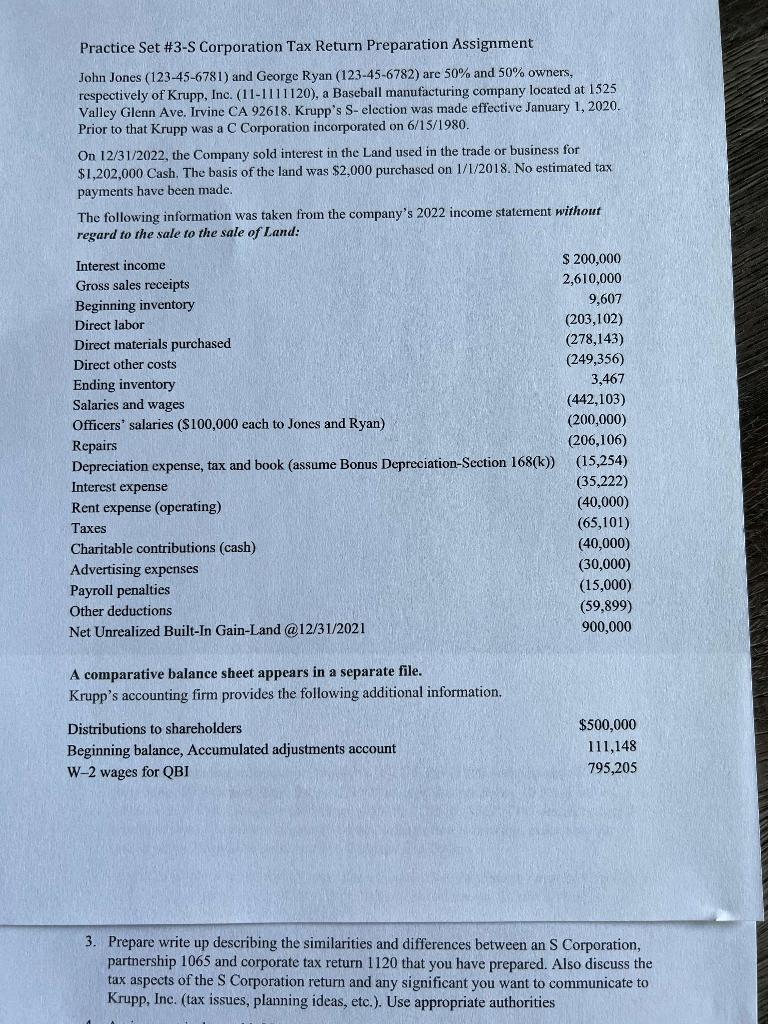

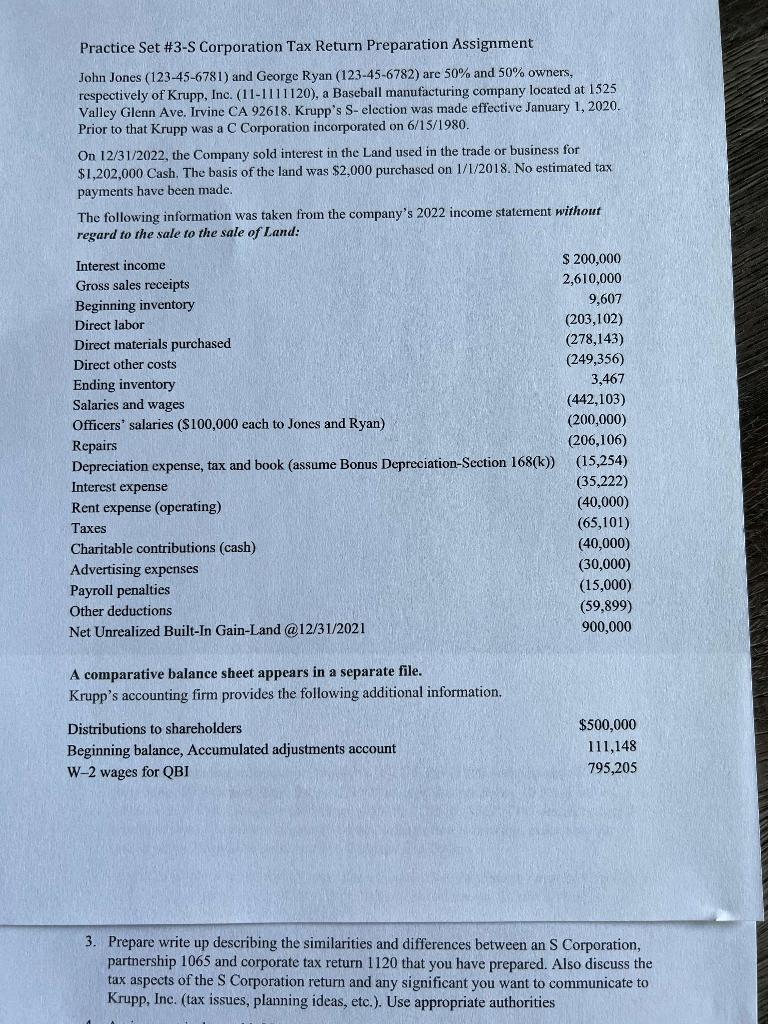

Practice Set \#3-S Corporation Tax Return Preparation Assignment John Jones (123-45-6781) and George Ryan (123-45-6782) are 50\% and 50\% owners, respectively of Krupp, Inc. (11-1111120), a Baseball manufacturing company located at 1525 Valley Glenn Ave. Irvine CA 92618. Krupp's S- election was made effective January 1, 2020. Prior to that Krupp was a C Corporation incorporated on 6/15/1980. On 12/31/2022, the Company sold interest in the Land used in the trade or business for $1,202,000 Cash. The basis of the land was $2,000 purchased on 1/1/2018. No estimated tax payments have been made. The following information was taken from the company's 2022 income statement without A comparative balance sheet appears in a separate file. Krupp's accounting firm provides the following additional information. 3. Prepare write up describing the similarities and differences between an S Corporation, partnership 1065 and corporate tax return 1120 that you have prepared. Also discuss the tax aspects of the S Corporation return and any significant you want to communicate to Krupp, Inc. (tax issues, planning ideas, ete.). Use appropriate authorities Practice Set \#3-S Corporation Tax Return Preparation Assignment John Jones (123-45-6781) and George Ryan (123-45-6782) are 50\% and 50\% owners, respectively of Krupp, Inc. (11-1111120), a Baseball manufacturing company located at 1525 Valley Glenn Ave. Irvine CA 92618. Krupp's S- election was made effective January 1, 2020. Prior to that Krupp was a C Corporation incorporated on 6/15/1980. On 12/31/2022, the Company sold interest in the Land used in the trade or business for $1,202,000 Cash. The basis of the land was $2,000 purchased on 1/1/2018. No estimated tax payments have been made. The following information was taken from the company's 2022 income statement without A comparative balance sheet appears in a separate file. Krupp's accounting firm provides the following additional information. 3. Prepare write up describing the similarities and differences between an S Corporation, partnership 1065 and corporate tax return 1120 that you have prepared. Also discuss the tax aspects of the S Corporation return and any significant you want to communicate to Krupp, Inc. (tax issues, planning ideas, ete.). Use appropriate authorities