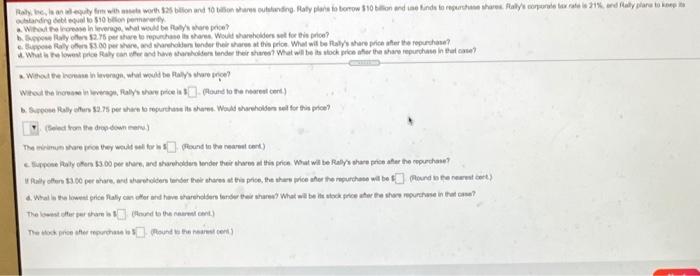

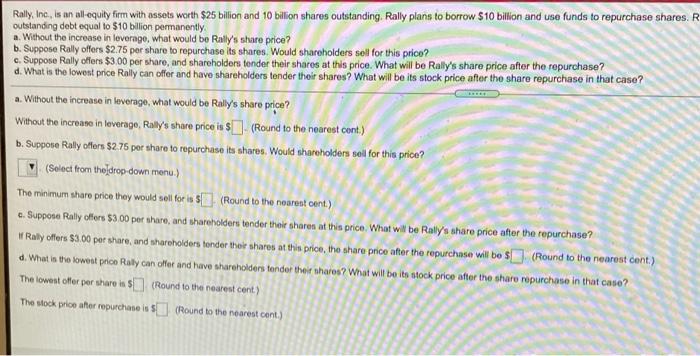

Praly. www.h325 bilion and to read. Ratio bomow 510 and se kinds to report any convert day party standing 510 pont Who In vergo, what shore hely $2.75 perwerphase would shareholders for this price? 300 per darken to the rest this prion What will be share iter the repurch? What were Raly and have shareholders and the hos What will be stock price for the share purchase in the case Without the oven, what would he als rece? Wired to increase in every radys w celound to the nearest cert) Som Rally Murs 52.75 per here reputhese share. Would wholesait for this price? led from the owner) The men are nowy would Pound to the nearest cert) cely 3.00 per here and shareholders and their share this price What wilt Ralys share prin far the purchase? Rallye 130 per here tentarder their respe, the the price for the purchase will be found in the work) . Wallstically care and archer fande terre What will be stock ricorrere motose in the come? The stutter erhad the rear cant) The compare round the Rally, Inc., is an all-equity firm with assets worth $25 billion and 10 bilion shares outstanding. Rally plans to borrow $10 billion and use funds to repurchase shares. R outstanding debt equal to $10 billion permanently a. Without the increase in leverago, what would be Rally's stare price? b. Suppose Rally offers $2.75 per share to repurchase its shares. Would shareholders soll for this price? c. Suppose Rally offers $3,00 per share, and shareholders onder their shares at this price. What will be Rally's share price after the repurchase? d. What is the lowest price Rally can offer and have shareholders tender their shares? What will be its stock price after the share repurchase in that caso? a. Without the increase in leverage, what would be Rally's share price? Without the increase in leverago, Rally's share price is S. (Round to the nearest cont.) b. Suppose Rally offers $2.75 per share to repurchase its shares. Would shareholders sell for this price? (Select from the drop-down menu.) The minimum share price they would sell for is 5 (Round to the nearest cent.) c. Suppose Rally offers $3.00 per share, and shareholders tender their shares at this price. What will be Ralys share price after the repurchase? W Rally offers $3.00 per share and shareholders tonder their shares at this price, the share price after the repurchase will be $(Round to the nearest cont.) d. What is the lowest price Raby can cher and have shareholders tendor their nharos? What will be to stock price after the sharo ropurchase in that caso? The lowest offer per share is (Round to the nearest cent) The stock price her repurchase is Round to the nearest cont.)