Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Predicting the oil price Oil market analysts are forecasting a decrease in oil prices next year. A surplus of production from US shale operations

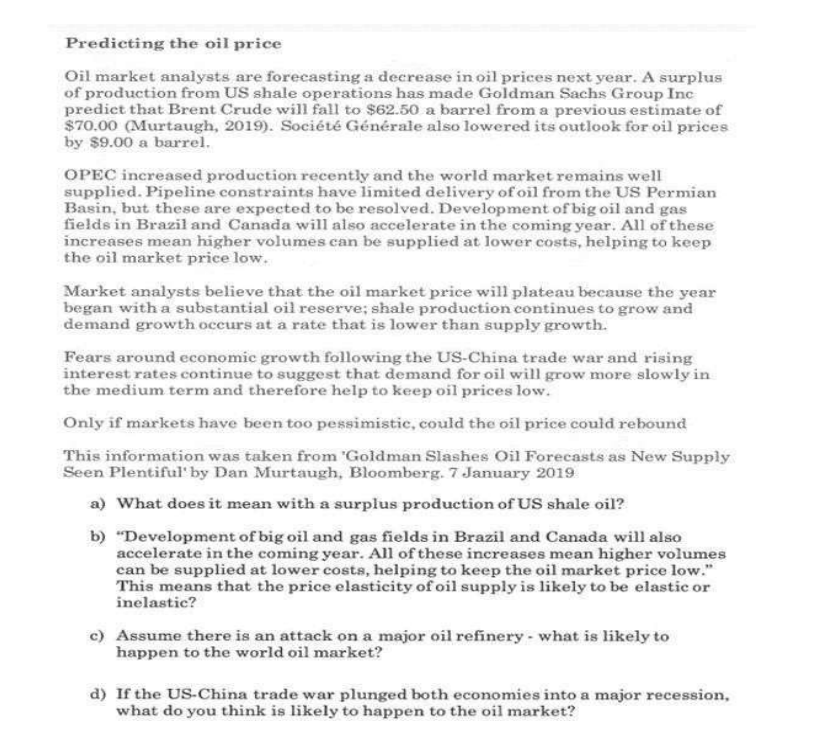

Predicting the oil price Oil market analysts are forecasting a decrease in oil prices next year. A surplus of production from US shale operations has made Goldman Sachs Group Inc predict that Brent Crude will fall to $62.50 a barrel from a previous estimate of $70.00 (Murtaugh, 2019). Socit Gnrale also lowered its outlook for oil prices by $9.00 a barrel. OPEC increased production recently and the world market remains well supplied. Pipeline constraints have limited delivery of oil from the US Permian Basin, but these are expected to be resolved. Development of big oil and gas fields in Brazil and Canada will also accelerate in the coming year. All of these increases mean higher volumes can be supplied at lower costs, helping to keep the oil market price low. Market analysts believe that the oil market price will plateau because the year began with a substantial oil reserve; shale production continues to grow and demand growth occurs at a rate that is lower than supply growth. Fears around economic growth following the US-China trade war and rising interest rates continue to suggest that demand for oil will grow more slowly in the medium term and therefore help to keep oil prices low. Only if markets have been too pessimistic, could the oil price could rebound This information was taken from 'Goldman Slashes Oil Forecasts as New Supply Seen Plentiful' by Dan Murtaugh, Bloomberg. 7 January 2019 a) What does it mean with a surplus production of US shale oil? b) "Development of big oil and gas fields in Brazil and Canada will also accelerate in the coming year. All of these increases mean higher volumes can be supplied at lower costs, helping to keep the oil market price low." This means that the price elasticity of oil supply is likely to be elastic or inelastic? c) Assume there is an attack on a major oil refinery - what is likely to happen to the world oil market? d) If the US-China trade war plunged both economies into a major recession, what do you think is likely to happen to the oil market?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a A surplus production of US shale oil means that there is an excess supply of oil coming from shale operations in the United States Shale oil is extr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started