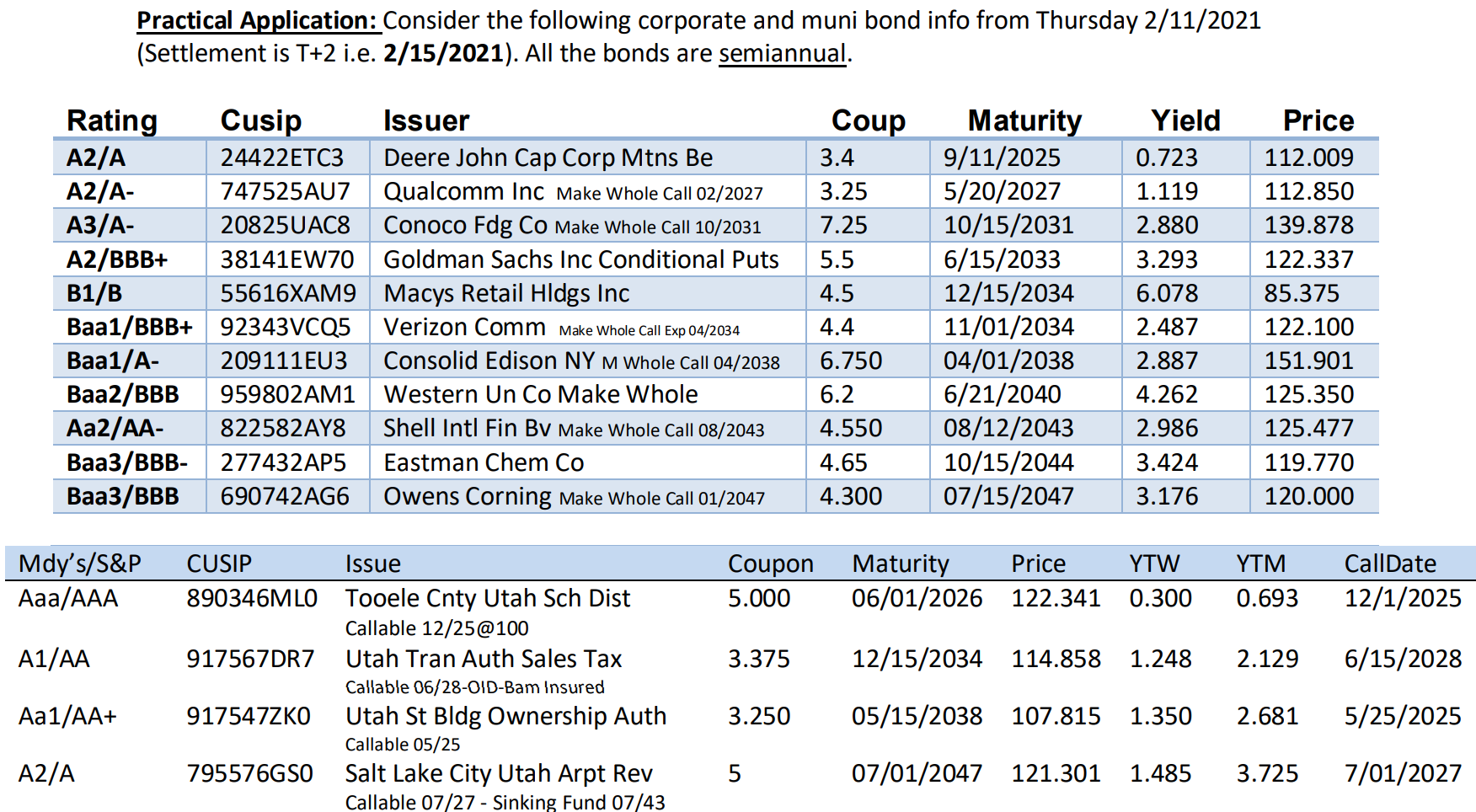

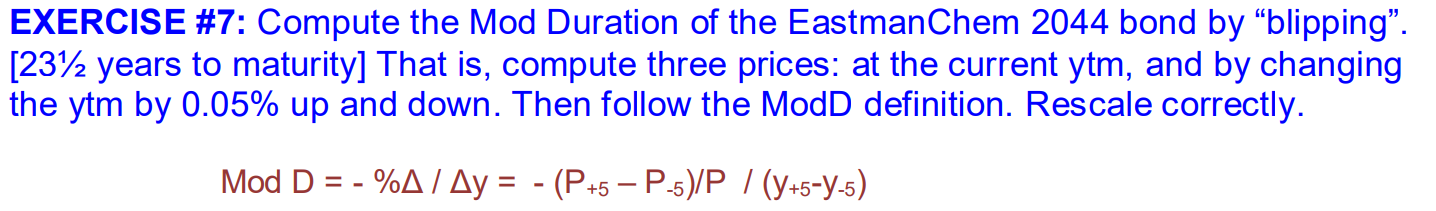

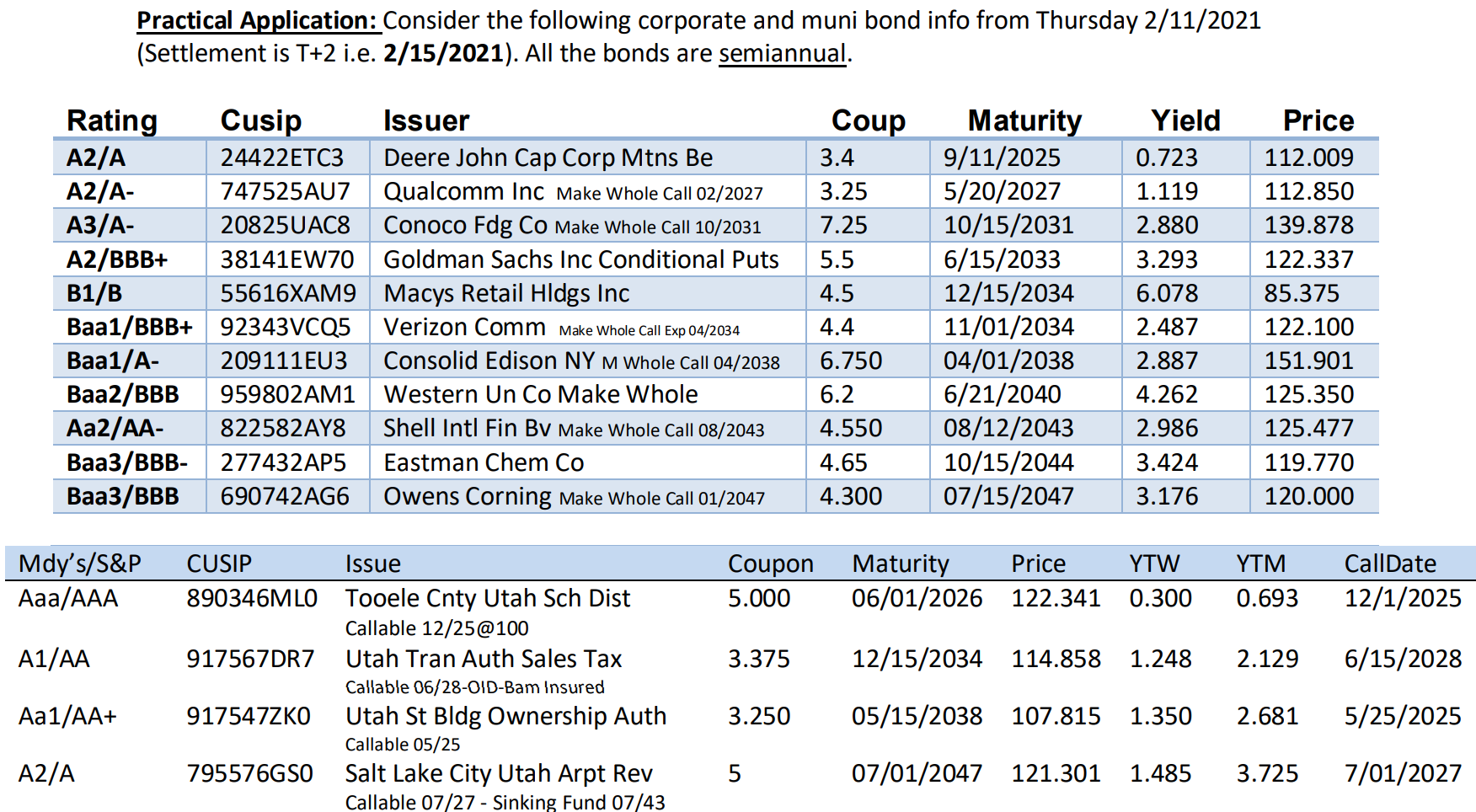

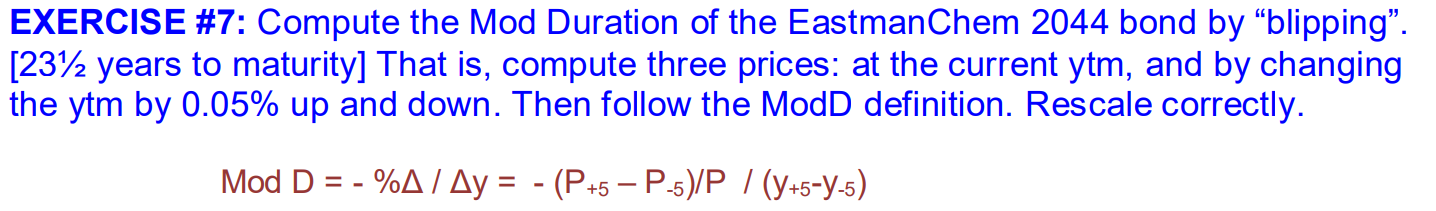

Practical Application: Consider the following corporate and muni bond info from Thursday 2/11/2021 (Settlement is T+2 i.e. 2/15/2021). All the bonds are semiannual. Rating Cusip Issuer A2/A 24422 ETC3 Deere John Cap Corp Mtns Be A2/A- 747525AUZ Qualcomm Inc Make Whole Call 02/2027 A3/A- 20825UAC8 Conoco Fdg Co Make Whole Call 10/2031 A2/BBB+ 38141EW70 Goldman Sachs Inc Conditional Puts B1/B 55616XAM9 Macys Retail Hldgs Inc Baa1/BBB+ 92343VCQ5 Verizon Comm Make Whole Call Exp 04/2034 Baa1/A- 209111E03 Consolid Edison NY M Whole Call 04/2038 Baa2/BBB 959802AM1 Western Un Co Make Whole Aa2/AA- 822582AY8 Shell Intl Fin BV Make Whole Call 08/2043 Baa3/BBB- 277432AP5 Eastman Chem Co Baa3/BBB 690742AG6 Owens Corning Make Whole Call 01/2047 Coup 3.4 3.25 7.25 5.5 4.5 4.4 6.750 6.2 4.550 4.65 4.300 Maturity 9/11/2025 5/20/2027 10/15/2031 6/15/2033 12/15/2034 11/01/2034 04/01/2038 6/21/2040 08/12/2043 10/15/2044 07/15/2047 Yield 0.723 1.119 2.880 3.293 6.078 2.487 2.887 4.262 2.986 3.424 3.176 Price 112.009 112.850 139.878 122.337 85.375 122.100 151.901 125.350 125.477 119.770 120.000 Mdy's/S&P Aaa/AAA Coupon 5.000 Maturity Price YTW 06/01/2026 122.341 0.300 YTM 0.693 CallDate 12/1/2025 A1/AA 3.375 12/15/2034 114.858 1.248 2.129 6/15/2028 CUSIP Issue 890346MLO Tooele Cnty Utah Sch Dist Callable 12/25@100 917567DRZ Utah Tran Auth Sales Tax Callable 06/28-OID-Bam Insured 917547ZKO Utah St Bldg Ownership Auth Callable 05/25 795576GSO Salt Lake City Utah Arpt Rev Callable 07/27 - Sinking Fund 07/43 Aa1/AA+ 3.250 05/15/2038 107.815 1.350 2.681 5/25/2025 A2/A 5 07/01/2047 121.301 1.485 3.725 7/01/2027 EXERCISE #7: Compute the Mod Duration of the EastmanChem 2044 bond by blipping. [23/2 years to maturity] That is, compute three prices: at the current ytm, and by changing the ytm by 0.05% up and down. Then follow the ModD definition. Rescale correctly. Mod D = - %A/Ay = - (P+5 P-5)/P | (Y+5-Y-5) Practical Application: Consider the following corporate and muni bond info from Thursday 2/11/2021 (Settlement is T+2 i.e. 2/15/2021). All the bonds are semiannual. Rating Cusip Issuer A2/A 24422 ETC3 Deere John Cap Corp Mtns Be A2/A- 747525AUZ Qualcomm Inc Make Whole Call 02/2027 A3/A- 20825UAC8 Conoco Fdg Co Make Whole Call 10/2031 A2/BBB+ 38141EW70 Goldman Sachs Inc Conditional Puts B1/B 55616XAM9 Macys Retail Hldgs Inc Baa1/BBB+ 92343VCQ5 Verizon Comm Make Whole Call Exp 04/2034 Baa1/A- 209111E03 Consolid Edison NY M Whole Call 04/2038 Baa2/BBB 959802AM1 Western Un Co Make Whole Aa2/AA- 822582AY8 Shell Intl Fin BV Make Whole Call 08/2043 Baa3/BBB- 277432AP5 Eastman Chem Co Baa3/BBB 690742AG6 Owens Corning Make Whole Call 01/2047 Coup 3.4 3.25 7.25 5.5 4.5 4.4 6.750 6.2 4.550 4.65 4.300 Maturity 9/11/2025 5/20/2027 10/15/2031 6/15/2033 12/15/2034 11/01/2034 04/01/2038 6/21/2040 08/12/2043 10/15/2044 07/15/2047 Yield 0.723 1.119 2.880 3.293 6.078 2.487 2.887 4.262 2.986 3.424 3.176 Price 112.009 112.850 139.878 122.337 85.375 122.100 151.901 125.350 125.477 119.770 120.000 Mdy's/S&P Aaa/AAA Coupon 5.000 Maturity Price YTW 06/01/2026 122.341 0.300 YTM 0.693 CallDate 12/1/2025 A1/AA 3.375 12/15/2034 114.858 1.248 2.129 6/15/2028 CUSIP Issue 890346MLO Tooele Cnty Utah Sch Dist Callable 12/25@100 917567DRZ Utah Tran Auth Sales Tax Callable 06/28-OID-Bam Insured 917547ZKO Utah St Bldg Ownership Auth Callable 05/25 795576GSO Salt Lake City Utah Arpt Rev Callable 07/27 - Sinking Fund 07/43 Aa1/AA+ 3.250 05/15/2038 107.815 1.350 2.681 5/25/2025 A2/A 5 07/01/2047 121.301 1.485 3.725 7/01/2027 EXERCISE #7: Compute the Mod Duration of the EastmanChem 2044 bond by blipping. [23/2 years to maturity] That is, compute three prices: at the current ytm, and by changing the ytm by 0.05% up and down. Then follow the ModD definition. Rescale correctly. Mod D = - %A/Ay = - (P+5 P-5)/P | (Y+5-Y-5)