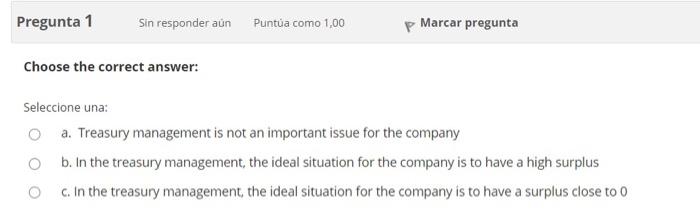

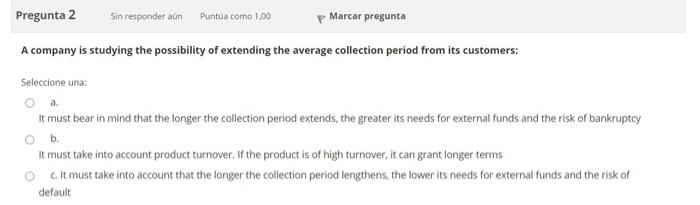

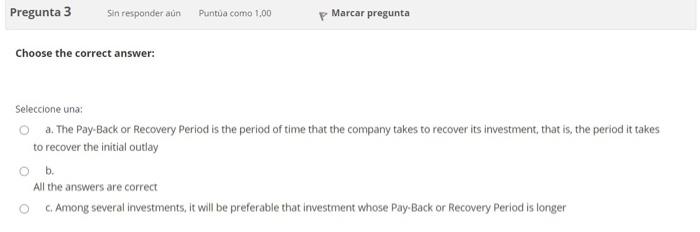

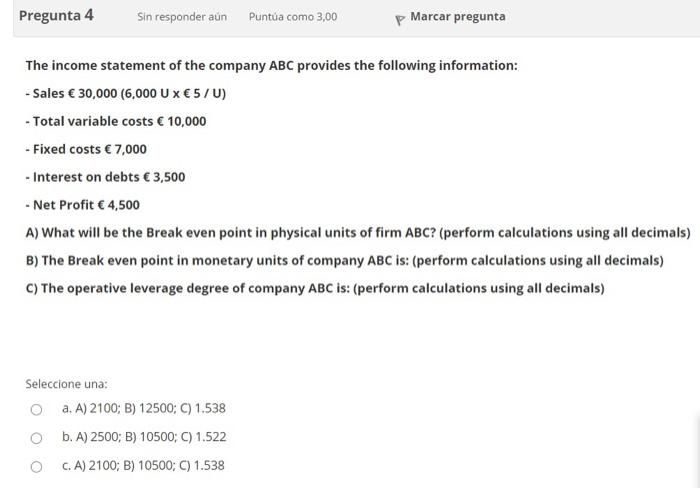

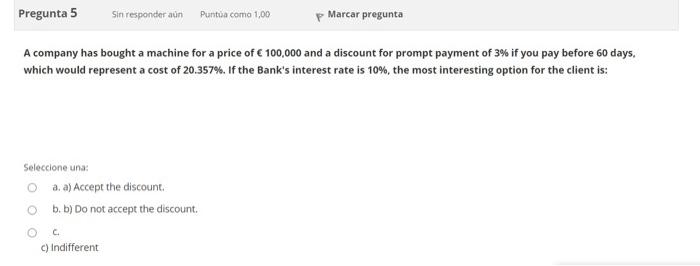

Pregunta 1 Sin responder an Puntua como 1,00 p Marcar pregunta Choose the correct answer: Seleccione una: O a. Treasury management is not an important issue for the company O b. In the treasury management, the ideal situation for the company is to have a high surplus c. In the treasury management, the ideal situation for the company is to have a surplus close to o Pregunta 2 Sin responder aan Punta como 1.00 Marcar pregunta A company is studying the possibility of extending the average collection period from its customers: Seleccione una: a. It must bear in mind that the longer the collection period extends, the greater its needs for external funds and the risk of bankruptcy b. It must take into account product turnover. If the product is of high turnover, it can grant longer terms c. It must take into account that the longer the collection period lengthens, the lower its needs for external funds and the risk of default Pregunta 3 Sin responder aun Puntua como 1,00 p Marcar pregunta Choose the correct answer: Seleccione una: a. The Pay-Back or Recovery Period is the period of time that the company takes to recover its investment, that is, the period it takes to recover the initial outlay b. All the answers are correct C. Among several investments, it will be preferable that investment whose Pay-Back or Recovery Period is longer Pregunta 4 Sin responder aun Puntua como 3,00 p Marcar pregunta The income statement of the company ABC provides the following information: - Sales 30,000 (6,000 U x 5/U) - Total variable costs 10,000 - Fixed costs 7,000 - Interest on debts 3,500 - Net Profit 4,500 A) What will be the Break even point in physical units of firm ABC? (perform calculations using all decimals) B) The Break even point in monetary units of company ABC is: (perform calculations using all decimals) C) The operative leverage degree of company ABC is: (perform calculations using all decimals) Seleccione una: oa. A) 2100; B) 12500; C) 1.538 b. A) 2500; B) 10500; C) 1.522 O C.A) 2100; B) 10500; C) 1.538 Pregunta 5 Sin responder an Puntua como 1,00 p Marcar pregunta A company has bought a machine for a price of 100,000 and a discount for prompt payment of 3% if you pay before 60 days. which would represent a cost of 20.357%. If the Bank's interest rate is 10%, the most interesting option for the client is: Seleccione una a. a) Accept the discount b. b) Do not accept the discount. C C) Indifferent