Preliminary information from Part 1:

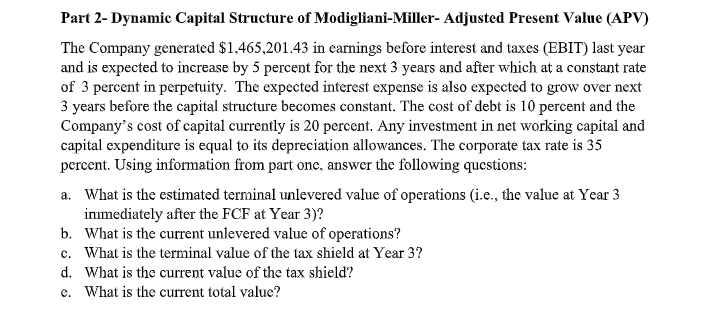

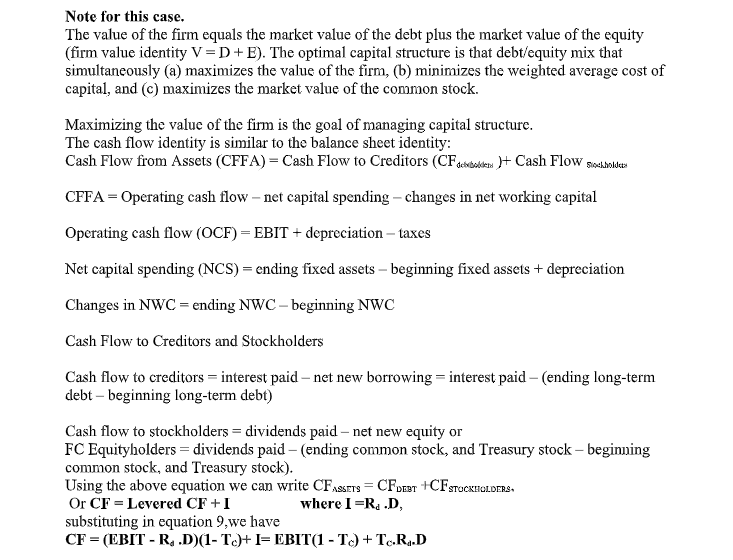

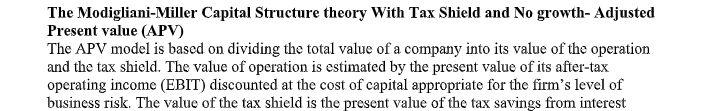

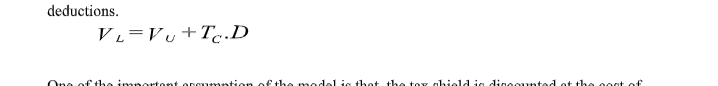

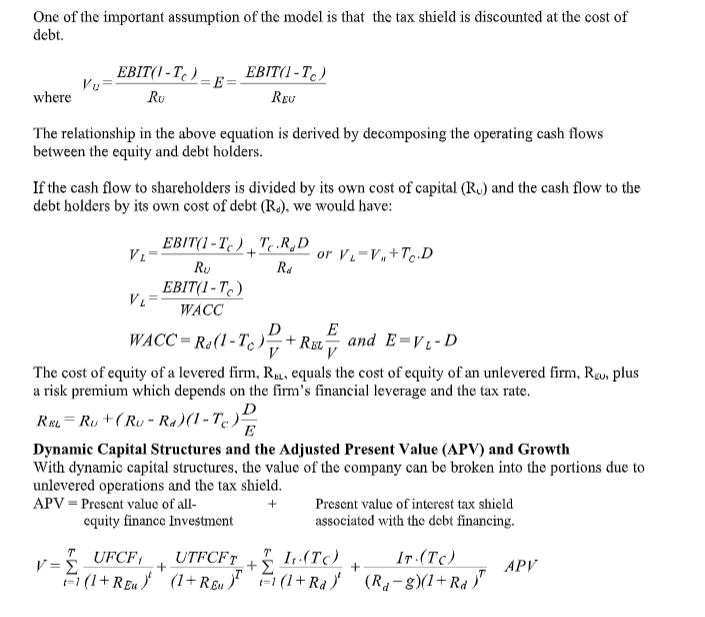

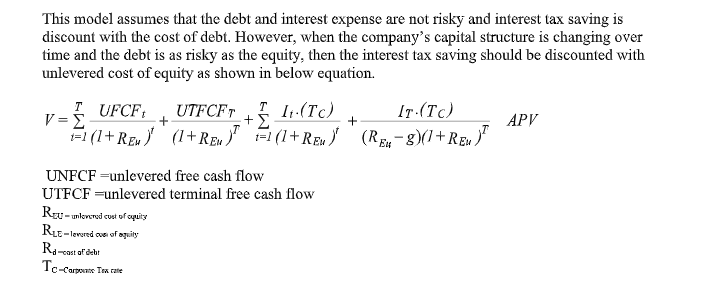

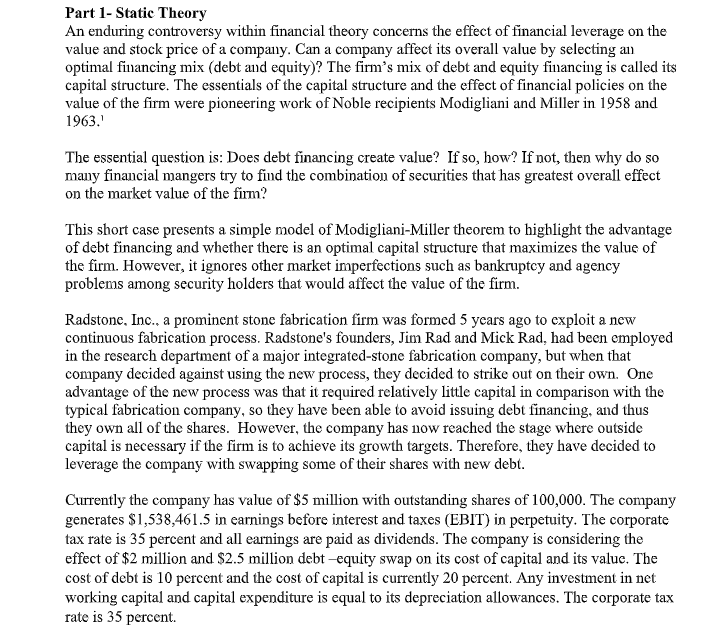

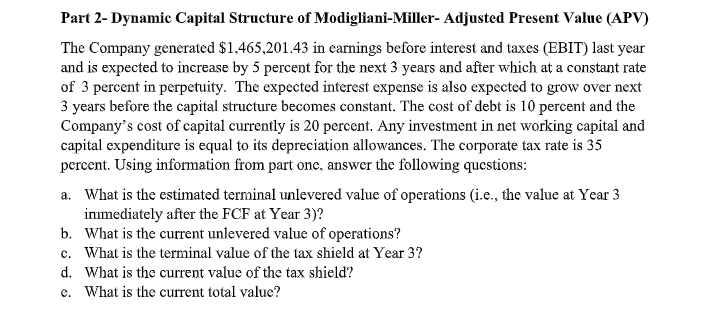

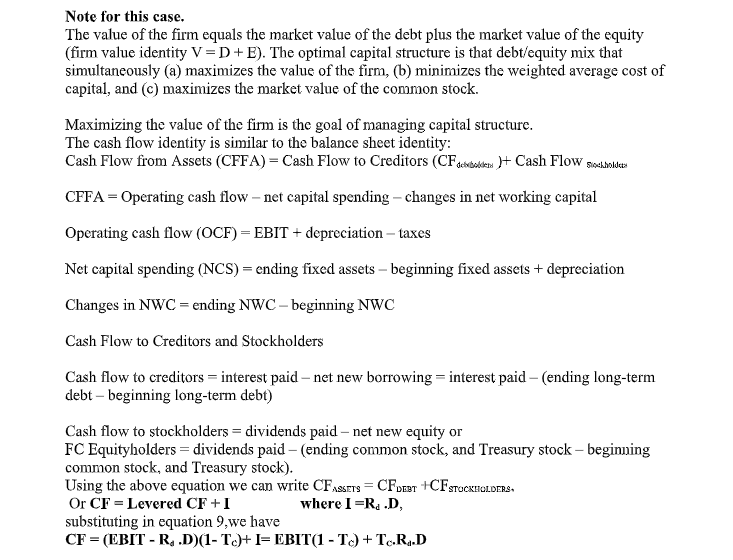

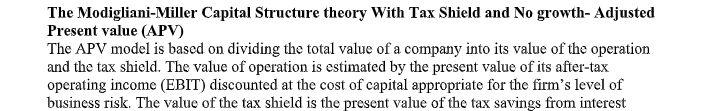

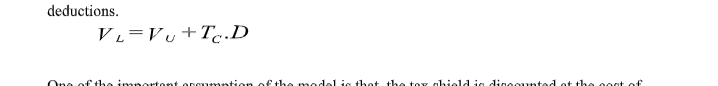

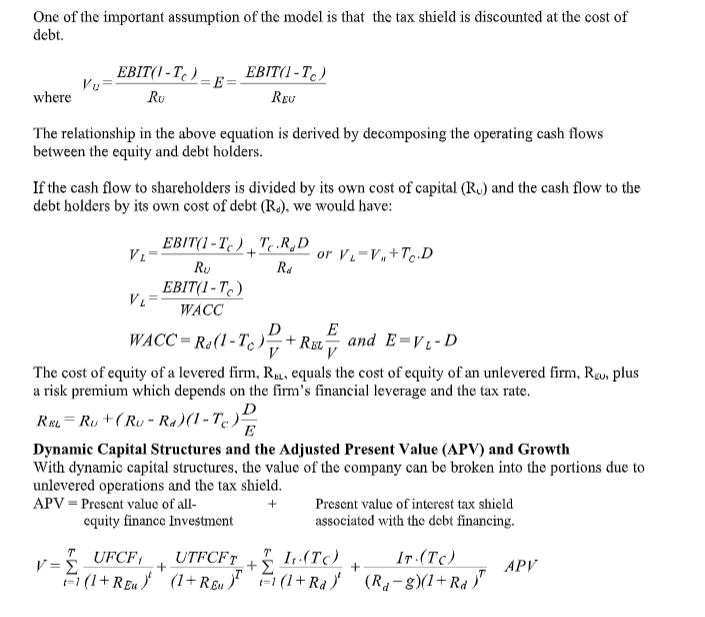

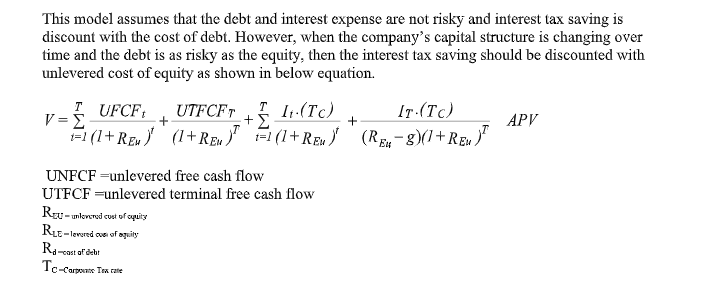

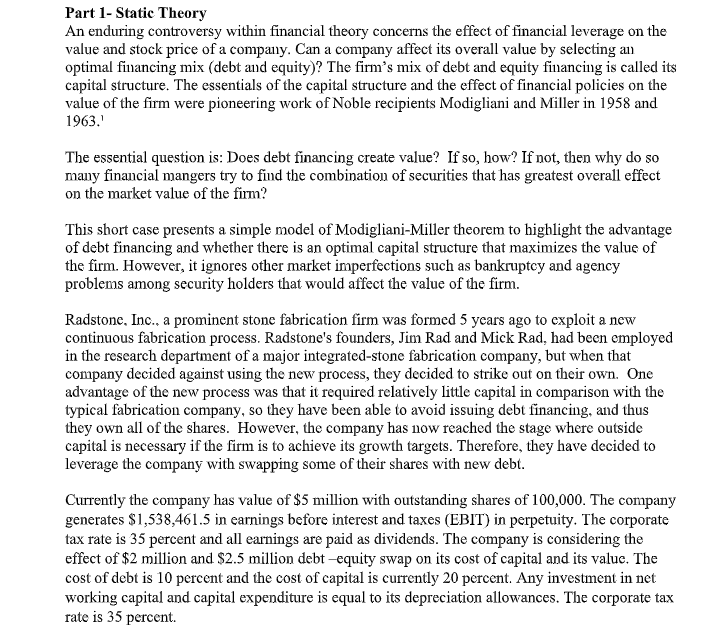

Part 2- Dynamic Capital Structure of Modigliani-Miller-Adjusted Present Value (APV) The Company generated $1,465,201.43 in earnings before interest and taxes (EBIT) last year and is expected to increase by 5 percent for the next 3 years and after which at a constant rate of 3 percent in perpetuity. The expected interest expense is also expected to grow over next 3 years before the capital structure becomes constant. The cost of debt is 10 percent and the Company's cost of capital currently is 20 percent. Any investment in net working capital and capital expenditure is equal to its depreciation allowances. The corporate tax rate is 35 percent. Using information from part one, answer the following questions: a. What is the estimated terminal unlevered value of operations (i.e., the value at Year 3 inmediately after the FCF at Year 3)? b. What is the current unlevered value of operations? c. What is the terminal value of the tax shield at Year 3? d. What is the current value of the tax shield? e. What is the current total value? Note for this case. The value of the firm equals the market value of the debt plus the market value of the equity (firm value identity V=D+E). The optimal capital structure is that debt/equity mix that simultaneously (a) maximizes the value of the firm, (b) minimizes the weighted average cost of capital, and (c) maximizes the market value of the common stock. Maximizing the value of the firm is the goal of managing capital structure. The cash flow identity is similar to the balance sheet identity: Cash Flow from Assets (CFFA) = Cash Flow to Creditors (CF deinbolikens )+ Cash Flow stockholders CFFA = Operating cash flow net capital spending - changes in net working capital Operating cash flow (OCF) = EBIT + depreciation - taxes Net capital spending (NCS) = ending fixed assets - beginning fixed assets + depreciation Changes in NWC = ending NWC - beginning NWC Cash Flow to Creditors and Stockholders Cash flow to creditors = interest paid net new borrowing = interest paid - (ending long-term debt - beginning long-term debt) Cash flow to stockholders = dividends paid - net new equity or FC Equityholders = dividends paid - (ending common stock, and Treasury stock - beginning common stock, and Treasury stock). Using the above equation we can write CFASSETS = CFBERT +CFSTOCKHOLDERS Or CF = Levered CF+I where I =R..D substituting in equation 9,we have CF = (EBIT - R..D)(1-T)+ I= EBIT(1 - Tc) + To.R.D The Modigliani-Miller Capital Structure theory With Tax Shield and No growth- Adjusted Present value (APV) The APV model is based on dividing the total value of a company into its value of the operation and the tax shield. The value of operation is estimated by the present value of its after-tax operating income (EBIT) discounted at the cost of capital appropriate for the firm's level of business risk. The value of the tax shield is the present value of the tax savings from interest 11+ " MUPP11+ +1+1+1+ **** ****170 VL=Vy+Tc.D deductions. One of the important assumption of the model is that the tax shield is discounted at the cost of debt. EBIT(I-T). EBIT(1-TC) REU where Ru The relationship in the above equation is derived by decomposing the operating cash flows between the equity and debt holders. If the cash flow to shareholders is divided by its own cost of capital (R.) and the cash flow to the debt holders by its own cost of debt (R.), we would have: + . EBIT(1-T) TRD VL or V-V. +T.D Ru Rd EBIT(1-7) V- WACC D E WACC = Ru(1-To) v +RBLV and E-V-D The cost of equity of a levered firm, Rol, equals the cost of equity of an unlevered firm, Reu, plus a risk premium which depends on the firm's financial leverage and the tax rate. D RAL= Ru + (Ru - R.)(1-T.) Dynamic Capital Structures and the Adjusted Present Value (APV) and Growth With dynamic capital structures, the value of the company can be broken into the portions due to unlevered operations and the tax shield. APV - Present value of all- Present value of interest tax shield oquity finance Investment associated with the debt financing. UFCF UTFCFT FI (TC) IT (TC) V= + F1 (1+ Reu)' (1+Reu)? =1(1+Ra) (R1-8)(1+Ra)" + + APV This model assumes that the debt and interest expense are not risky and interest tax saving is discount with the cost of debt. However, when the company's capital structure is changing over time and the debt is as risky as the equity, then the interest tax saving should be discounted with unlevered cost of equity as shown in below equation. T UFCF V= UTFCFTI 1(TC) Ir.(TC) =1 (1+Rew) (1+REW)" =1(1+Rew) (R-8)(1+REM)" , + + APV UNFCF =unlevered free cash flow UTFCF =unlevered terminal free cash flow Rev-ankerod cost of puis RLE-led oue of aquilles Ro-cast of debt c- Part 1-Static Theory An enduring controversy within financial theory concerns the effect of financial leverage on the value and stock price of a company. Can a company affect its overall value by selecting an optimal financing mix (debt and equity)? The firm's mix of debt and equity financing is called its capital structure. The essentials of the capital structure and the effect of financial policies on the value of the firm were pioneering work of Noble recipients Modigliani and Miller in 1958 and 1963. The essential question is: Does debt financing create value? If so, how? If not, then why do so many financial mangers try to find the combination of securities that has greatest overall effect on the market value of the firm? This short case presents a simple model of Modigliani-Miller theorem to highlight the advantage of debt financing and whether there is an optimal capital structure that maximizes the value of the firm. However, it ignores other market imperfections such as bankruptcy and agency problems among security holders that would affect the value of the firm. Radstone, Inc., a prominent stone fabrication firm was formed 5 years ago to exploit a new continuous fabrication process. Radstone's founders, Jim Rad and Mick Rad, had been employed in the research department of a major integrated-stone fabrication company, but when that company decided against using the new process, they decided to strike out on their own. One advantage of the new process was that it required relatively little capital in comparison with the typical fabrication company, so they have been able to avoid issuing debt financing, and thus they own all of the shares. However, the company has now reached the stage where outside capital is necessary if the firm is to achieve its growth targets. Therefore, they have decided to leverage the company with swapping some of their shares with new debt. Currently the company has value of $5 million with outstanding shares of 100,000. The company generates $1,538,461.5 in earnings before interest and taxes (EBIT) in perpetuity. The corporate tax rate is 35 percent and all earnings are paid as dividends. The company is considering the effect of $2 million and $2.5 million debt equity swap on its cost of capital and its value. The cost of debt is 10 percent and the cost of capital is currently 20 percent. Any investment in net working capital and capital expenditure is equal to its depreciation allowances. The corporate tax rate is 35 percent. Part 2- Dynamic Capital Structure of Modigliani-Miller-Adjusted Present Value (APV) The Company generated $1,465,201.43 in earnings before interest and taxes (EBIT) last year and is expected to increase by 5 percent for the next 3 years and after which at a constant rate of 3 percent in perpetuity. The expected interest expense is also expected to grow over next 3 years before the capital structure becomes constant. The cost of debt is 10 percent and the Company's cost of capital currently is 20 percent. Any investment in net working capital and capital expenditure is equal to its depreciation allowances. The corporate tax rate is 35 percent. Using information from part one, answer the following questions: a. What is the estimated terminal unlevered value of operations (i.e., the value at Year 3 inmediately after the FCF at Year 3)? b. What is the current unlevered value of operations? c. What is the terminal value of the tax shield at Year 3? d. What is the current value of the tax shield? e. What is the current total value? Note for this case. The value of the firm equals the market value of the debt plus the market value of the equity (firm value identity V=D+E). The optimal capital structure is that debt/equity mix that simultaneously (a) maximizes the value of the firm, (b) minimizes the weighted average cost of capital, and (c) maximizes the market value of the common stock. Maximizing the value of the firm is the goal of managing capital structure. The cash flow identity is similar to the balance sheet identity: Cash Flow from Assets (CFFA) = Cash Flow to Creditors (CF deinbolikens )+ Cash Flow stockholders CFFA = Operating cash flow net capital spending - changes in net working capital Operating cash flow (OCF) = EBIT + depreciation - taxes Net capital spending (NCS) = ending fixed assets - beginning fixed assets + depreciation Changes in NWC = ending NWC - beginning NWC Cash Flow to Creditors and Stockholders Cash flow to creditors = interest paid net new borrowing = interest paid - (ending long-term debt - beginning long-term debt) Cash flow to stockholders = dividends paid - net new equity or FC Equityholders = dividends paid - (ending common stock, and Treasury stock - beginning common stock, and Treasury stock). Using the above equation we can write CFASSETS = CFBERT +CFSTOCKHOLDERS Or CF = Levered CF+I where I =R..D substituting in equation 9,we have CF = (EBIT - R..D)(1-T)+ I= EBIT(1 - Tc) + To.R.D The Modigliani-Miller Capital Structure theory With Tax Shield and No growth- Adjusted Present value (APV) The APV model is based on dividing the total value of a company into its value of the operation and the tax shield. The value of operation is estimated by the present value of its after-tax operating income (EBIT) discounted at the cost of capital appropriate for the firm's level of business risk. The value of the tax shield is the present value of the tax savings from interest 11+ " MUPP11+ +1+1+1+ **** ****170 VL=Vy+Tc.D deductions. One of the important assumption of the model is that the tax shield is discounted at the cost of debt. EBIT(I-T). EBIT(1-TC) REU where Ru The relationship in the above equation is derived by decomposing the operating cash flows between the equity and debt holders. If the cash flow to shareholders is divided by its own cost of capital (R.) and the cash flow to the debt holders by its own cost of debt (R.), we would have: + . EBIT(1-T) TRD VL or V-V. +T.D Ru Rd EBIT(1-7) V- WACC D E WACC = Ru(1-To) v +RBLV and E-V-D The cost of equity of a levered firm, Rol, equals the cost of equity of an unlevered firm, Reu, plus a risk premium which depends on the firm's financial leverage and the tax rate. D RAL= Ru + (Ru - R.)(1-T.) Dynamic Capital Structures and the Adjusted Present Value (APV) and Growth With dynamic capital structures, the value of the company can be broken into the portions due to unlevered operations and the tax shield. APV - Present value of all- Present value of interest tax shield oquity finance Investment associated with the debt financing. UFCF UTFCFT FI (TC) IT (TC) V= + F1 (1+ Reu)' (1+Reu)? =1(1+Ra) (R1-8)(1+Ra)" + + APV This model assumes that the debt and interest expense are not risky and interest tax saving is discount with the cost of debt. However, when the company's capital structure is changing over time and the debt is as risky as the equity, then the interest tax saving should be discounted with unlevered cost of equity as shown in below equation. T UFCF V= UTFCFTI 1(TC) Ir.(TC) =1 (1+Rew) (1+REW)" =1(1+Rew) (R-8)(1+REM)" , + + APV UNFCF =unlevered free cash flow UTFCF =unlevered terminal free cash flow Rev-ankerod cost of puis RLE-led oue of aquilles Ro-cast of debt c- Part 1-Static Theory An enduring controversy within financial theory concerns the effect of financial leverage on the value and stock price of a company. Can a company affect its overall value by selecting an optimal financing mix (debt and equity)? The firm's mix of debt and equity financing is called its capital structure. The essentials of the capital structure and the effect of financial policies on the value of the firm were pioneering work of Noble recipients Modigliani and Miller in 1958 and 1963. The essential question is: Does debt financing create value? If so, how? If not, then why do so many financial mangers try to find the combination of securities that has greatest overall effect on the market value of the firm? This short case presents a simple model of Modigliani-Miller theorem to highlight the advantage of debt financing and whether there is an optimal capital structure that maximizes the value of the firm. However, it ignores other market imperfections such as bankruptcy and agency problems among security holders that would affect the value of the firm. Radstone, Inc., a prominent stone fabrication firm was formed 5 years ago to exploit a new continuous fabrication process. Radstone's founders, Jim Rad and Mick Rad, had been employed in the research department of a major integrated-stone fabrication company, but when that company decided against using the new process, they decided to strike out on their own. One advantage of the new process was that it required relatively little capital in comparison with the typical fabrication company, so they have been able to avoid issuing debt financing, and thus they own all of the shares. However, the company has now reached the stage where outside capital is necessary if the firm is to achieve its growth targets. Therefore, they have decided to leverage the company with swapping some of their shares with new debt. Currently the company has value of $5 million with outstanding shares of 100,000. The company generates $1,538,461.5 in earnings before interest and taxes (EBIT) in perpetuity. The corporate tax rate is 35 percent and all earnings are paid as dividends. The company is considering the effect of $2 million and $2.5 million debt equity swap on its cost of capital and its value. The cost of debt is 10 percent and the cost of capital is currently 20 percent. Any investment in net working capital and capital expenditure is equal to its depreciation allowances. The corporate tax rate is 35 percent