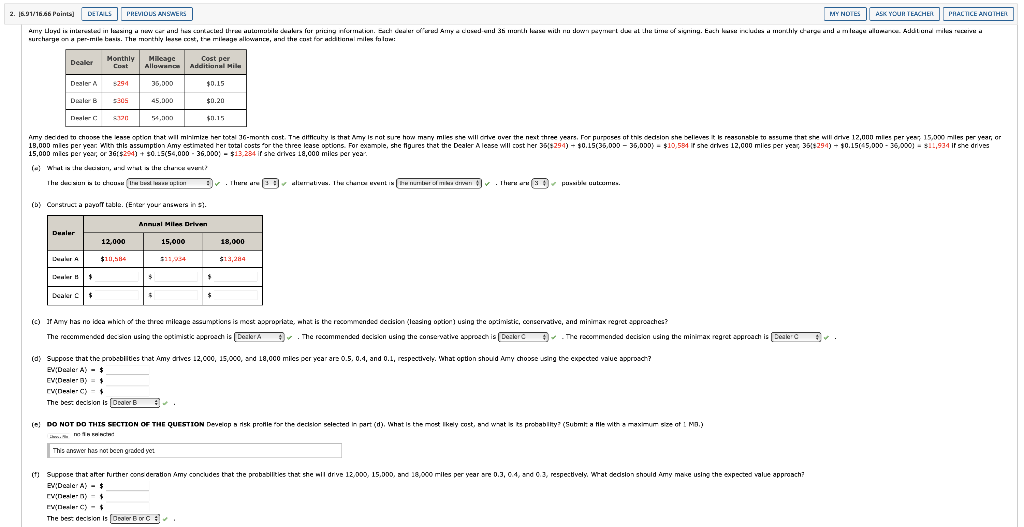

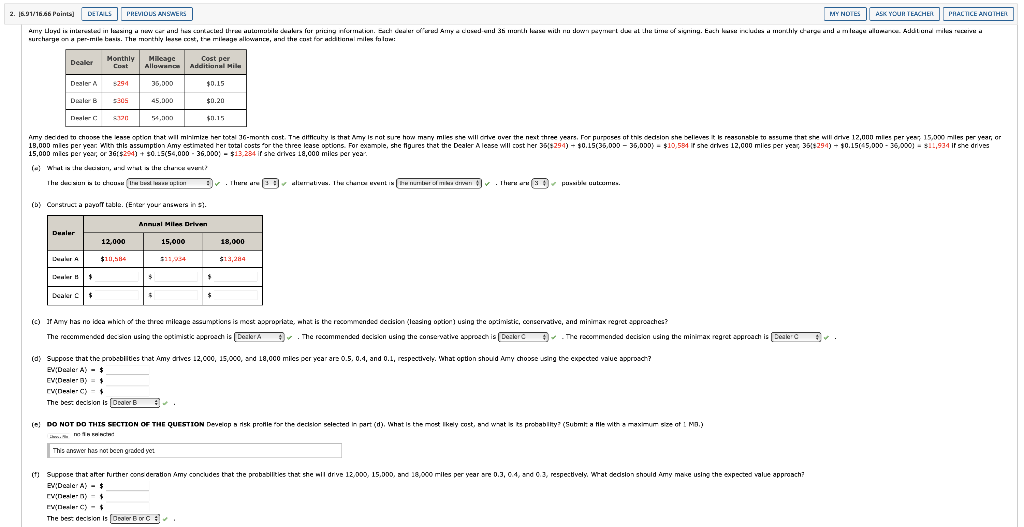

PRACTICE AND THE 2. 16.91/16.66 Points] DETALS PREVIOUS ANSWERS MY NOTES ASK YOUR TEACHER Any Ward in it. i liny w car and the comical thrulum cukura lur pricing num.io. Si det ord Ally cu 3 marks with nu serwyl Jux attein. Ewch babe re marily around wurde. Audit surcharge on a permile bests. The methylamig allowanca, and the net for den miles fole: Dealer Monthly Coat Mileage Allowano Cost per Additional Mile Dealer 5294 36.000 $0.15 DB 5205 45.000 $0.20 son 14,000 $11.15 Amy decided to choose the lesse option tat will minimize her total 16-month cost. The cluty is that my is not sure how many mlles she will cite over the next three years. For purposes of this cedolon she believes it is reasonable to assume that she will crtve 12,000 mlie: per yer; 15,000 miles per year, or 13.000 miles per year. With this assumption Amy estimated ter total costs of the three lease options. For example, the figures that the Dealer Alesse will cost her 358294) - $0.15(35,000 - 35.000) - $10.591 if she crtes 12,000 miles per year 35294) - $0.15(45,000 - 35,000) - $11.934 if she drives 15,000 miles per year, or 3G[$294) + $0..5(54,000 - 36.000 - $13,284 if she cries 18,000 miles per yea'. - What I, dwut the wat? The main hullush v . I herrirali. It can with all of ladie. Ihr Split ulim (b) Construct a pagal table. (You answers in s. Annual Miles Driven Dunler 12,000 15,000 18,000 $10,584 $13,954 $13,214 Deler $ $ Dealer $ (O) Amy has no idea which of the three mileage su motions is most apropriate, what is the recommended Cecision loging option using the opimistic, conservatic, and minimax regret approaches? The recommended decsion using the optimistic approach is Deaker ). The rccommended deckion using the conse vative approach is Deaker . . The recommended decision using the minimax regret approach is Dealer (d) Suppose that the probabilities that my dites 12.000, 15,000, and 18,000 miles per year ar 0.5.0.4, and O.L, respectacly. What option should Amy chose sing the cocted value approach? V Deale A) - $ EVDesiert ruinele-C) - The bes: dection is Dealer (e! DO NOT DO THIS SECTION OF THE QUESTION Develop a risk profile for the decisior selected in part (d). What is the most likely tout, or wat is to probabilty? (Submit a hle with a maximum szeot 1MD.) .. This awer has no congreded you ( Suppose that after further consderation my concludes that the probabilities that she wil drive 12,000, 15,000, and 18,000 miles per year sre 0.3, 0.4 and 0.3, respectively. What dedslon should Amy maice using the expected value approach? Ev Dealer A) - $ ruinele - The bes decision is lower Borca PRACTICE AND THE 2. 16.91/16.66 Points] DETALS PREVIOUS ANSWERS MY NOTES ASK YOUR TEACHER Any Ward in it. i liny w car and the comical thrulum cukura lur pricing num.io. Si det ord Ally cu 3 marks with nu serwyl Jux attein. Ewch babe re marily around wurde. Audit surcharge on a permile bests. The methylamig allowanca, and the net for den miles fole: Dealer Monthly Coat Mileage Allowano Cost per Additional Mile Dealer 5294 36.000 $0.15 DB 5205 45.000 $0.20 son 14,000 $11.15 Amy decided to choose the lesse option tat will minimize her total 16-month cost. The cluty is that my is not sure how many mlles she will cite over the next three years. For purposes of this cedolon she believes it is reasonable to assume that she will crtve 12,000 mlie: per yer; 15,000 miles per year, or 13.000 miles per year. With this assumption Amy estimated ter total costs of the three lease options. For example, the figures that the Dealer Alesse will cost her 358294) - $0.15(35,000 - 35.000) - $10.591 if she crtes 12,000 miles per year 35294) - $0.15(45,000 - 35,000) - $11.934 if she drives 15,000 miles per year, or 3G[$294) + $0..5(54,000 - 36.000 - $13,284 if she cries 18,000 miles per yea'. - What I, dwut the wat? The main hullush v . I herrirali. It can with all of ladie. Ihr Split ulim (b) Construct a pagal table. (You answers in s. Annual Miles Driven Dunler 12,000 15,000 18,000 $10,584 $13,954 $13,214 Deler $ $ Dealer $ (O) Amy has no idea which of the three mileage su motions is most apropriate, what is the recommended Cecision loging option using the opimistic, conservatic, and minimax regret approaches? The recommended decsion using the optimistic approach is Deaker ). The rccommended deckion using the conse vative approach is Deaker . . The recommended decision using the minimax regret approach is Dealer (d) Suppose that the probabilities that my dites 12.000, 15,000, and 18,000 miles per year ar 0.5.0.4, and O.L, respectacly. What option should Amy chose sing the cocted value approach? V Deale A) - $ EVDesiert ruinele-C) - The bes: dection is Dealer (e! DO NOT DO THIS SECTION OF THE QUESTION Develop a risk profile for the decisior selected in part (d). What is the most likely tout, or wat is to probabilty? (Submit a hle with a maximum szeot 1MD.) .. This awer has no congreded you ( Suppose that after further consderation my concludes that the probabilities that she wil drive 12,000, 15,000, and 18,000 miles per year sre 0.3, 0.4 and 0.3, respectively. What dedslon should Amy maice using the expected value approach? Ev Dealer A) - $ ruinele - The bes decision is lower Borca