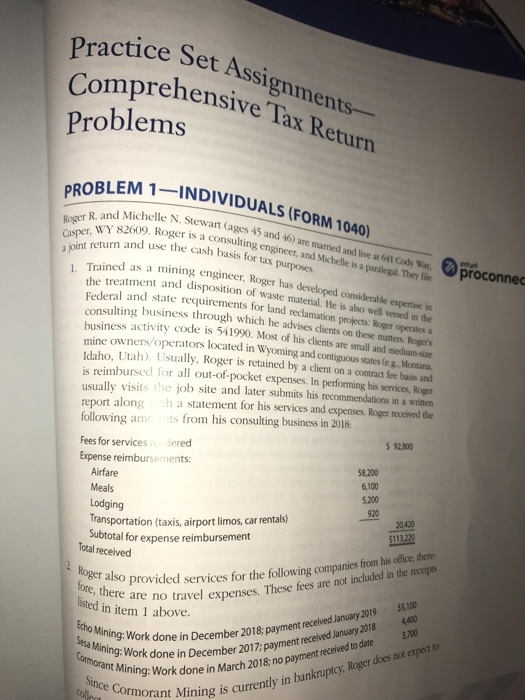

Practice Set Assig rice Set Assignments- Comprehensive Tax Return Problems PROBLEM 1-INDIVIDU -INDIVIDUALS (FORM 1040) Roger R. and Michelle Casper, WY 82609. Roge dichelle N. Stewart (ages 45 and 46) are married and live 641 Cody Way. 2609, Roger is a consulting engineer, and Michelle is a paralegal. They file the cash basis for tax purposes joint return and use the cash bas 1. Trained as a m proconnec Federal and state reo Consul as a mining engineer, Roger has developed considerable expertise in alment and disposition of waste material. He is also well versed in the beral and state requirements for land reclamation projects: Roest operates a sulting business through which he advises clients on these matters Real siness activity code is 541990. Most of his clients are small and medium size mine owners/operators located in Wyoming and contiguous states Macan Idaho, Utah). Usually, Roger is retained by a client on a contract fee basis and is reimbursed for all out-of-pocket expenses. In performing his services, Roger usually visits the job site and later submits his recommendations in a written report along th a statement for his services and expenses. Roger received the on these mun operates in Wyominos clients ally, Roger $ 92,800 following am ts from his consulting business in 2018: Fees for services dered Expense reimbursements: Airfare Meals Lodging Transportation (taxis, airport limos, car rentals) Subtotal for expense reimbursement 58.200 6,100 5.200 920 20,420 $111.720 Total received Roger also provi fore, there are no services for the following companies from his office there Te no travel expenses. These fees are not included in the recipes isted in item 1 above. Echo Mining: Work done Sesa Mining: Work * done in December 2018: payment received January 2019 Cormorant Mining: Work ng: Work done in December 2017, paymer ing: Work done in March 2018; no payment receive 55.100 2017, payment received January 2018 4000 12018 no payment received to date 3.700 lining is currently in bankruptcy, Roger does not expect to Since Cormorant Mining Coleh Practice Set Assig rice Set Assignments- Comprehensive Tax Return Problems PROBLEM 1-INDIVIDU -INDIVIDUALS (FORM 1040) Roger R. and Michelle Casper, WY 82609. Roge dichelle N. Stewart (ages 45 and 46) are married and live 641 Cody Way. 2609, Roger is a consulting engineer, and Michelle is a paralegal. They file the cash basis for tax purposes joint return and use the cash bas 1. Trained as a m proconnec Federal and state reo Consul as a mining engineer, Roger has developed considerable expertise in alment and disposition of waste material. He is also well versed in the beral and state requirements for land reclamation projects: Roest operates a sulting business through which he advises clients on these matters Real siness activity code is 541990. Most of his clients are small and medium size mine owners/operators located in Wyoming and contiguous states Macan Idaho, Utah). Usually, Roger is retained by a client on a contract fee basis and is reimbursed for all out-of-pocket expenses. In performing his services, Roger usually visits the job site and later submits his recommendations in a written report along th a statement for his services and expenses. Roger received the on these mun operates in Wyominos clients ally, Roger $ 92,800 following am ts from his consulting business in 2018: Fees for services dered Expense reimbursements: Airfare Meals Lodging Transportation (taxis, airport limos, car rentals) Subtotal for expense reimbursement 58.200 6,100 5.200 920 20,420 $111.720 Total received Roger also provi fore, there are no services for the following companies from his office there Te no travel expenses. These fees are not included in the recipes isted in item 1 above. Echo Mining: Work done Sesa Mining: Work * done in December 2018: payment received January 2019 Cormorant Mining: Work ng: Work done in December 2017, paymer ing: Work done in March 2018; no payment receive 55.100 2017, payment received January 2018 4000 12018 no payment received to date 3.700 lining is currently in bankruptcy, Roger does not expect to Since Cormorant Mining Coleh