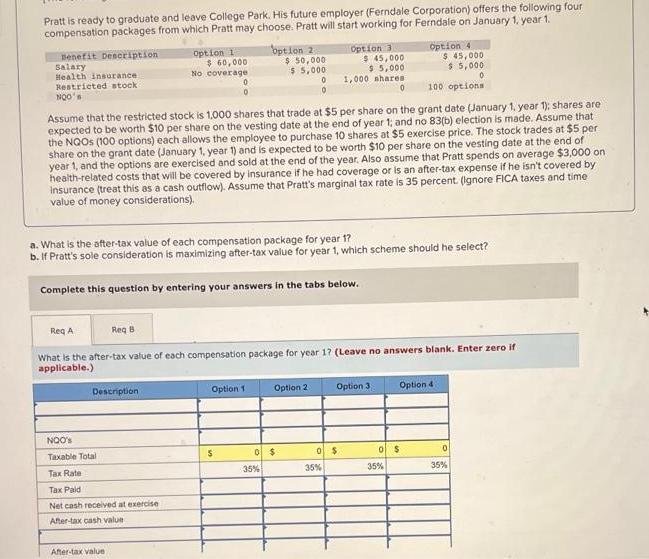

Pratt is ready to graduate and leave College Park. His future employer (Ferndale Corporation) offers the following four compensation packages from which Pratt may

Pratt is ready to graduate and leave College Park. His future employer (Ferndale Corporation) offers the following four compensation packages from which Pratt may choose. Pratt will start working for Ferndale on January 1, year 1. Benefit Description Salary Health insurance Restricted stock NOO' Req A Option 4 $ 45,000 $5,000 0 100 options Assume that the restricted stock is 1,000 shares that trade at $5 per share on the grant date (January 1, year 1); shares are expected to be worth $10 per share on the vesting date at the end of year 1; and no 83(b) election is made. Assume that the NQOS (100 options) each allows the employee to purchase 10 shares at $5 exercise price. The stock trades at $5 per share on the grant date (January 1, year 1) and is expected to be worth $10 per share on the vesting date at the end of year 1, and the options are exercised and sold at the end of the year. Also assume that Pratt spends on average $3,000 on health-related costs that will be covered by insurance if he had coverage or is an after-tax expense if he isn't covered by insurance (treat this as a cash outflow). Assume that Pratt's marginal tax rate is 35 percent. (Ignore FICA taxes and time value of money considerations). a. What is the after-tax value of each compensation package for year 1? b. If Pratt's sole consideration is maximizing after-tax value for year 1, which scheme should he select? Complete this question by entering your answers in the tabs below. Req B Description NOO'S Taxable Total Option 1 $ 60,000 No coverage Tax Rate Tax Paid Net cash received at exercise After-tax cash value After-tax value What is the after-tax value of each compensation package for year 17 (Leave no answers blank. Enter zero if applicable.). 0 Option 2 $ 50,000 $ 5,000 0 Option 1 $ 35% Option 2 0 $ Option 3 $ 45,000 $5,000 1,000 shares 0 0 $ 35% Option 3 Option 4. 0 $ 35% 0 35% Complete this question by entering your answers in the tabs below. Req A Req B If Pratt's sole consideration is maximizing after-tax value for year 1, which scheme should he select? Option 1 Option 2 Option 3 OOption 4 < Req A Rag >

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

answers Compute the aftertax value of each compensation package for year1 as ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started