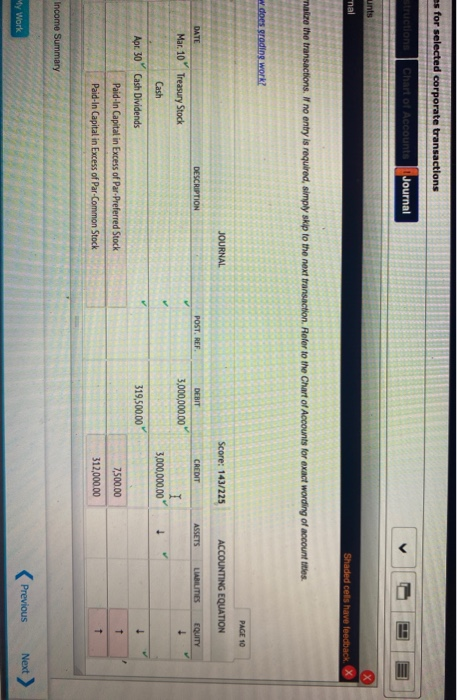

Selected transactions completed by ATV Discount Corporation during the current fiscal year are as folows: Jan 5. Mar. 10. Apr. 30. June 15. Split the common stock 4 for 1 and reduced the par from $20 to $5 per share. After the split, there were 4,000,000 common shares outstanding. Purchased 100,000 shares of the corporation's own common stock at $30, recording the stock at cost. Declared semiannual dividends of $0.25 on 30,000 shares of preferred stock and $0.08 on the common stock to stockholders of record on May 15, payable on June 15. Paid the cash dividends. Sold 60,000 shares of treasury stock at $40, receiving cash. Declared semiannual dividends of $0.25 on the preferred stock and $0.08 on the common stock (before the stock dividend). In addition, a 1% common stock dividend was declared on the common stock outstanding. The fair market value of the common stock is estimated at $35. The dividend date of record is November 15 payable on December 19. Aug 20. Oct. 15. Dec. 19 Paid the cash dividends and issued the certificates for the common stock dividend Journalize the transactions. If no entry is required, simply skip to the next transaction. Refer to the Chart of Accounts for exact wording of account titles of Accounts ASSETS REVENUE 110 Cash 410 Sales 120 Accounts Receivable 610 Interest Revenue 131 Notes Receivable 132 Interest Receivable EXPENSES 510 Cost of Merchandise Sold 141 Merchandise Inventory 145 Office Supplies 515 Credit Card Expense 520 Salaries Expense 151 Prepaid Insurance 181 Land 193 Equipment 194 Accumulated Depreciation-Equipment 531 Advertising Expense 532 Delivery Expense 533 Selling Expenses 534 Rent Expense 535 Insurance Expense 536 Office Supplies Expense 537 Organizational Expenses 562 Depreciation Expense-Equipment LIABILITIES 210 Accounts Payable 221 Notes Payable 226 Interest Payable Journal of Accounts 231 Cash Dividends Payable 590 Miscellaneous Expense 710 Interest Expense 241 Salaries Payable 261 Mortgage Note Payable EQUITY 311 Common Stock 312 Paid-In Capital in Excess of Par-Common Stock 315 Treasury Stock 321 Preferred Stock 322 Paid-In Capital in Excess of Par-Preferred Stock 331 Pald-In Capital from Sale of Treasury Stock 340 Retained Earnings 350 Stock Dividends Distributable I 351 Cash Dividends 352 Stock Dividends 390 Income Summary es for selected corporate transactions Chart of Accounts Journal unts nal Shaded cels have feedback. X alize the transactions. I no entry is required, simply skip to the next transaction. Refer to the Chart of Accounts for exact wording of account titles. w does grading work? PAGE 10 JOURNAL Score: 143/225 ACCOUNTING EQUATION DESCRIPTION POST. REF CREDIT ASSETS LIABILITIES DATE Mar. 10 Treasury Stock Cash DEBIT 3,000,000.00 EQUITY + I 3,000,000.00 Apr 30 Cash Dividends 319,500.00 Paid-In Capital in Excess of Par-Preferred Stock 7,500.00 + 1 1 Paid-In Capital in Excess of Par-Common Stock 312,000.00 Income Summary Previous Next > My Work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started