Answered step by step

Verified Expert Solution

Question

1 Approved Answer

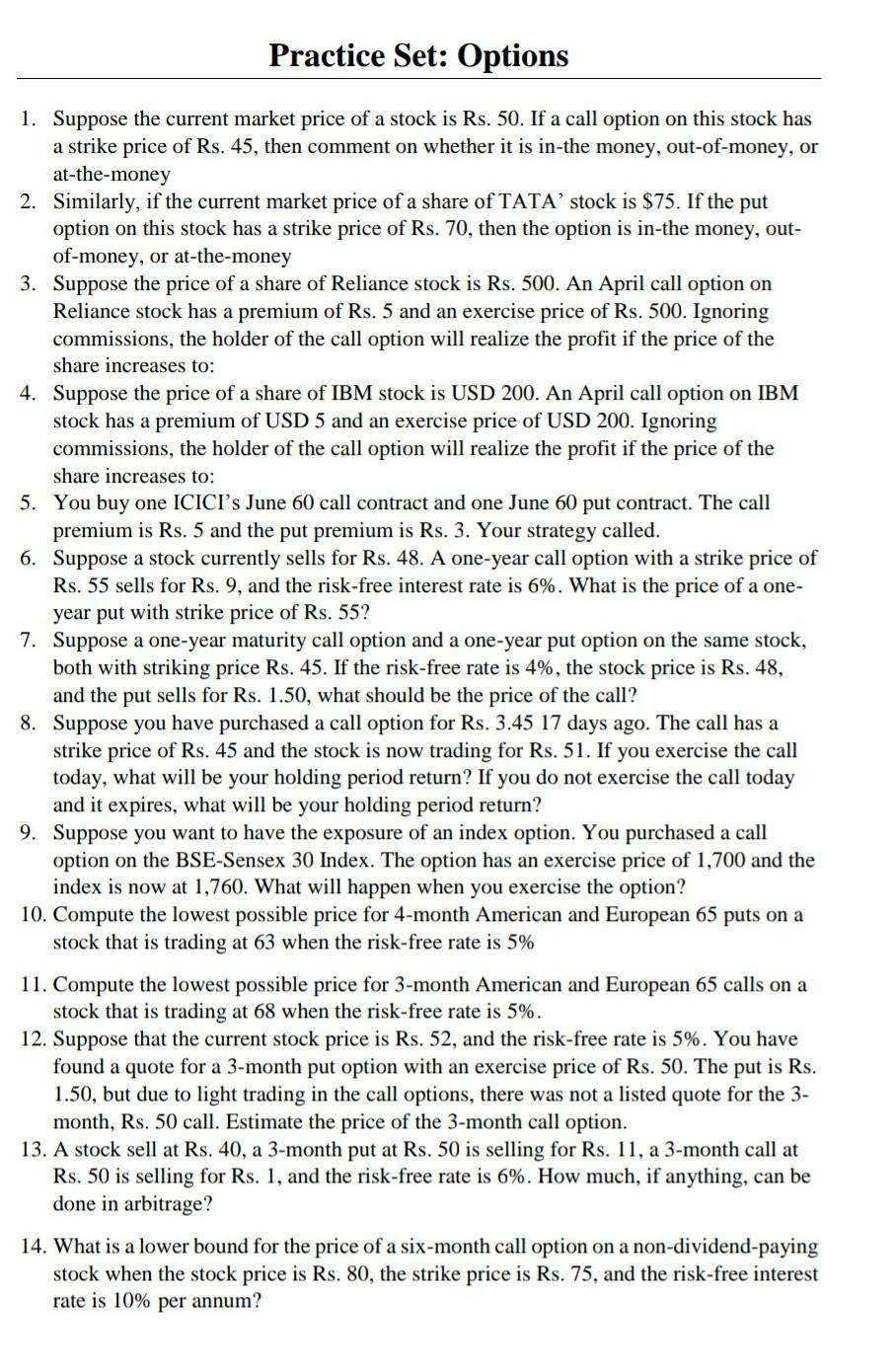

Practice Set: Options 1. Suppose the current market price of a stock is Rs. 50. If a call option on this stock has a strike

Practice Set: Options 1. Suppose the current market price of a stock is Rs. 50. If a call option on this stock has a strike price of Rs. 45, then comment on whether it is in-the money, out-of-money, or at-the-money 2. Similarly, if the current market price of a share of TATA' stock is $75. If the put option on this stock has a strike price of Rs. 70 , then the option is in-the money, outof-money, or at-the-money 3. Suppose the price of a share of Reliance stock is Rs. 500. An April call option on Reliance stock has a premium of Rs. 5 and an exercise price of Rs. 500. Ignoring commissions, the holder of the call option will realize the profit if the price of the share increases to: 4. Suppose the price of a share of IBM stock is USD 200. An April call option on IBM stock has a premium of USD 5 and an exercise price of USD 200. Ignoring commissions, the holder of the call option will realize the profit if the price of the share increases to: 5. You buy one ICICI's June 60 call contract and one June 60 put contract. The call premium is Rs. 5 and the put premium is Rs. 3. Your strategy called. 6. Suppose a stock currently sells for Rs. 48. A one-year call option with a strike price of Rs. 55 sells for Rs. 9 , and the risk-free interest rate is 6%. What is the price of a oneyear put with strike price of Rs. 55 ? 7. Suppose a one-year maturity call option and a one-year put option on the same stock, both with striking price Rs. 45 . If the risk-free rate is 4%, the stock price is Rs. 48 , and the put sells for Rs. 1.50 , what should be the price of the call? 8. Suppose you have purchased a call option for Rs. 3.4517 days ago. The call has a strike price of Rs. 45 and the stock is now trading for Rs. 51. If you exercise the call today, what will be your holding period return? If you do not exercise the call today and it expires, what will be your holding period return? 9. Suppose you want to have the exposure of an index option. You purchased a call option on the BSE-Sensex 30 Index. The option has an exercise price of 1,700 and the index is now at 1,760 . What will happen when you exercise the option? 10. Compute the lowest possible price for 4-month American and European 65 puts on a stock that is trading at 63 when the risk-free rate is 5% 11. Compute the lowest possible price for 3-month American and European 65 calls on a stock that is trading at 68 when the risk-free rate is 5%. 12. Suppose that the current stock price is Rs. 52 , and the risk-free rate is 5%. You have found a quote for a 3-month put option with an exercise price of Rs. 50. The put is Rs. 1.50 , but due to light trading in the call options, there was not a listed quote for the 3month, Rs. 50 call. Estimate the price of the 3-month call option. 13. A stock sell at Rs. 40, a 3-month put at Rs. 50 is selling for Rs. 11, a 3-month call at Rs. 50 is selling for Rs. 1, and the risk-free rate is 6%. How much, if anything, can be done in arbitrage? 14. What is a lower bound for the price of a six-month call option on a non-dividend-paying stock when the stock price is Rs. 80 , the strike price is Rs. 75 , and the risk-free interest rate is 10% per annum? 15. What is a lower bound for the price of a two-month European put option on a nondividend-paying stock when the stock price is Rs. 58 , the strike price is R. risk-free interest rate is 5% per annum? 16. Use the Black-Scholes Option Pricing Model for the following problem. Given: SO=Ks./U; X= Rs. 70; T=70 days; r=0.06 annually (0.0001648 daily); =0.020506 (daily). No dividends will be paid before the option expires. The value of the call option is 17. The price of a European call that expires in six months and has a strike price of Rs. 30 is Rs. 2. The underlying stock price is Rs. 29, and a dividend of Rs. 0.50 is expected in two months and again in five months. Risk-free interest rates for all maturities are 10%. What is the price of a European put option that expires in six months and has a strike price of Rs. 30 ? 18. Suppose a call with a strike price of Rs. 60 costs Rs. 6. A put with the same strike price and expiration date costs Rs. 4. Construct a table that shows the profit from a straddle. For what range of stock prices would the straddle lead to a loss? 19. Suppose a stock price is currently Rs. 80. It is known that at the end of four months it will be either Rs. 75 or Rs. 85 . The risk-free interest rate is 5% per annum with continuous compounding. What is the value of a four-month European put option with a strike price of Rs. 80? Use no-arbitrage arguments. 20. In another setting, suppose a stock price is currently Rs 40 . It is known that at the end of three months it will be either Rs. 45 or Rs. 35 . The risk-free rate of interest with quarterly compounding is 8% per annum. Calculate the value of a three-month European put option on the stock with an exercise price of Rs. 40. Verify that noarbitrage arguments and risk-neutral valuation arguments give the same answers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started