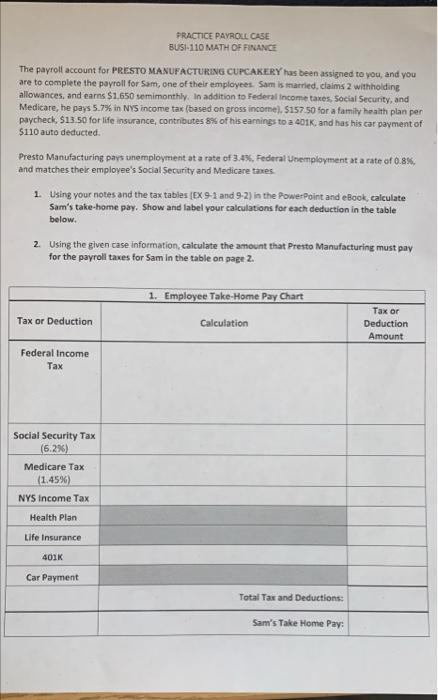

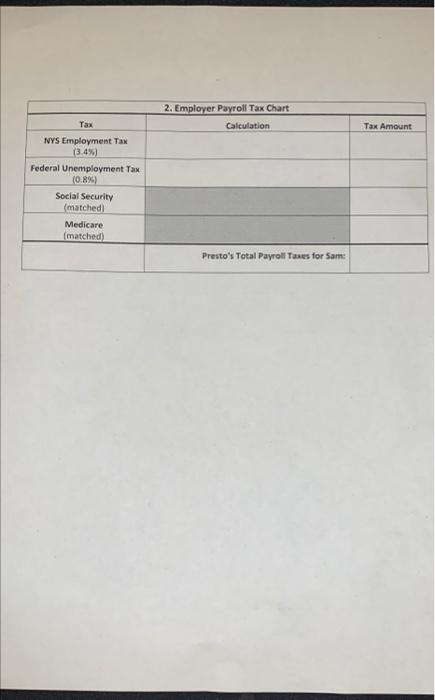

PRACTICE PAYROLL CASE BUSI-110 MATH OF FINANCE The payroll account for PRESTO MANUFACTURING CUPCAKERY has been assigned to you and you are to complete the payroll for Sam, one of their employees. Sam is married, claims 2 withholding allowances, and earns $1.650 semimonthly. In addition to Federal Income taxes, Social Security, and Medicare, he pays 5.7% in NYS income tax (based on gross income). $157.50 for a family health plan per paycheck. $13.50 for life insurance, contributes 8% of his earnings to a 401K, and has his car payment of $110 auto deducted Presto Manufacturing pays unemployment at a rate of 3.4%, Federal Unemployment at a rate of 0.8%, and matches their employee's Social Security and Medicare taxes 1. Using your notes and the tax tables [EX 9-1 and 9-2) in the PowerPoint and eBook, calculate Sam's take-home pay. Show and label your calculations for each deduction in the table below. 2. Using the given case information, calculate the amount that Presto Manufacturing must pay for the payroll taxes for Sam in the table on page 2 1. Employee Take-Home Pay Chart Calculation Tax or Tax or Deduction Deduction Amount Federal Income Tax Social Security Tax (6.2%) Medicare Tax (1.45%) NYS Income Tax Health Plan Life Insurance 401K Car Payment Total Tax and Deductions: Sam's Take Home Pay 2. Employer Payroll Tax Chart Calculation Tax Amount Tax NYS Employment Tax (3.4%) Federal Unemployment Tax (0.8%) Social Security (matched) Medicare matched) Presto's Total Payroll Taxes for Sam: PRACTICE PAYROLL CASE BUSI-110 MATH OF FINANCE The payroll account for PRESTO MANUFACTURING CUPCAKERY has been assigned to you and you are to complete the payroll for Sam, one of their employees. Sam is married, claims 2 withholding allowances, and earns $1.650 semimonthly. In addition to Federal Income taxes, Social Security, and Medicare, he pays 5.7% in NYS income tax (based on gross income). $157.50 for a family health plan per paycheck. $13.50 for life insurance, contributes 8% of his earnings to a 401K, and has his car payment of $110 auto deducted Presto Manufacturing pays unemployment at a rate of 3.4%, Federal Unemployment at a rate of 0.8%, and matches their employee's Social Security and Medicare taxes 1. Using your notes and the tax tables [EX 9-1 and 9-2) in the PowerPoint and eBook, calculate Sam's take-home pay. Show and label your calculations for each deduction in the table below. 2. Using the given case information, calculate the amount that Presto Manufacturing must pay for the payroll taxes for Sam in the table on page 2 1. Employee Take-Home Pay Chart Calculation Tax or Tax or Deduction Deduction Amount Federal Income Tax Social Security Tax (6.2%) Medicare Tax (1.45%) NYS Income Tax Health Plan Life Insurance 401K Car Payment Total Tax and Deductions: Sam's Take Home Pay 2. Employer Payroll Tax Chart Calculation Tax Amount Tax NYS Employment Tax (3.4%) Federal Unemployment Tax (0.8%) Social Security (matched) Medicare matched) Presto's Total Payroll Taxes for Sam