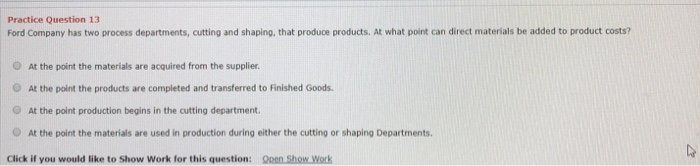

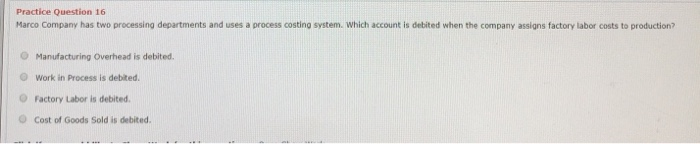

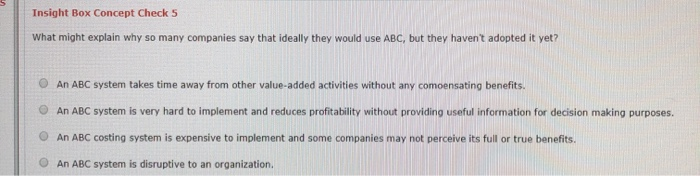

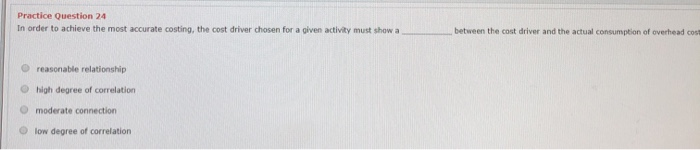

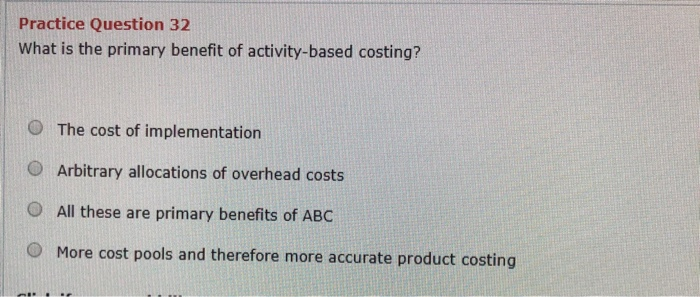

Practice Question 13 Ford Company has two process departments, cutting and shaping, that produce products. At what point can direct materials be added to product costs? At the point the materials are acquired from the supplier. At the point the products are completed and transferred to Finished Goods. At the point production begins in the cutting department. At the point the materials are used in production during either the cutting or shaping Departments. Qnen Show Work Click if you would like to Show Work for this question: Practice Question 16 Marco Company has two processing departments and uses a process costing system. Which account is debited when the company assigns factory labor costs to production? Manufacturing Overhead is debited. Work in Process is debited. OFactory Labor is debited. O Cost of Goods Sold is debited. Insight Box Concept Check 5 What might explain why so many companies say that ideally they would use ABC, but they haven't adopted it yet? An ABC system takes time away from other value-added activities without any comoensating benefits. An ABC system is very hard to implement and reduces profitability without providing useful information for decision making purposes. An ABC costing system is expensive to implement and some companies may not perceive its full or true benefits. An ABC system is disruptive to an organization. Practice Question 23 Which one of the following would be the best cost driver for the activity of purchasing? The number of purchase orders issued The number of employees in the purchasing department O Total number of items ordered O Total dollar value of items orders cit-L Practice Question 24 In order to achieve the most accurate costing, the cost driver chosen for a given activity must show a between the cost driver and the actual consumption of overhead cost reasonable relationship high degree of correlation moderate connection low degree of correlation Practice Question 32 What is the primary benefit of activity-based costing? The cost of implementation Arbitrary allocations of overhead costs O All these are primary benefits of ABC More cost pools and therefore more accurate product costing