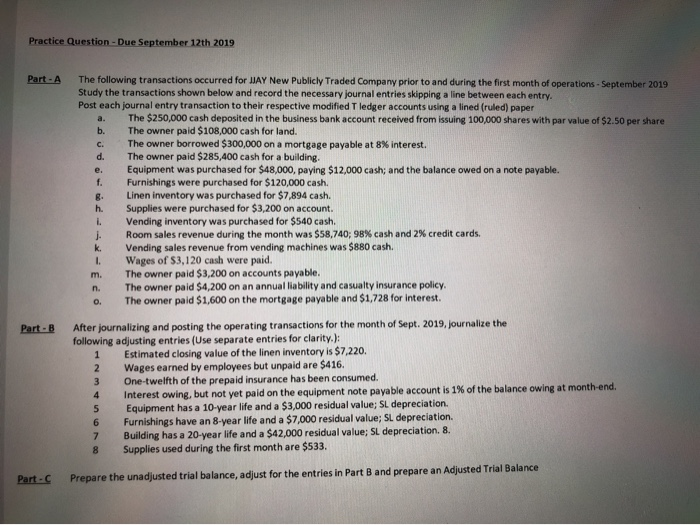

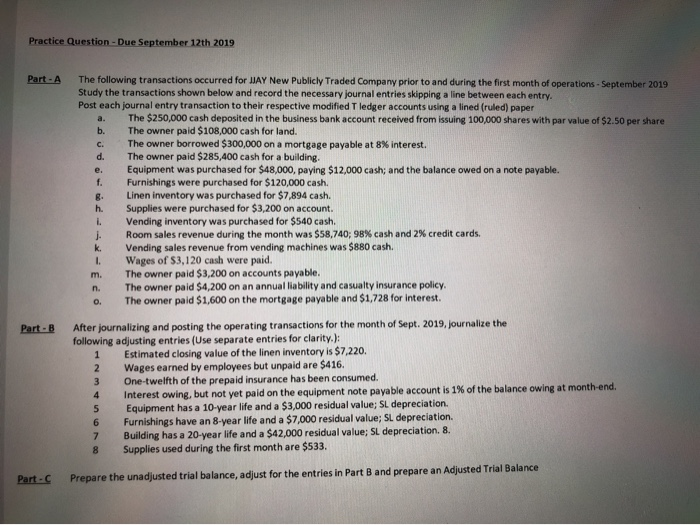

Practice Question - Due September 12th 2019 Part - A The following transactions occurred for JAY New Publicly Traded Company prior to and during the first month of operations. September 2019 Study the transactions shown below and record the necessary journal entries skipping a line between each entry. Post each journal entry transaction to their respective modified T ledger accounts using a lined (ruled) paper a. The $250,000 cash deposited in the business bank account received from issuing 100,000 shares with par value of $2.50 per share b. The owner paid $108,000 cash for land. c. The owner borrowed $300,000 on a mortgage payable at 8% interest. d. The owner paid $285,400 cash for a building. e. Equipment was purchased for $48,000, paying $12,000 cash; and the balance owed on a note payable. Furnishings were purchased for $120,000 cash. Linen inventory was purchased for $7,894 cash. Supplies were purchased for $3,200 on account. Vending inventory was purchased for $540 cash. Room sales revenue during the month was $58,740; 98% cash and 2% credit cards. Vending sales revenue from vending machines was $880 cash. Wages of $3,120 cash were paid. The owner paid $3,200 on accounts payable. n. The owner paid $4,200 on an annual liability and casualty insurance policy o. The owner paid $1,600 on the mortgage payable and $1,728 for interest. m. Part - B After journalizing and posting the operating transactions for the month of Sept. 2019, journalize the following adjusting entries (Use separate entries for clarity.): Estimated closing value of the linen inventory is $7,220. Wages earned by employees but unpaid are $416. One-twelfth of the prepaid insurance has been consumed. Interest owing, but not yet paid on the equipment note payable account is 1% of the balance owing at month-end, Equipment has a 10-year life and a $3,000 residual value; SL depreciation Furnishings have an 8-year life and a $7,000 residual value; SL depreciation Building has a 20-year life and a $42,000 residual value; SL depreciation. 8. Supplies used during the first month are $533. Part. Prepare the unadjusted trial balance, adjust for the entries in Part B and prepare an Adjusted Trial Balance