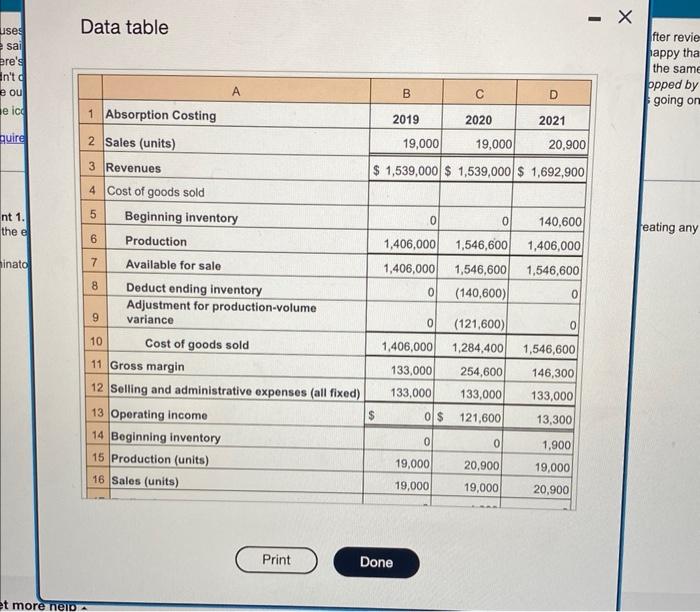

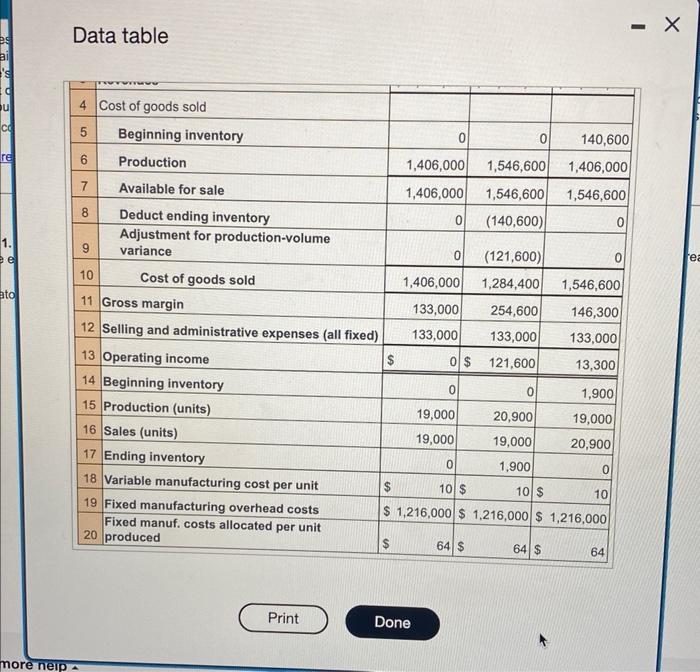

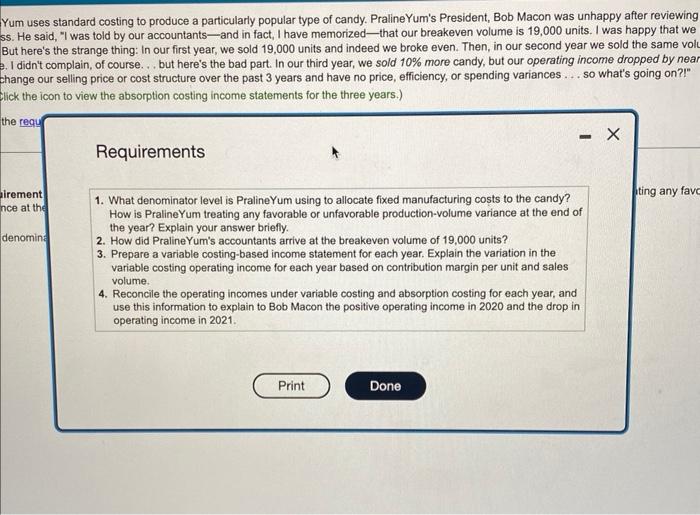

PralinoYum uses standard costing to produce a particularly popular type of candy. PralineYum's President. Bob Macon was unhappy affer reviewing the income statements for the first 3 year of business. He said, "I was told by our accountants-and in fact, I harve memortzed-lhat cur breakeven volume is 19,000 units. I was happy that we reached that sales goal in ooch of our frst 2 . years, But here's the strange thing. In our first year, we sold 19,000 units and indeed we broke even. Then, in our second year we sold the same volume and had a signficart, positve operating income. I didnt complain, of course. but here's the bad part. In our third year, we sold tos more candy, but our operating hoome diopped by nasty gosk trom what it was in the second year We didnt change our soling price or cost structure over the past 3 years and have no price, efficiency, or spending variances ... so whats going on?" (Click the icon to view the absorption costing income statements for the three yearh.) Read the teguirements Requirement 1. What denominalor level is PralineYum using to allocate faed marutacturing conts to the candy? How is PraineYum treating any tavorabie or unfavorable production-volume variance of the end of the year? Explain your answer briety. The denominator level used to alocate fixed manutacturng coets is PralineYum uses standard costing to produce a particularly popular type of candy. PralineYum's President, Bob Maco business. He said, "I was told by our accountants-and in fact, I have memorized-that our breakeven volume is 19 , years. But here's the strange thing: In our first year, we sold 19,000 units and indeed we broke even. Then, in our sec income. I didn't complain, of course... but here's the bad part. In our third year, we sold 10% more candy, but our ope didn't change our selling price or cost structure over the past 3 years and have no price, efficiency, or spending varian (Click the icon to view the absorption costing income statements for the three years.) Read the requirements. Requirement 1. What denominator level is PralineYum using to allocate fixed manufacturing costs to the candy? How variance at the end of the year? Explain your answer briefly. The denominator level used to allocate fixed manufacturing costs is units. candy. PralineYum's President, Bob Macon was unhappy after reviewing the income statements for the first 3 years of orized-that our breakeven volume is 19,000 units. I was happy that we reached that sales goal in each of our first 2 id indeed we broke even. Then, in our second year we sold the same volume and had a signficant, positive operating rear, we sold 10% more candy, but our operating income dropped by nearly 90% from what it was in the second year! We ave no price, efficiency, or spending variances... so what's going on?!" three years.) ixed manufacturing costs to the candy? How is PralineYum treating any favorable or unfavorable production-volume units. Data table Data table Yum uses standard costing to produce a particularly popular type of candy. PralineYum's President, Bob Macon was unhappy after reviewing s. He said, II was told by our accountants-and in fact, I have memorized-that our breakeven volume is 19,000 units. I was happy that we But here's the strange thing: In our first year, we sold 19,000 units and indeed we broke even. Then, in our second year we sold the same volu I didn't complain, of course... but here's the bad part. In our third year, we sold 10% more candy, but our operating income dropped by near hange our selling price or cost structure over the past 3 years and have no price, efficiency, or spending variances ... so what's going on?!" lick the icon to view the absorption costing income statements for the three years.) Requirements 1. What denominator level is PralineYum using to allocate fixed manufacturing costs to the candy? How is PralineYum treating any favorable or unfavorable production-volume variance at the end of the year? Explain your answer briefly. 2. How did PralineYum's accountants arrive at the breakeven volume of 19,000 units? 3. Prepare a variable costing-based income statement for each year. Explain the variation in the variable costing operating income for each year based on contribution margin per unit and sales volume. 4. Reconcile the operating incomes under variable costing and absorption costing for each year, and use this information to explain to Bob Macon the positive operating income in 2020 and the drop in operating income in 2021