Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Practice Question 2 : Valuation with a Binomial Lattice Approach The current market price of a stock is 4 5 . 5 . Over the

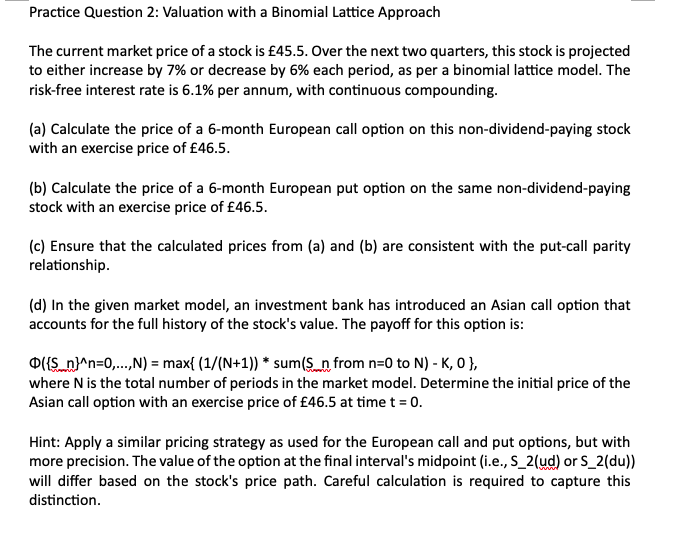

Practice Question : Valuation with a Binomial Lattice Approach

The current market price of a stock is Over the next two quarters, this stock is projected

to either increase by or decrease by each period, as per a binomial lattice model. The

riskfree interest rate is per annum, with continuous compounding.

a Calculate the price of a month European call option on this nondividendpaying stock

with an exercise price of

b Calculate the price of a month European put option on the same nondividendpaying

stock with an exercise price of

c Ensure that the calculated prices from a and b are consistent with the putcall parity

relationship.

d In the given market model, an investment bank has introduced an Asian call option that

accounts for the full history of the stock's value. The payoff for this option is:

from to

where is the total number of periods in the market model. Determine the initial price of the

Asian call option with an exercise price of at time

Hint: Apply a similar pricing strategy as used for the European call and put options, but with

more precision. The value of the option at the final interval's midpoint ie Sud or Sdu

will differ based on the stock's price path. Careful calculation is required to capture this

distinction.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started