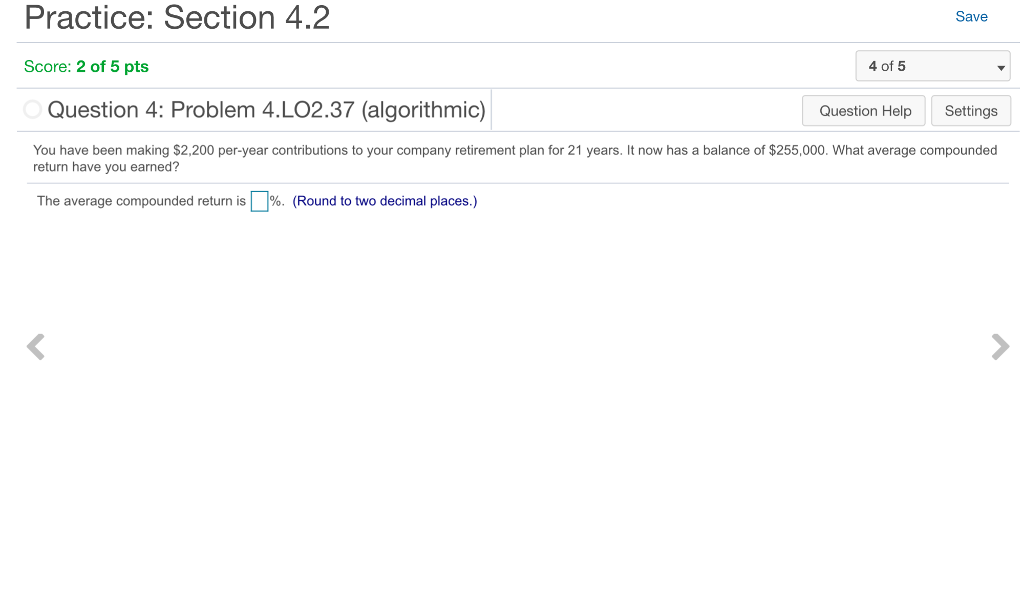

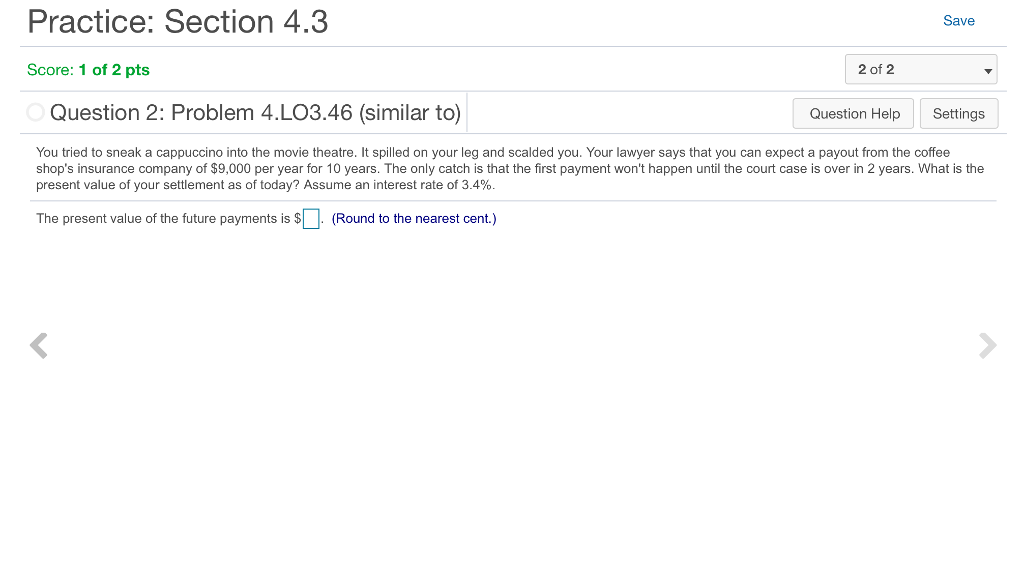

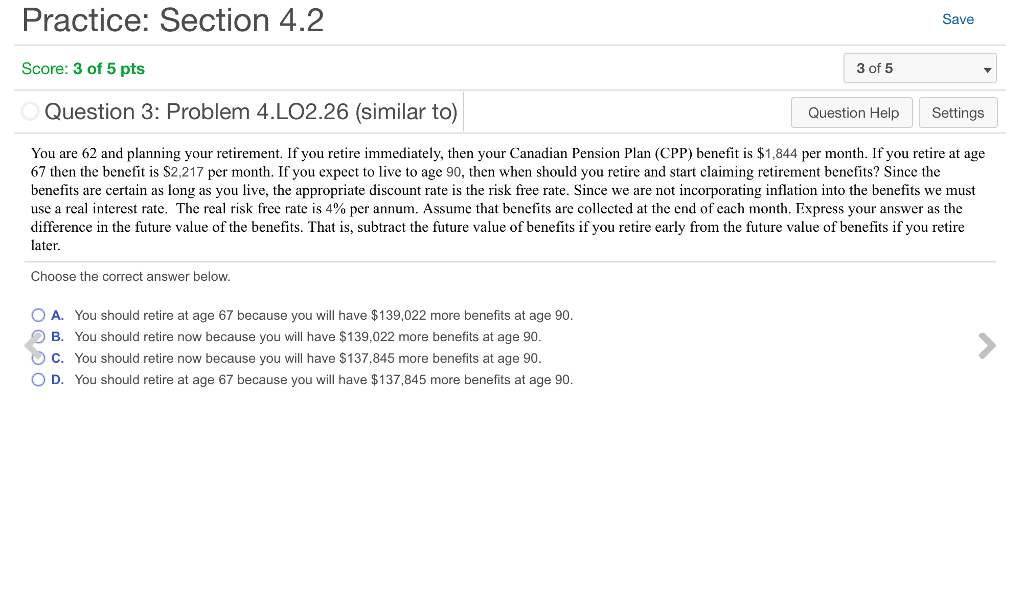

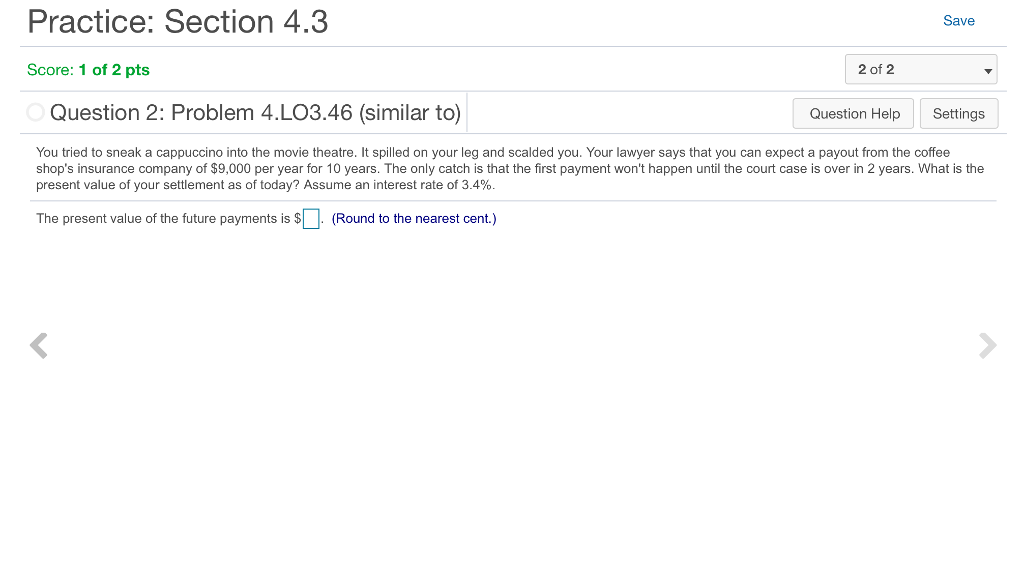

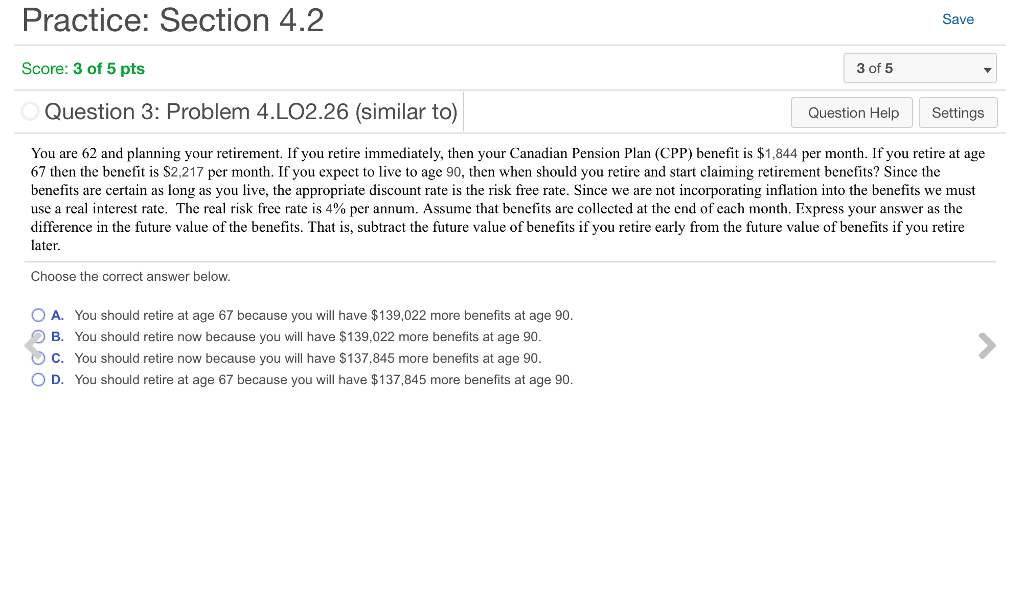

Practice: Section 4.2 Save Score: 2 of 5 pts 4 of 5 Question 4: Problem 4.LO2.37 (algorithmic) Question Help Settings You have been making $2,200 per-year contributions to your company retirement plan for 21 years. It now has a balance of $255,000. What average compounded return have you earned? The average compounded return is | %. (Round to two decimal places.) Practice: Section 4.3 Save Score: 1 of 2 pts 2 of 2 Question 2: Problem 4.LO3.46 (similar to) Question Help Settings You tried to sneak a cappuccino into the movie theatre. It spilled on your leg and scalded you. Your lawyer says that you can expect a payout from the coffee shop's insurance company of $9,000 per year for 10 years. The only catch is that the first payment won't happen until the court case is over in 2 years. What is the present value of your settlement as of today? Assume an interest rate of 3 4%. The present value of the future payments is $. (Round to the nearest cent.) Practice: Section 4.2 Save Score: 3 of 5 pts 3 of 5 Question 3: Problem 4.LO2.26 (similar to) Question Help Settings You are 62 and planning your retirement. If you retire immediately, then your Canadian Pension Plan (CPP) benefit is $1,844 per month. If you retire at age 67 then the benefit is S2,217 per month. If you expect to live to age 90, then when should you retire and start claiming retirement benefits? Since the benefits are certain as long as you live, the appropriate discount rate is the risk free rate. Since we are not incorporating inflation into the benefits we must use a real interest rate. The real risk free rate is 4% per annum. Assume that bene ts are co ected athe end of ac month xmes our answeras e difference in the future value of the benefits. That is, subtract the future value of benefits if you retire early from the future value of benefits if you retire later. ralriskfrerates4%per naut theft revalue ofbenefits if you Choose the correct answer below. O A. You should retire at age 67 because you will have $139,022 more benefits at age 90 B. You should retire now because you will have $139,022 more benefits at age 90. C. You should retire now because you will have $137,845 more benefits at age 90 O D. You should retire at age 67 because you will have $137,845 more benefits at age 90