Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Premium, Inc. uses a standard cost system and provides the following information. BEE (Click the icon to view the information.) Premium allocates manufacturing overhead

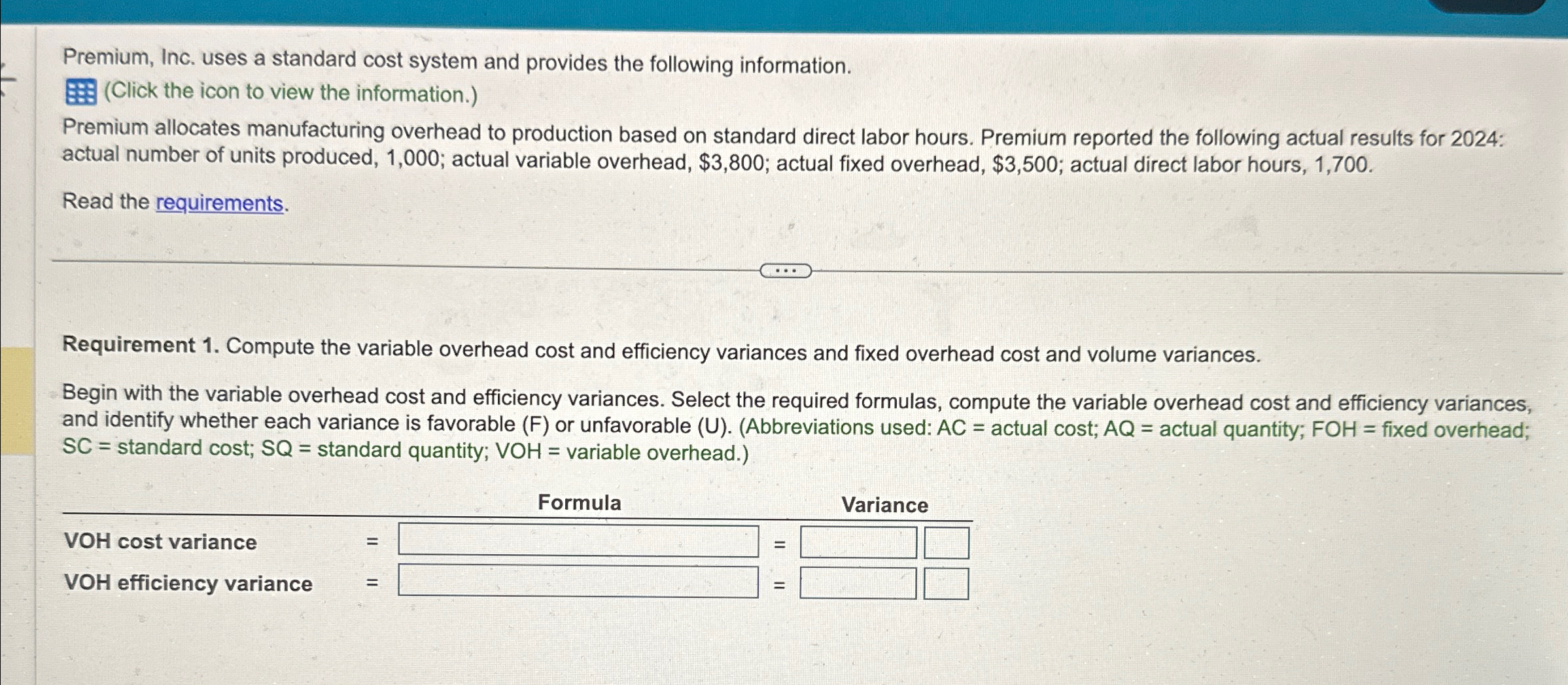

Premium, Inc. uses a standard cost system and provides the following information. BEE (Click the icon to view the information.) Premium allocates manufacturing overhead to production based on standard direct labor hours. Premium reported the following actual results for 2024: actual number of units produced, 1,000; actual variable overhead, $3,800; actual fixed overhead, $3,500; actual direct labor hours, 1,700. Read the requirements. Requirement 1. Compute the variable overhead cost and efficiency variances and fixed overhead cost and volume variances. Begin with the variable overhead cost and efficiency variances. Select the required formulas, compute the variable overhead cost and efficiency variances, and identify whether each variance is favorable (F) or unfavorable (U). (Abbreviations used: AC = actual cost; AQ = actual quantity; FOH = fixed overhead; SC = standard cost; SQ = standard quantity; VOH = variable overhead.) VOH cost variance VOH efficiency variance = Formula II II Variance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started