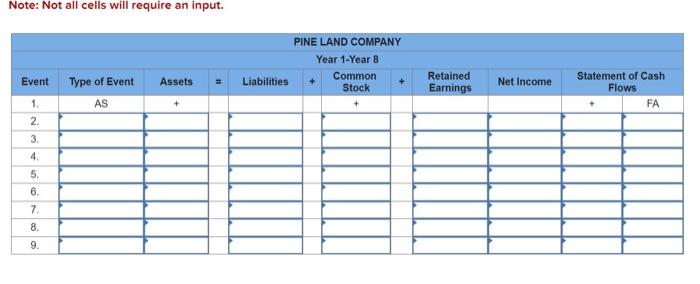

premium on January 1, Year 1 . Interest is payable annually on December 31 of each year, beginning December 31 , Year 1 . On January 2, Year 1 , Pine Land Company purchased a plece of land and leased it for an annual rental fee. The rent is received annually on December 31, beginning December 31, Year 1. At the end of the eight-year period (December 31, Year 8), the land was sold at a gain, and the bonds were paid off. A summary of the transactions for each year follows: Year 1 1. Acquired cash from the issue of common stock. 2. Issued eight-year bonds. 3. Purchased land. 4. Received land rental income. 5. Recognized interest expense including the straight-line amortization of the premium and made the cash payment for interest on December 31. Year 2 through Year 7 6. Recelved land rental income. 7. Recognized interest expense. Including the straight-ine amortization of the premium, and made the cash payment for interest on December 31 . Year 8 8. Sold iand at a gain. 9. Retired bonds at face value. Required Iclentify each of these events and transactions as an asset source (AS), osset use (AU), asset exchange (AE), or claims exchange (CE). Explain how each event affects the amount of total assets, liabilities, equity, net income, and cash flow by placing a + for increase or for decrease. In the Statement of Cash Flows column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). Columns for events that have no effect on any of the elements should be left blank. The first event is recorded as an example. Note: Not all cells will require an input. Note: Not all cells will require an input. premium on January 1, Year 1 . Interest is payable annually on December 31 of each year, beginning December 31 , Year 1 . On January 2, Year 1 , Pine Land Company purchased a plece of land and leased it for an annual rental fee. The rent is received annually on December 31, beginning December 31, Year 1. At the end of the eight-year period (December 31, Year 8), the land was sold at a gain, and the bonds were paid off. A summary of the transactions for each year follows: Year 1 1. Acquired cash from the issue of common stock. 2. Issued eight-year bonds. 3. Purchased land. 4. Received land rental income. 5. Recognized interest expense including the straight-line amortization of the premium and made the cash payment for interest on December 31. Year 2 through Year 7 6. Recelved land rental income. 7. Recognized interest expense. Including the straight-ine amortization of the premium, and made the cash payment for interest on December 31 . Year 8 8. Sold iand at a gain. 9. Retired bonds at face value. Required Iclentify each of these events and transactions as an asset source (AS), osset use (AU), asset exchange (AE), or claims exchange (CE). Explain how each event affects the amount of total assets, liabilities, equity, net income, and cash flow by placing a + for increase or for decrease. In the Statement of Cash Flows column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). Columns for events that have no effect on any of the elements should be left blank. The first event is recorded as an example. Note: Not all cells will require an input. Note: Not all cells will require an input