Answered step by step

Verified Expert Solution

Question

1 Approved Answer

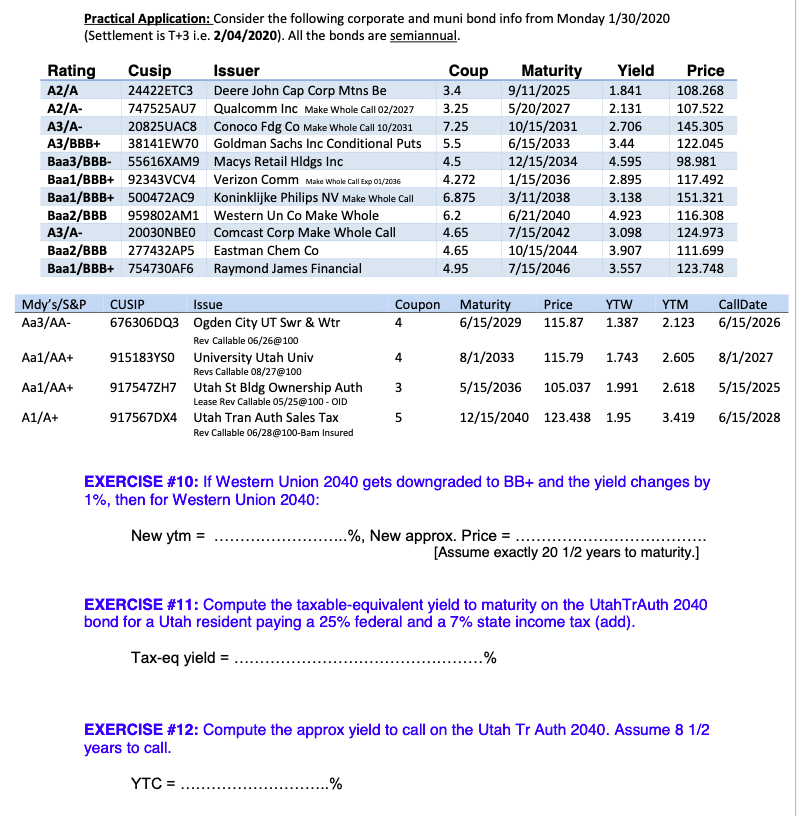

Practical Application: Consider the following corporate and muni bond info from Monday 1/30/2020 (Settlement is T+3 i.e. 2/04/2020). All the bonds are semiannual. Issuer

Practical Application: Consider the following corporate and muni bond info from Monday 1/30/2020 (Settlement is T+3 i.e. 2/04/2020). All the bonds are semiannual. Issuer 24422ETC3 Deere John Cap Corp Mtns Be 747525AU7 Qualcomm Inc Make Whole Call 02/2027 20825UAC8 Conoco Fdg Co Make Whole Call 10/2031 A3/BBB+ 38141EW70 Goldman Sachs Inc Conditional Puts Baa3/BBB- 55616XAM9 Macys Retail Hldgs Inc Baa1/BBB+ 92343VCV4 Verizon Comm Make Whole Call Exp 01/2036 Baal/BBB+ 500472AC9 Koninklijke Philips NV Make Whole Call Western Un Co Make Whole Baa2/BBB 959802AM1 A3/A- 20030NBEO Baa2/BBB 277432AP5 Eastman Chem Co Comcast Corp Make Whole Call Baa1/BBB+ 754730AF6 Rating Cusip A2/A A2/A- A3/A- Mdy's/S&P CUSIP Aa3/AA- Aa1/AA+ Aa1/AA+ A1/A+ 676306DQ3 915183YSO 917547ZH7 917567DX4 Raymond James Financial Issue Ogden City UT Swr & Wtr Rev Callable 06/26@100 University Utah Univ Revs Callable 08/27@100 Utah St Bldg Ownership Auth Lease Rev Callable 05/25@100-OID Utah Tran Auth Sales Tax Rev Callable 06/28@100-Bam Insured Coupon 4 4 3 5 ..% Coup 3.4 3.25 7.25 5.5 4.5 4.272 6.875 6.2 4.65 4.65 4.95 Yield Price 1.841 108.268 9/11/2025 5/20/2027 2.131 107.522 10/15/2031 2.706 3.44 Maturity 6/15/2033 12/15/2034 4.595 1/15/2036 2.895 3/11/2038 3.138 4.923 3.098 3.907 3.557 6/21/2040 7/15/2042 10/15/2044 7/15/2046 8/1/2033 115.79 1.743 5/15/2036 105.037 1.991 12/15/2040 123.438 1.95 ..%, New approx. Price = 145.305 122.045 Maturity Price YTW YTM 6/15/2029 115.87 1.387 98.981 117.492 151.321 116.308 124.973 111.699 123.748 CallDate 2.123 6/15/2026 8/1/2027 5/15/2025 3.419 6/15/2028 2.605 EXERCISE #10: If Western Union 2040 gets downgraded to BB+ and the yield changes by 1%, then for Western Union 2040: New ytm = 2.618 [Assume exactly 20 1/2 years to maturity.] EXERCISE #11: Compute the taxable-equivalent yield to maturity on the Utah TrAuth 2040 bond for a Utah resident paying a 25% federal and a 7% state income tax (add). Tax-eq yield = .% EXERCISE #12: Compute the approx yield to call on the Utah Tr Auth 2040. Assume 8 1/2 years to call. YTC=

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the answers to the practical bond analysis questions EXERCISE 10 If Western ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started