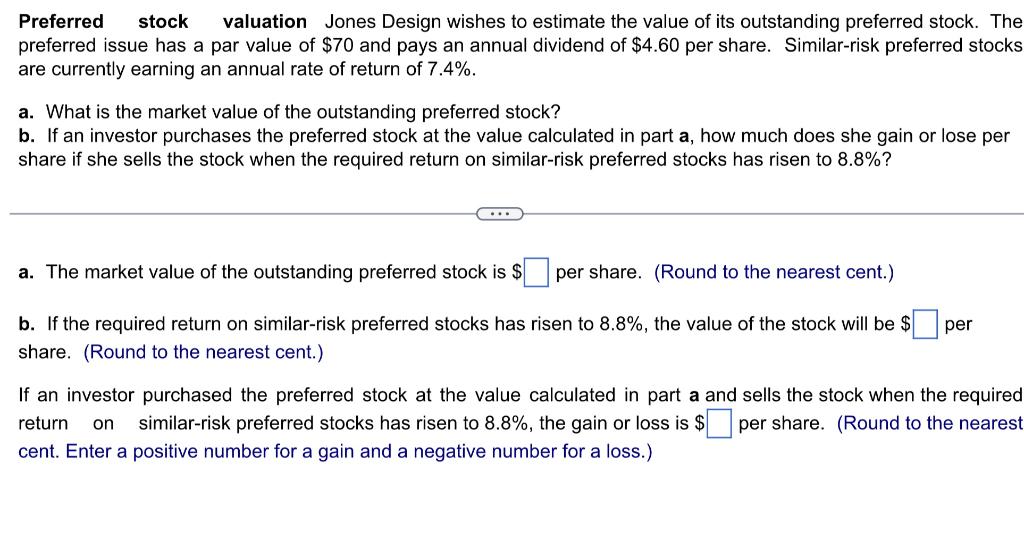

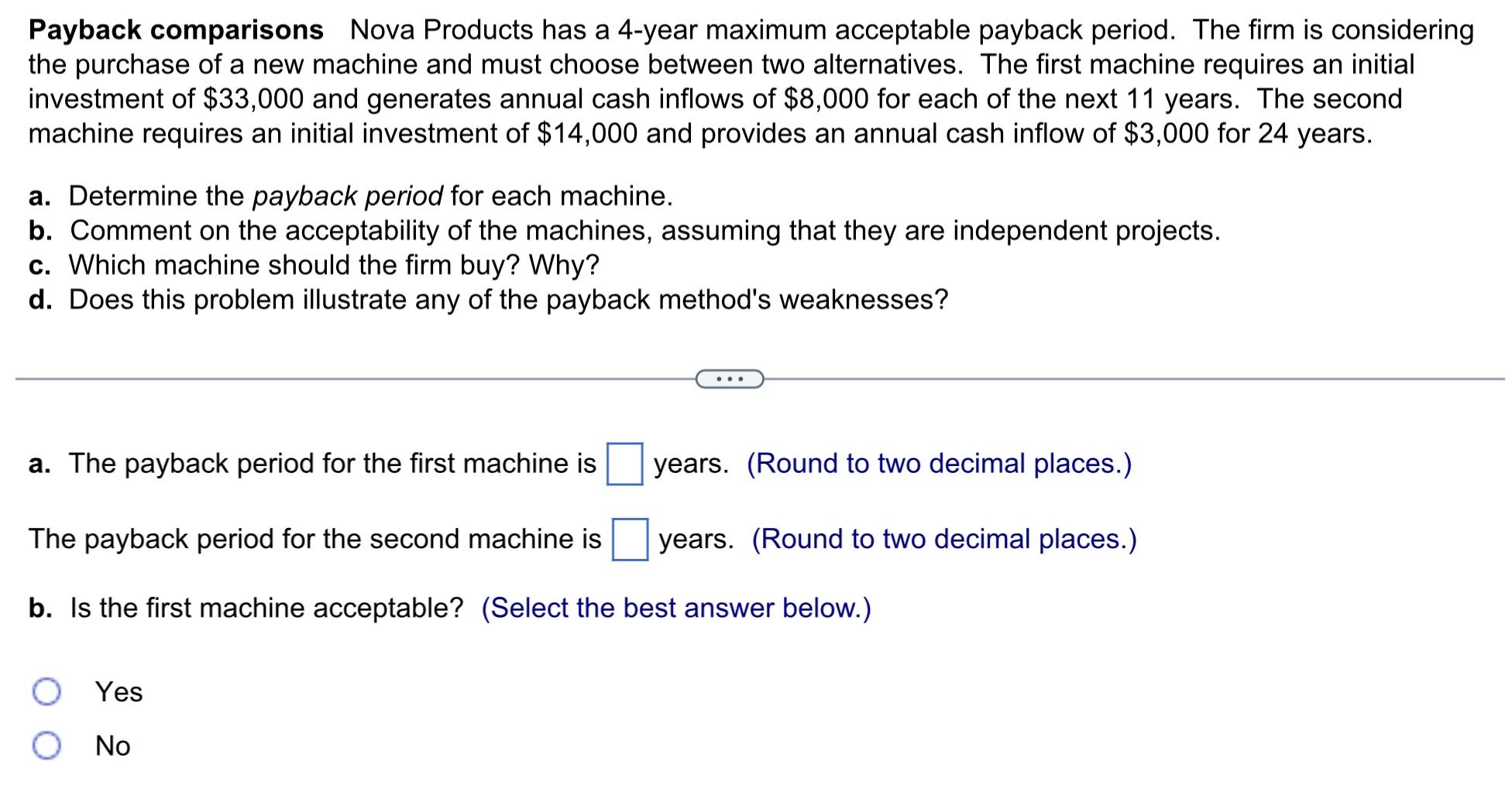

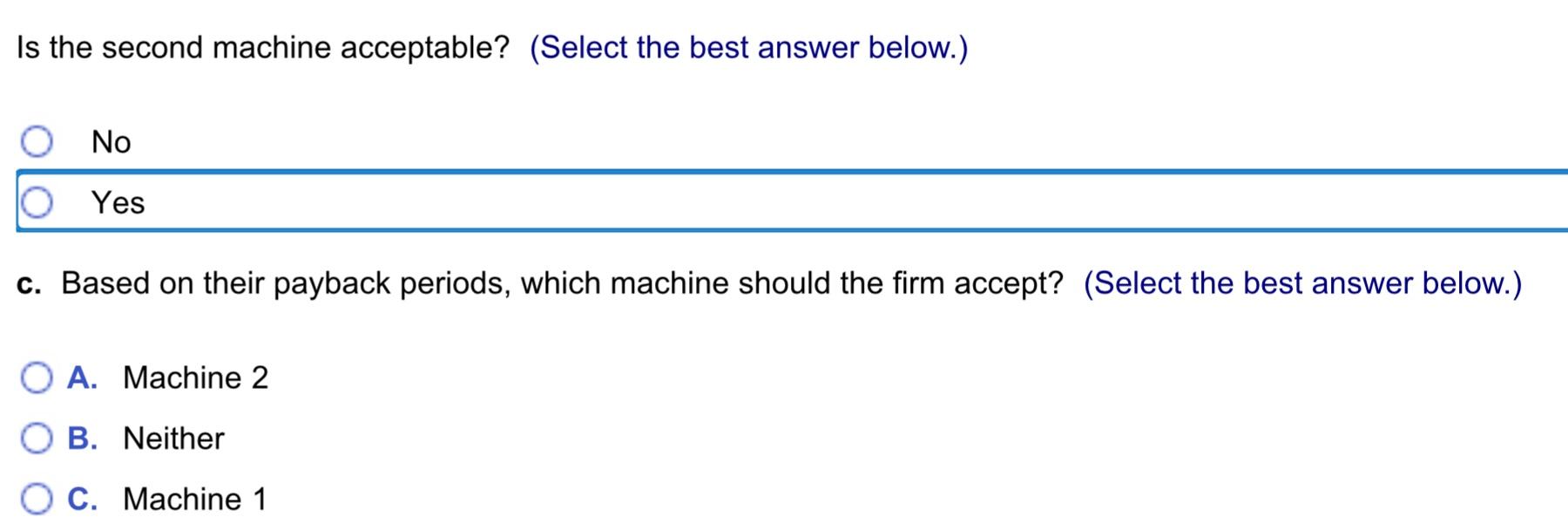

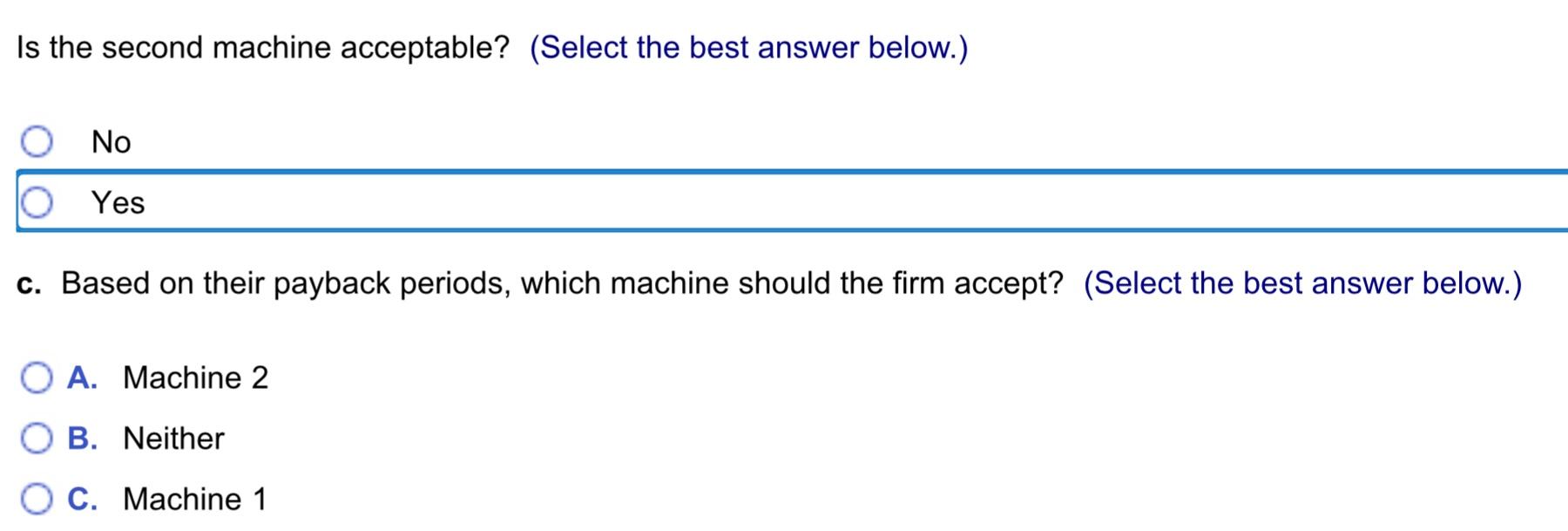

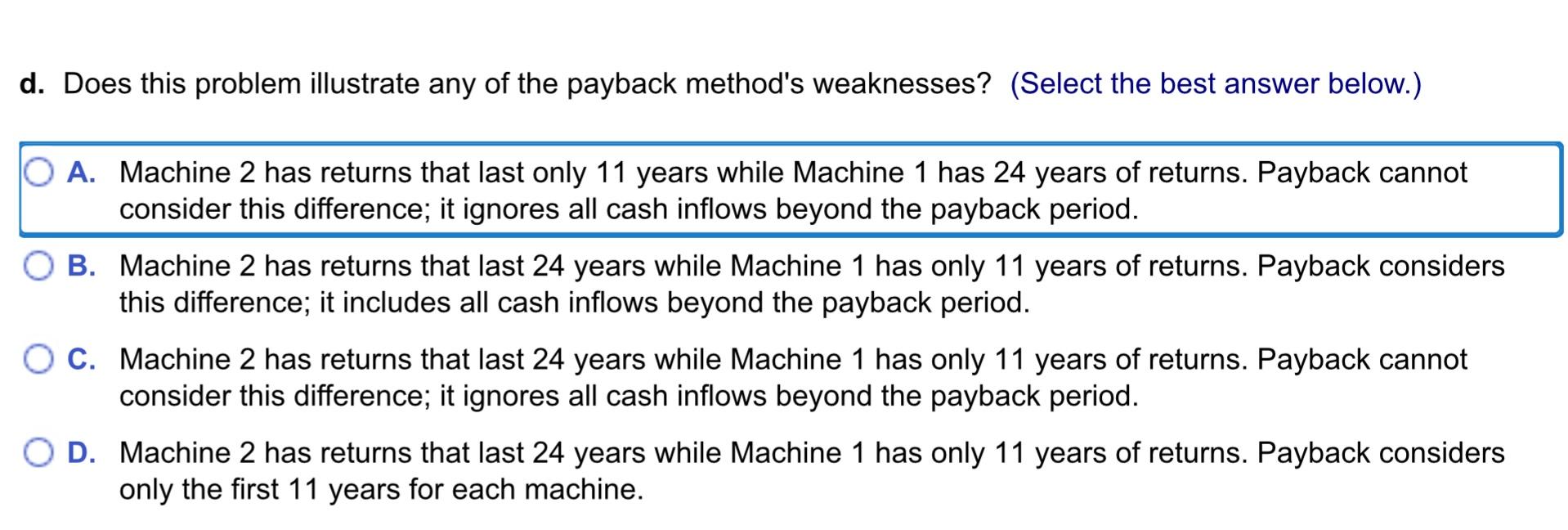

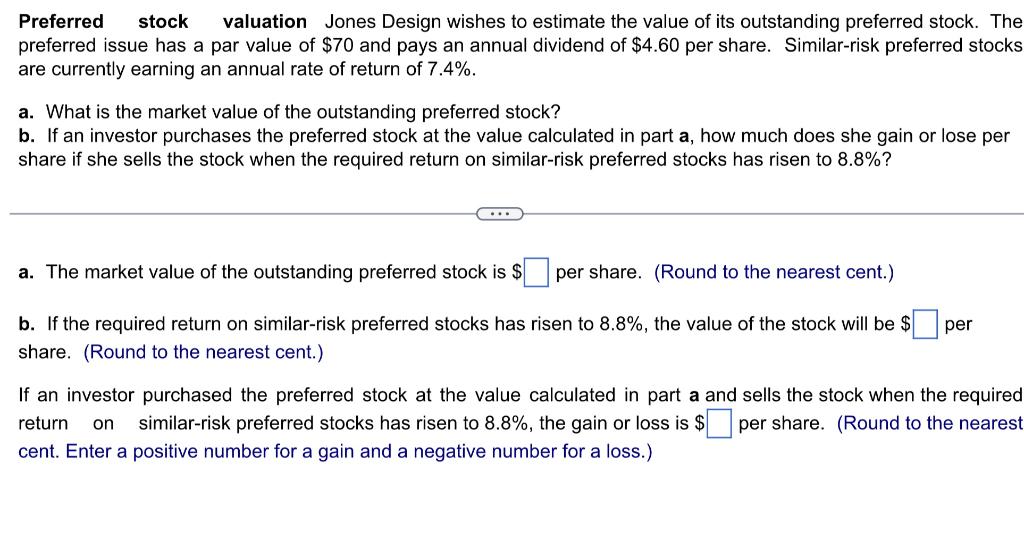

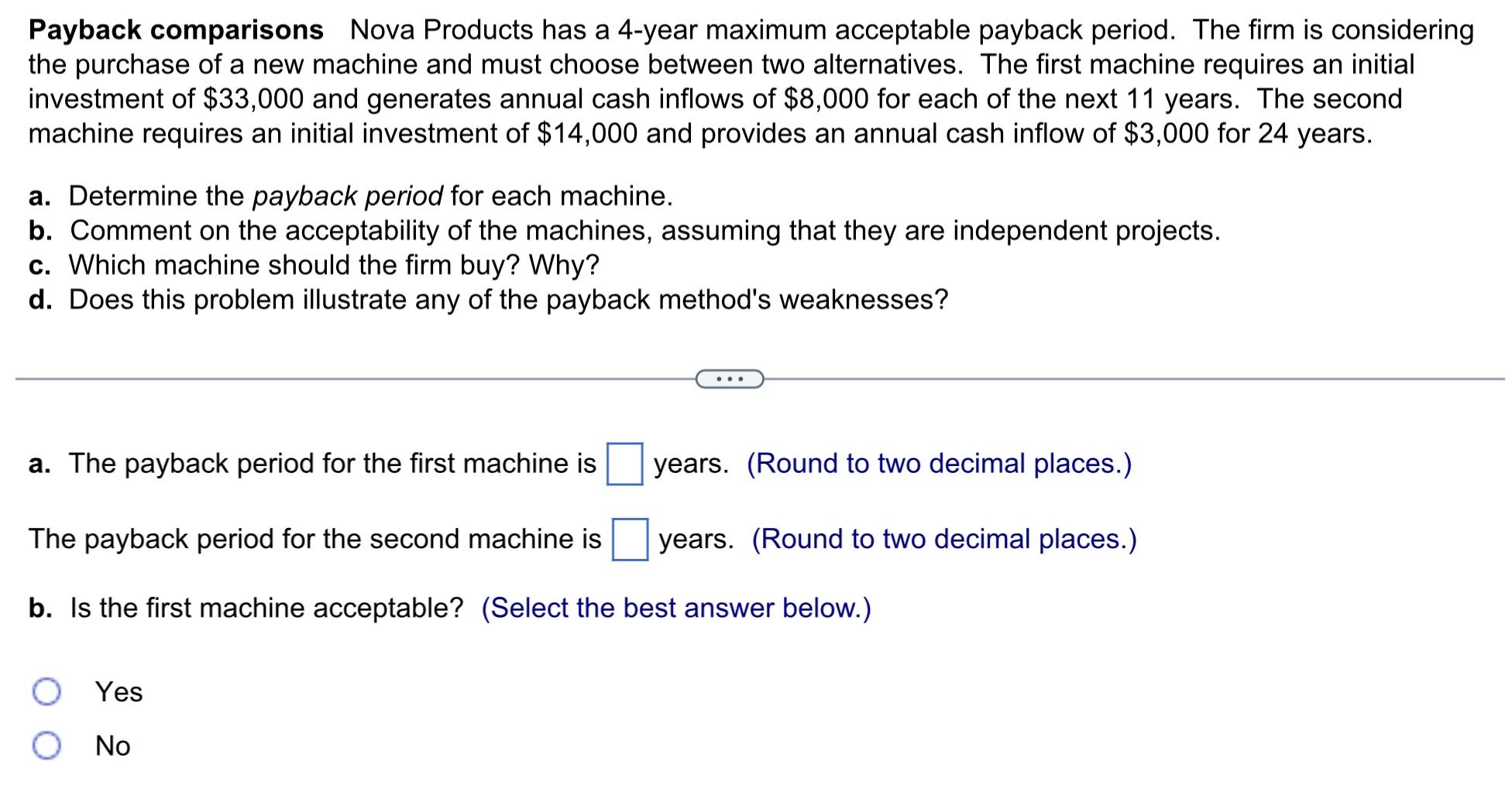

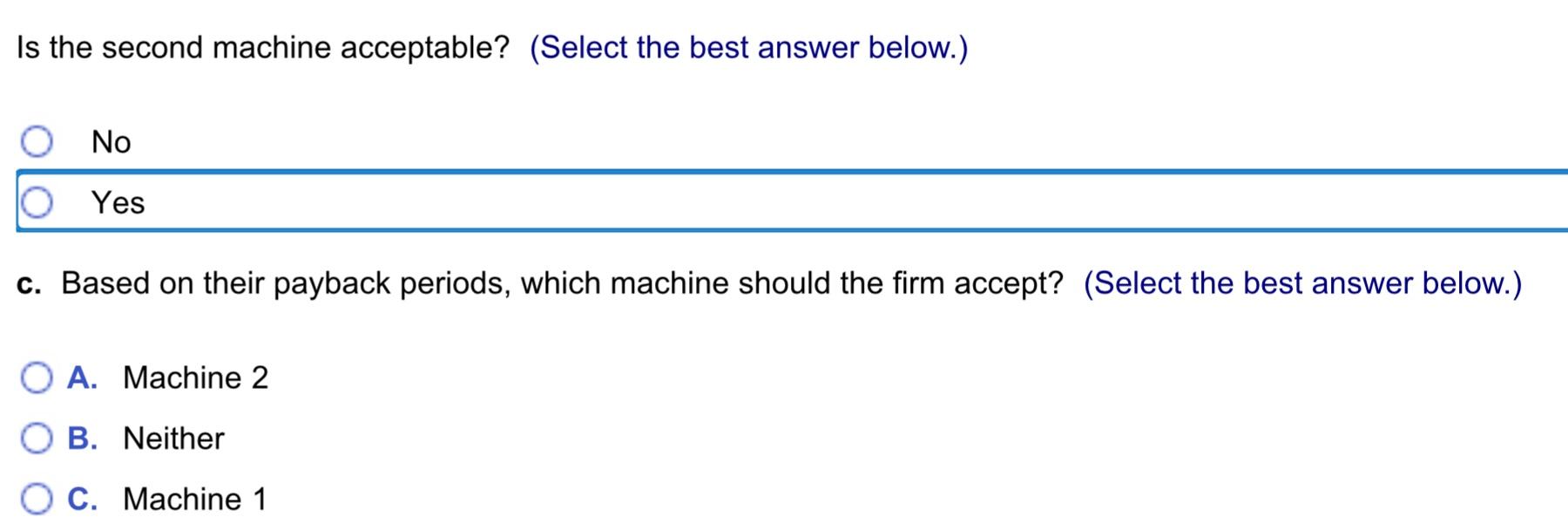

Preferred stock valuation Jones Design wishes to estimate the value of its outstanding preferred stock. The preferred issue has a par value of $70 and pays an annual dividend of $4.60 per share. Similar-risk preferred stocks are currently earning an annual rate of return of 7.4%. a. What is the market value of the outstanding preferred stock? b. If an investor purchases the preferred stock at the value calculated in part a, how much does she gain or lose per share if she sells the stock when the required return on similar-risk preferred stocks has risen to 8.8% ? a. The market value of the outstanding preferred stock is $ per share. (Round to the nearest cent.) b. If the required return on similar-risk preferred stocks has risen to 8.8%, the value of the stock will be $ per share. (Round to the nearest cent.) If an investor purchased the preferred stock at the value calculated in part a and sells the stock when the required return on similar-risk preferred stocks has risen to 8.8%, the gain or loss is $ per share. (Round to the nearesi cent. Enter a positive number for a gain and a negative number for a loss.) Payback comparisons Nova Products has a 4-year maximum acceptable payback period. The firm is considering the purchase of a new machine and must choose between two alternatives. The first machine requires an initial investment of $33,000 and generates annual cash inflows of $8,000 for each of the next 11 years. The second machine requires an initial investment of $14,000 and provides an annual cash inflow of $3,000 for 24 years. a. Determine the payback period for each machine. b. Comment on the acceptability of the machines, assuming that they are independent projects. c. Which machine should the firm buy? Why? d. Does this problem illustrate any of the payback method's weaknesses? a. The payback period for the first machine is years. (Round to two decimal places.) The payback period for the second machine is years. (Round to two decimal places.) b. Is the first machine acceptable? (Select the best answer below.) Yes No Is the second machine acceptable? (Select the best answer below.) YesNo c. Based on their payback periods, which machine should the firm accept? (Select the best answer below.) A. Machine 2 B. Neither C. Machine 1 Is the second machine acceptable? (Select the best answer below.) YesNo c. Based on their payback periods, which machine should the firm accept? (Select the best answer below.) A. Machine 2 B. Neither C. Machine 1 Does this problem illustrate any of the payback method's weaknesses? (Select the best answer below.) A. Machine 2 has returns that last only 11 years while Machine 1 has 24 years of returns. Payback cannot consider this difference; it ignores all cash inflows beyond the payback period. B. Machine 2 has returns that last 24 years while Machine 1 has only 11 years of returns. Payback considers this difference; it includes all cash inflows beyond the payback period. C. Machine 2 has returns that last 24 years while Machine 1 has only 11 years of returns. Payback cannot consider this difference; it ignores all cash inflows beyond the payback period. D. Machine 2 has returns that last 24 years while Machine 1 has only 11 years of returns. Payback considers only the first 11 years for each machine