Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Practice Set #4 Having recorded, posted (to the General Ledger) and completed the '1-31-23 Trial Balance' worksheet with the unadjusted balances (Practice Set #3),

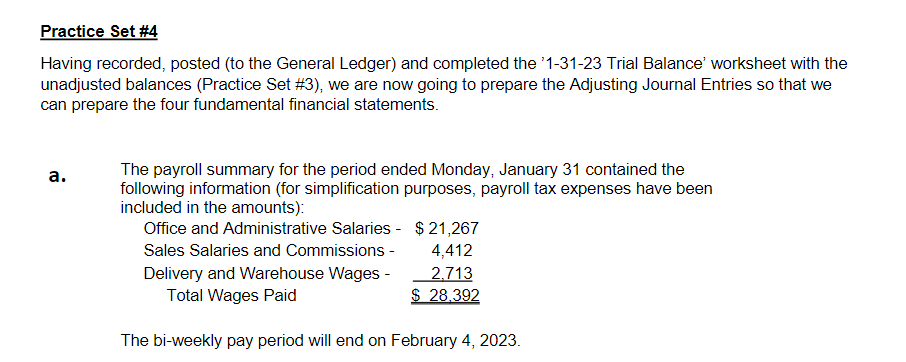

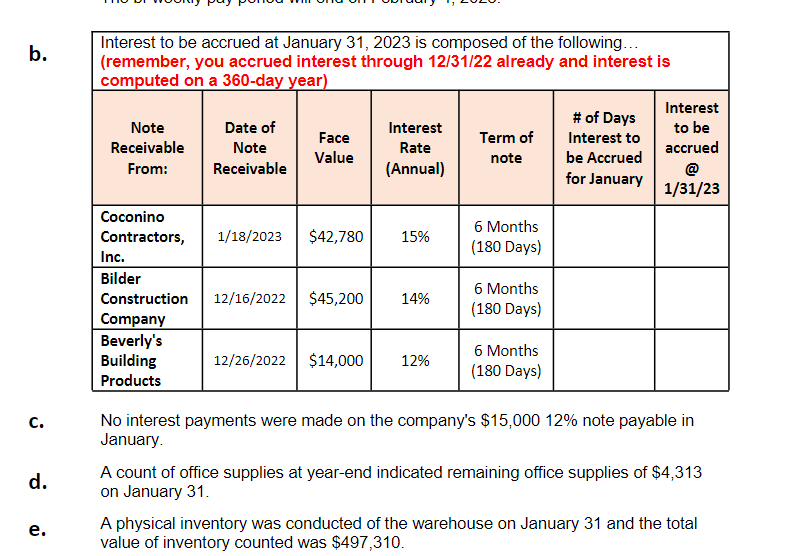

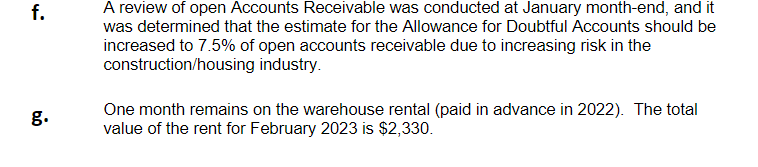

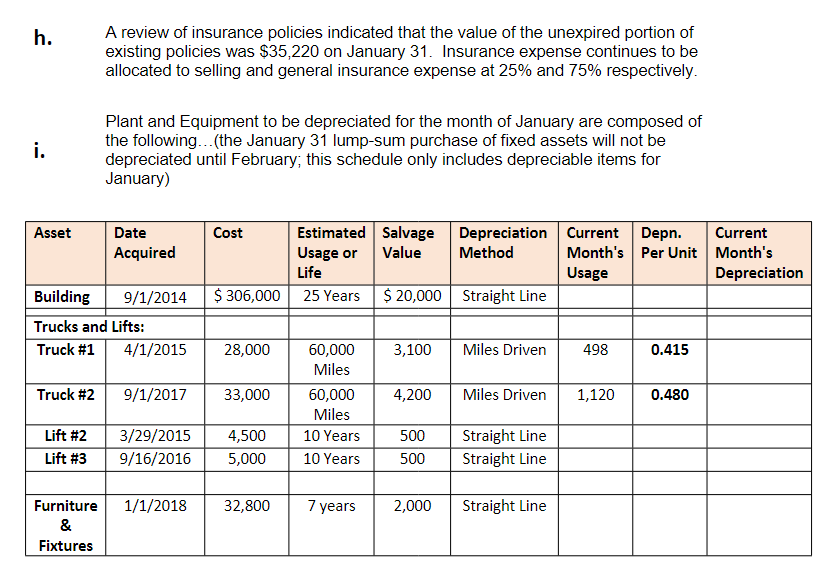

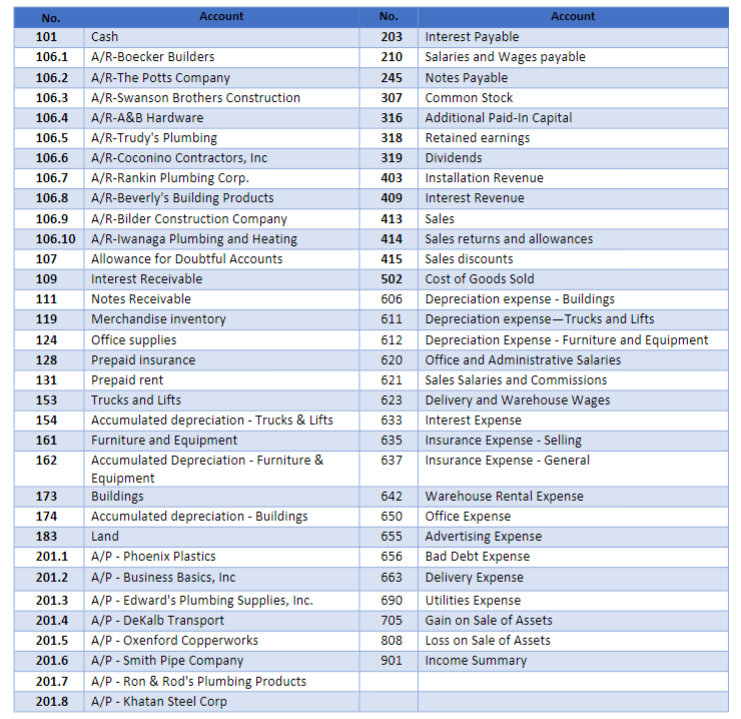

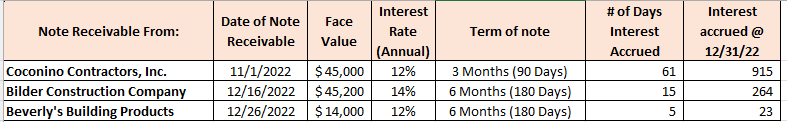

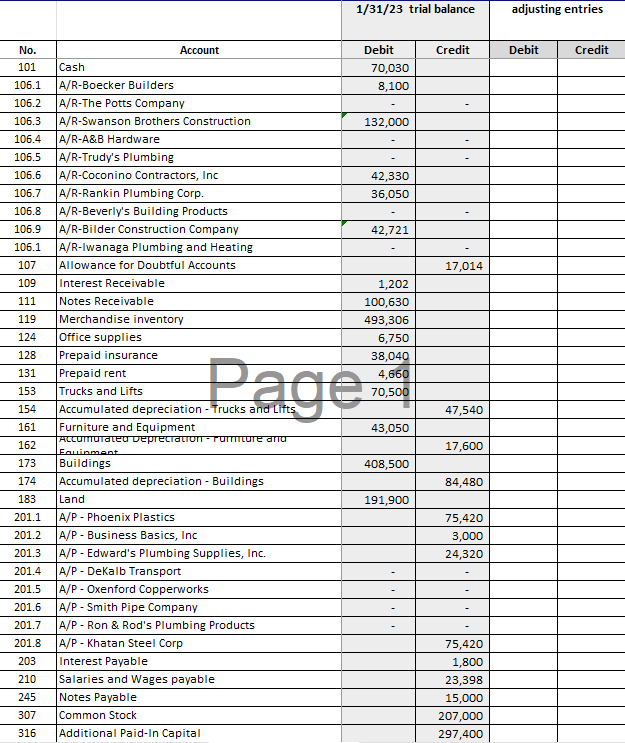

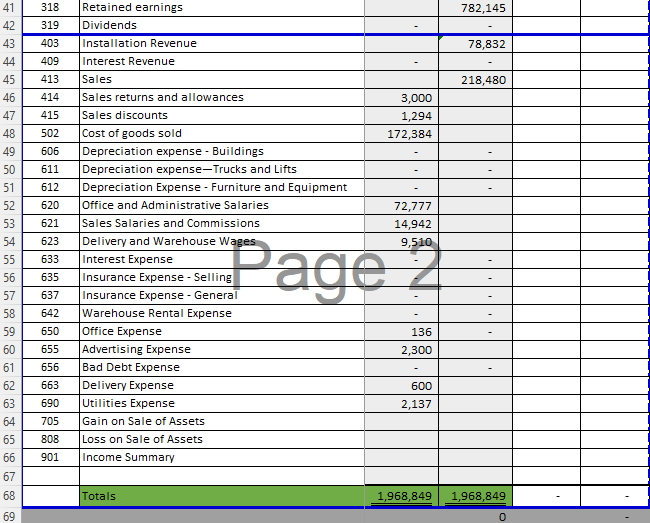

Practice Set #4 Having recorded, posted (to the General Ledger) and completed the '1-31-23 Trial Balance' worksheet with the unadjusted balances (Practice Set #3), we are now going to prepare the Adjusting Journal Entries so that we can prepare the four fundamental financial statements. a. The payroll summary for the period ended Monday, January 31 contained the following information (for simplification purposes, payroll tax expenses have been included in the amounts): Office and Administrative Salaries - $ 21,267 Sales Salaries and Commissions - 4,412 2,713 $ 28,392 Delivery and Warehouse Wages - Total Wages Paid The bi-weekly pay period will end on February 4, 2023. b. C. d. e. Interest to be accrued at January 31, 2023 is composed of the following... (remember, you accrued interest through 12/31/22 already and interest is computed on a 360-day year) Note Receivable From: Coconino Contractors, Inc. Bilder Construction Company Beverly's Building Products Date of Note Receivable Face Value 1/18/2023 $42,780 Interest Rate (Annual) 15% 12/16/2022 $45,200 14% 12/26/2022 $14,000 12% Term of note 6 Months (180 Days) 6 Months (180 Days) 6 Months (180 Days) # of Days Interest to be Accrued for January Interest to be accrued 1/31/23 No interest payments were made on the company's $15,000 12 % note payable in January. A count of office supplies at year-end indicated remaining office supplies of $4,313 on January 31. A physical inventory was conducted of the warehouse on January 31 and the total value of inventory counted was $497,310. f. g. A review of open Accounts Receivable was conducted at January month-end, and it was determined that the estimate for the Allowance for Doubtful Accounts should be increased to 7.5% of open accounts receivable due to increasing risk in the construction/housing industry. One month remains on the warehouse rental (paid in advance in 2022). The total value of the rent for February 2023 is $2,330. h. i. Asset Truck #2 Lift #2 Lift #3 A review of insurance policies indicated that the value of the unexpired portion of existing policies was $35,220 on January 31. Insurance expense continues to be allocated to selling and general insurance expense at 25% and 75% respectively. Building Trucks and Lifts: Truck #1 Furniture & Fixtures Plant and Equipment to be depreciated for the month of January are composed of the following...(the January 31 lump-sum purchase of fixed assets will not be depreciated until February; this schedule only includes depreciable items for January) Date Acquired 9/1/2014 4/1/2015 9/1/2017 3/29/2015 9/16/2016 1/1/2018 Cost $ 306,000 28,000 33,000 4,500 5,000 32,800 Estimated Salvage Usage or Value Life 25 Years $20,000 Straight Line 60,000 Miles 60,000 Miles 10 Years 10 Years 7 years 3,100 4,200 500 500 Depreciation Current Depn. Method Month's Per Unit Usage 2,000 Miles Driven Miles Driven Straight Line Straight Line Straight Line 498 1,120 0.415 0.480 Current Month's Depreciation No. 101 Cash 106.1 A/R-Boecker Builders 106.2 A/R-The Potts Company 106.3 106.4 A/R-A&B Hardware 106.5 A/R-Trudy's Plumbing 106.6 106.7 106.8 106.9 106.10 107 109 111 119 124 128 131 153 154 161 162 Account 173 174 183 201.1 201.2 201.3 201.4 201.5 201.6 201.7 201.8 A/R-Swanson Brothers Construction A/R-Coconino Contractors, Inc A/R-Rankin Plumbing Corp. A/R-Beverly's Building Products A/R-Bilder Construction Company A/R-Iwanaga Plumbing and Heating Allowance for Doubtful Accounts Interest Receivable Notes Receivable Merchandise inventory Office supplies Prepaid insurance Prepaid rent Trucks and Lifts Accumulated depreciation - Trucks & Lifts Furniture and Equipment Accumulated Depreciation - Furniture & Equipment Buildings Accumulated depreciation - Buildings Land A/P - Phoenix Plastics A/P - Business Basics, Inc A/P - Edward's Plumbing Supplies, Inc. A/P - DeKalb Transport A/P - Oxenford Copperworks A/P - Smith Pipe Company A/P - Ron & Rod's Plumbing Products A/P - Khatan Steel Corp No. 203 210 245 307 316 318 319 403 409 413 414 415 502 606 611 612 620 621 623 633 635 637 642 650 655 656 663 690 705 808 901 Account Interest Payable Salaries and Wages payable Notes Payable Common Stock Additional Paid-In Capital Retained earnings Dividends Installation Revenue Interest Revenue Sales Sales returns and allowances Sales discounts Cost of Goods Sold Depreciation expense - Buildings Depreciation expense-Trucks and Lifts Depreciation Expense- Furniture and Equipment Office and Administrative Salaries Sales Salaries and Commissions Delivery and Warehouse Wages Interest Expense Insurance Expense - Selling Insurance Expense - General Warehouse Rental Expense Office Expense Advertising Expense Bad Debt Expense Delivery Expense Utilities Expense Gain on Sale of Assets Loss on Sale of Assets Income Summary Note Receivable From: Coconino Contractors, Inc. Bilder Construction Company Beverly's Building Products Interest Rate (Annual) 11/1/2022 $ 45,000 12% 12/16/2022 $45,200 14% 12/26/2022 $14,000 12% Date of Note Receivable Face Value Term of note 3 Months (90 Days) 6 Months (180 Days) 6 Months (180 Days) # of Days Interest Accrued 61 15 5 Interest accrued @ 12/31/22 915 264 23 No. 101 106.1 A/R-Boecker Builders 106.2 A/R-The Potts Company 106.3 A/R-Swanson Brothers Construction 106.4 A/R-A&B Hardware 106.5 106.6 106.7 106.8 106.9 106.1 107 109 111 119 Merchandise inventory 124 128 131 153 154 161 162 173 174 183 201.1 201.2 201.3 201.4 201.5 201.6 201.7 201.8 203 210 245 307 316 Additional Paid-In Capital Cash Account A/R-Trudy's Plumbing A/R-Coconino Contractors, Inc A/R-Rankin Plumbing Corp. A/R-Beverly's Building Products A/R-Bilder Construction Company A/R-Iwanaga Plumbing and Heating Allowance for Doubtful Accounts Interest Receivable Notes Receivable Office supplies Prepaid insurance Prepaid rent Trucks and Lifts Accumulated depreciation - Trucks and Lifts Furniture and Equipment Accumulated Depreciation - Furniture and Equipment Buildings Accumulated depreciation - Buildings Page Land A/P - Phoenix Plastics A/P - Business Basics, Inc A/P - Edward's Plumbing Supplies, Inc. A/P - DeKalb Transport A/P - Oxenford Copperworks A/P - Smith Pipe Company A/P - Ron & Rod's Plumbing Products A/P Khata Steel Corp 1/31/23 trial balance Interest Payable Salaries and Wages payable Notes Payable Common Stock Debit 70,030 8,100 132,000 42,330 36,050 42,721 1,202 100,630 493,306 6,750 38,040 4,660 70,500 43,050 408,500 191,900 Credit 17,014 47,540 17,600 84,480 75,420 3,000 24,320 75,420 1,800 23,398 15,000 207,000 297,400 adjusting entries Debit Credit 4 2 3 4 45 45 7 48 49 50 41 318 42 319 43 403 409 413 44 46 414 Interest Revenue Sales Sales returns and allowances Sales discounts Cost of goods sold 606 Depreciation expense - Buildings 611 Depreciation expense-Trucks and Lifts Depreciation Expense - Furniture and Equipment Office and Administrative Salaries Sales Salaries and Commissions 47 415 502 Retained earnings Dividends Installation Revenue 51 612 52 620 53 621 54 623 55 633 56 635 57 637 58 642 59 650 60 655 61 656 62 663 63 690 64 705 65 808 66 901 67 68 69 Delivery and Warehouse Wages Interest Expense Insurance Expense - Selling Insurance Expense - General Warehouse Rental Expense Office Expense Advertising Expense Bad Debt Expense Delivery Expense Utilities Expense Gain on Sale of Assets Loss on Sale of Assets Income Summary Totals 3,000 1,294 172,384 Page 72,777 14,942 9,510 136 2,300 600 2,137 782,145 78,832 218,480 1,968,849 1,968,849 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the adjusting journal entry for the payroll expenses as of January 31 2023 you would need to recognize the wages earned by employees up to that date Heres how you can calculate and record t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started