practice problems please help!

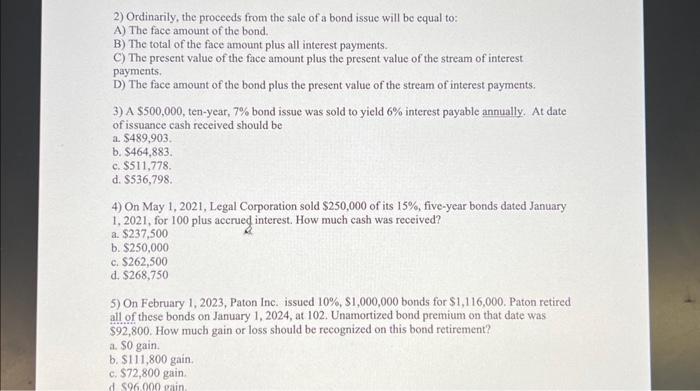

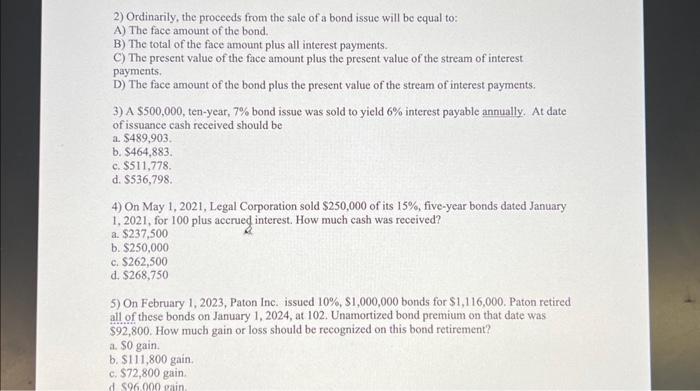

2) Ordinarily, the proceeds from the sale of a bond issue will be equal to: A) The face amount of the bond. B) The total of the face amount plus all interest payments. C) The present value of the face amount plus the present value of the stream of interest payments. D) The face amount of the bond plus the present value of the stream of interest payments. 3) A $500,000, ten-year, 7% bond issue was sold to yield 6% interest payable annually. At date of issuance cash received should be a. $489,903. b. $464,883. c. $511,778. d. $536,798. 4) On May 1, 2021, Legal Corporation sold $250,000 of its 15%, five-year bonds dated January 1,2021 , for 100 plus accrued interest. How much cash was received? a. $237,500 b. $250,000 c. $262,500 d. $268,750 5) On February 1, 2023, Paton Inc. issued 10%,$1,000,000 bonds for $1,116,000. Paton retired all of these bonds on January 1,2024, at 102. Unamortized bond premium on that date was $92,800. How much gain or loss should be recognized on this bond retirement? a. $0 gain. b. $111,800 gain. c. $72,800 gain. 2) Ordinarily, the proceeds from the sale of a bond issue will be equal to: A) The face amount of the bond. B) The total of the face amount plus all interest payments. C) The present value of the face amount plus the present value of the stream of interest payments. D) The face amount of the bond plus the present value of the stream of interest payments. 3) A $500,000, ten-year, 7% bond issue was sold to yield 6% interest payable annually. At date of issuance cash received should be a. $489,903. b. $464,883. c. $511,778. d. $536,798. 4) On May 1, 2021, Legal Corporation sold $250,000 of its 15%, five-year bonds dated January 1,2021 , for 100 plus accrued interest. How much cash was received? a. $237,500 b. $250,000 c. $262,500 d. $268,750 5) On February 1, 2023, Paton Inc. issued 10%,$1,000,000 bonds for $1,116,000. Paton retired all of these bonds on January 1,2024, at 102. Unamortized bond premium on that date was $92,800. How much gain or loss should be recognized on this bond retirement? a. $0 gain. b. $111,800 gain. c. $72,800 gain