Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Precico Enterprise purchased two rivet-making machines on 1 January 2017 at a cost of RM15,000 each. Each had an estimated life of five years

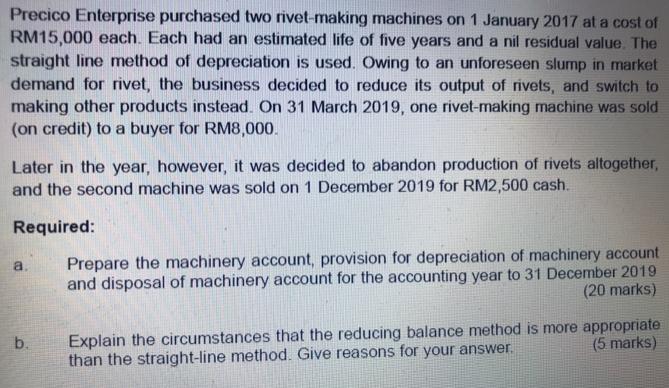

Precico Enterprise purchased two rivet-making machines on 1 January 2017 at a cost of RM15,000 each. Each had an estimated life of five years and a nil residual value, The straight line method of depreciation is used. Owing to an unforeseen slump in market demand for rivet, the business decided to reduce its output of rivets, and switch to making other products instead. On 31 March 2019, one rivet-making machine was sold (on credit) to a buyer for RM8,000. Later in the year, however, it was decided to abandon production of rivets altogether, and the second machine was sold on 1 December 2019 for RM2,500 cash. Required: a. Prepare the machinery account, provision for depreciation of machinery account and disposal of machinery account for the accounting year to 31 December 2019 (20 marks) Explain the circumstances that the reducing balance method is more appropriate than the straight-line method. Give reasons for your answer. b. (5 marks)

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

A B The reducing balancing method assumes that future benefits associated with th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started