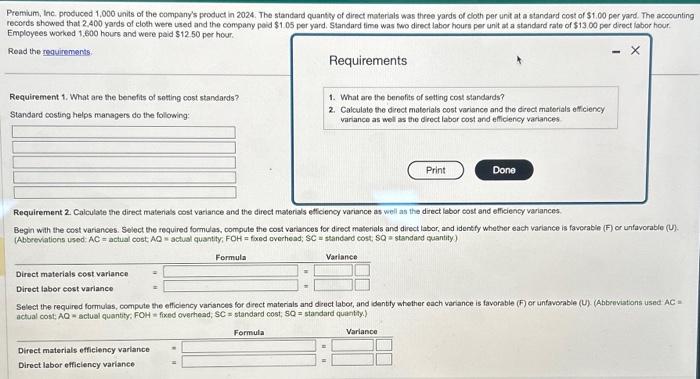

Premium, Inc. produced 1,000 units of the company's product in 2024. The standard quantity of direct materials was three yards of cloth per unit at a standard cost of $1.00 per yard. The accounting records showed that 2,400 yards of cloth were used and the company paid $1.05 per yard. Standard time was two direct labor hours per unit at a standard rate of $13.00 per direct labor hour.

Employees worked 1,600 hours and were paid $12.50 per hour.

Premium, Inc. produced 1,000 units of the company's product in 2024. The standard quanty of drect materials was three yards of cloth per unit at a standard cost of $1.00 per yard. The accounti records showed that 2,400 yards of eloth were used and the compary poid $1.05 per yard. $ tandard time was two direct labor hourn per unit at a standard rate of $13.00 per drect iabor hour. Employees workod 1,600 hours and were paid $12.50 per hour. Read the requirements: Requirements Requirement 1. What are the benefits of sotting cost standards? Standard costing helps managers do the following: 1. What are the benofits of setting cost standards? 2. Calculato the direct motorials cost variance and the direct matorials efficiency yariance as well as the drect labor cost and efficiency variances. Requirement 2 . Calculate the direct matenas cost variance and the direct materis/s efficienoy variance as well as the direct labor cost and efficiency variances. Begin with the cost variances. Select the required formulas, compute the cost varlances for direct moterials and direct labor, and identify wheoher each variance is favcrable (F) or unfavorable (U). (Abbrevations used: AC= actual cost, AQ= actual quantity; FOH= fored overhead; SC= standard cost, SQ= standand puantity) Select the required formulas, compule the efficlency vanisnces for decet materiais and diect labot, and idently whether each variance is favorable (F) or unfavorable (U) (Abbreviations used AC = actual cost; AQ= actual quantity, FOH = fixed overhead, SC= standard cost; SQ= standard quantity.) Premium, Inc. produced 1,000 units of the company's product in 2024. The standard quanty of drect materials was three yards of cloth per unit at a standard cost of $1.00 per yard. The accounti records showed that 2,400 yards of eloth were used and the compary poid $1.05 per yard. $ tandard time was two direct labor hourn per unit at a standard rate of $13.00 per drect iabor hour. Employees workod 1,600 hours and were paid $12.50 per hour. Read the requirements: Requirements Requirement 1. What are the benefits of sotting cost standards? Standard costing helps managers do the following: 1. What are the benofits of setting cost standards? 2. Calculato the direct motorials cost variance and the direct matorials efficiency yariance as well as the drect labor cost and efficiency variances. Requirement 2 . Calculate the direct matenas cost variance and the direct materis/s efficienoy variance as well as the direct labor cost and efficiency variances. Begin with the cost variances. Select the required formulas, compute the cost varlances for direct moterials and direct labor, and identify wheoher each variance is favcrable (F) or unfavorable (U). (Abbrevations used: AC= actual cost, AQ= actual quantity; FOH= fored overhead; SC= standard cost, SQ= standand puantity) Select the required formulas, compule the efficlency vanisnces for decet materiais and diect labot, and idently whether each variance is favorable (F) or unfavorable (U) (Abbreviations used AC = actual cost; AQ= actual quantity, FOH = fixed overhead, SC= standard cost; SQ= standard quantity.)