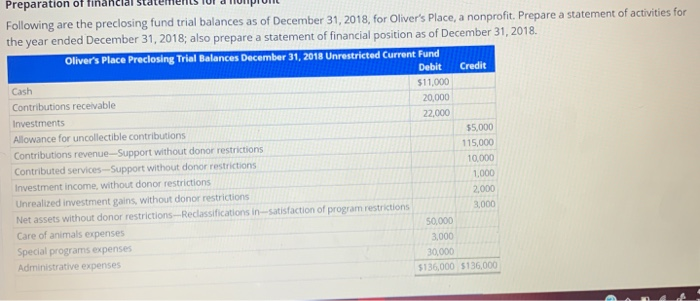

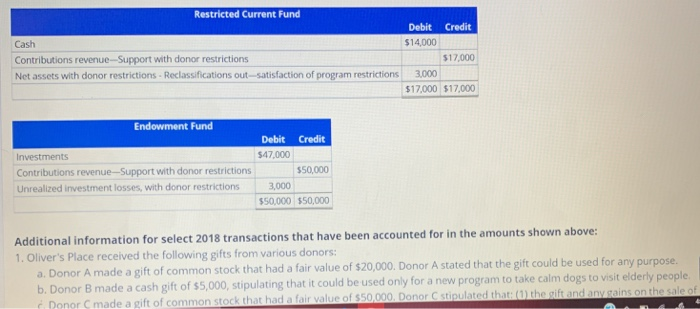

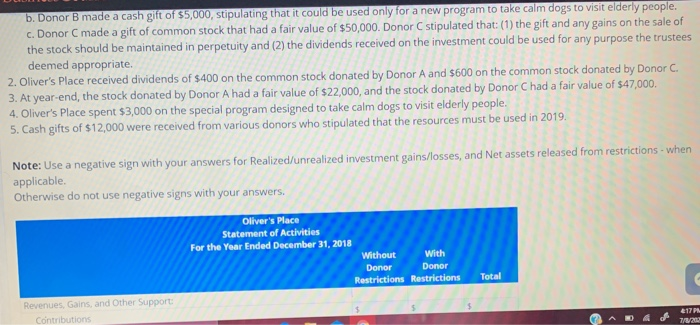

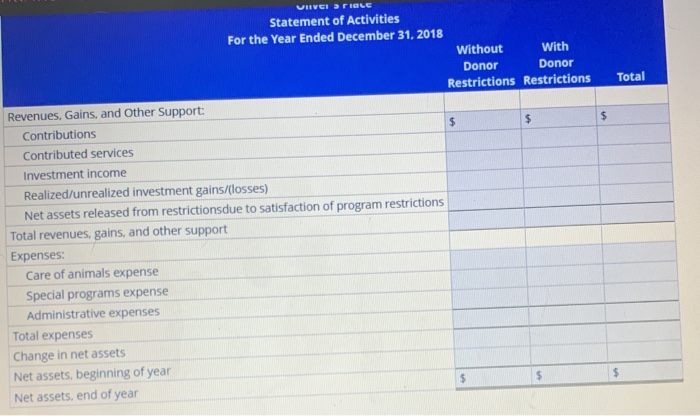

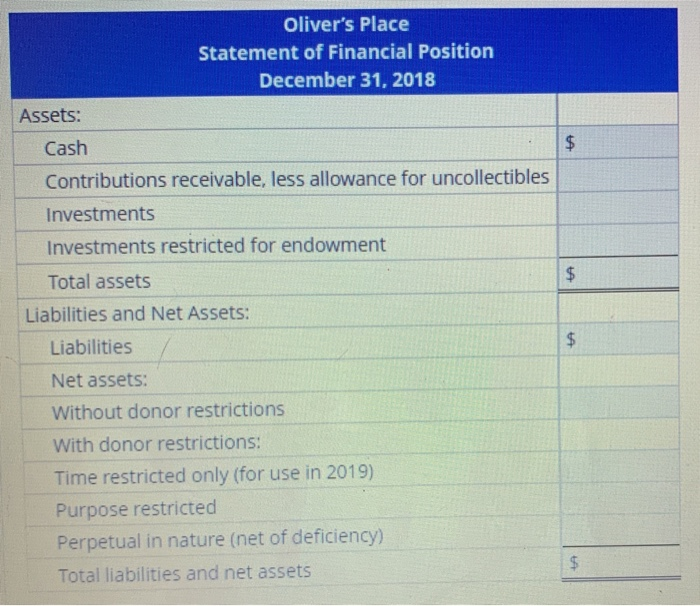

Preparation Following are the preclosing fund trial balances as of December 31, 2018, for Oliver's Place, a nonprofit. Prepare a statement of activities for the year ended December 31, 2018; also prepare a statement of financial position as of December 31, 2018. Oliver's Place Preclosing Trial Balances December 31, 2018 Unrestricted Current Fund Cash Contributions receivable Investments Allowance for uncollectible contributions Contributions revenue--Support without donor restrictions Contributed services-Support without donor restrictions Investment income, without donor restrictions Unrealized investment gains, without donor restrictions Net assets without donor restrictions-Reclassifications insatisfaction of program restrictions Care of animals expenses Special programs expenses Administrative expenses Debit Credit $11,000 20,000 22.000 55.000 115,000 10000 1.000 2,000 3.000 50.000 3,000 30,000 5136,000 5136,000 Restricted Current Fund Cash Contributions revenue-Support with donor restrictions Net assets with donor restrictions - Reclassifications out satisfaction of program restrictions Debit Credit $14,000 $17,000 3,000 $17,000 $17,000 Endowment Fund Investments Contributions revenue-Support with donor restrictions Unrealized investment losses, with donor restrictions Debit Credit $47.000 $50,000 3,000 $50,000 $50,000 Additional information for select 2018 transactions that have been accounted for in the amounts shown above: 1. Oliver's Place received the following gifts from various donors: a. Donor A made a gift of common stock that had a fair value of $20,000. Donor A stated that the gift could be used for any purpose. b. Donor B made a cash gift of $5,000, stipulating that it could be used only for a new program to take calm dogs to visit elderly people Donor C made a gift of common stock that had a fair value of $50,000. Donor C stipulated that the sift and any sains on the sale of b. Donor B made a cash gift of $5,000, stipulating that it could be used only for a new program to take calm dogs to visit elderly people. c. Donor C made a gift of common stock that had a fair value of $50,000. Donor C stipulated that: (1) the gift and any gains on the sale of the stock should be maintained in perpetuity and (2) the dividends received on the investment could be used for any purpose the trustees deemed appropriate 2. Oliver's Place received dividends of $400 on the common stock donated by Donor A and $600 on the common stock donated by Donor C. 3. At year-end, the stock donated by Donor A had a fair value of $22,000, and the stock donated by Donor C had a fair value of $47,000. 4. Oliver's Place spent $3,000 on the special program designed to take calm dogs to visit elderly people. 5. Cash gifts of $12,000 were received from various donors who stipulated that the resources must be used in 2019. Note: Use a negative sign with your answers for Realized/unrealized investment gains/losses, and Net assets released from restrictions - when applicable. Otherwise do not use negative signs with your answers. Oliver's Place Statement of Activities For the Year Ended December 31, 2018 Without With Donor Donor Restrictions Restrictions Total Revenues, Gains, and Other Support: Contributions &17 7/8/2002 Total $ VIVEI TILE Statement of Activities For the Year Ended December 31, 2018 Without With Donor Donor Restrictions Restrictions Revenues, Gains, and Other Support: Contributions $ $ Contributed services Investment income Realized/unrealized investment gains/(losses) Net assets released from restrictionsdue to satisfaction of program restrictions Total revenues, gains, and other support Expenses: Care of animals expense Special programs expense Administrative expenses Total expenses Change in net assets Net assets, beginning of year $ $ Net assets, end of year $ Oliver's Place Statement of Financial Position December 31, 2018 Assets: LA Cash Contributions receivable, less allowance for uncollectibles Investments Investments restricted for endowment $ Total assets Liabilities and Net Assets: Liabilities $ Net assets: Without donor restrictions With donor restrictions: Time restricted only (for use in 2019) Purpose restricted Perpetual in nature (net of deficiency) Total liabilities and net assets $ $ Preparation Following are the preclosing fund trial balances as of December 31, 2018, for Oliver's Place, a nonprofit. Prepare a statement of activities for the year ended December 31, 2018; also prepare a statement of financial position as of December 31, 2018. Oliver's Place Preclosing Trial Balances December 31, 2018 Unrestricted Current Fund Cash Contributions receivable Investments Allowance for uncollectible contributions Contributions revenue--Support without donor restrictions Contributed services-Support without donor restrictions Investment income, without donor restrictions Unrealized investment gains, without donor restrictions Net assets without donor restrictions-Reclassifications insatisfaction of program restrictions Care of animals expenses Special programs expenses Administrative expenses Debit Credit $11,000 20,000 22.000 55.000 115,000 10000 1.000 2,000 3.000 50.000 3,000 30,000 5136,000 5136,000 Restricted Current Fund Cash Contributions revenue-Support with donor restrictions Net assets with donor restrictions - Reclassifications out satisfaction of program restrictions Debit Credit $14,000 $17,000 3,000 $17,000 $17,000 Endowment Fund Investments Contributions revenue-Support with donor restrictions Unrealized investment losses, with donor restrictions Debit Credit $47.000 $50,000 3,000 $50,000 $50,000 Additional information for select 2018 transactions that have been accounted for in the amounts shown above: 1. Oliver's Place received the following gifts from various donors: a. Donor A made a gift of common stock that had a fair value of $20,000. Donor A stated that the gift could be used for any purpose. b. Donor B made a cash gift of $5,000, stipulating that it could be used only for a new program to take calm dogs to visit elderly people Donor C made a gift of common stock that had a fair value of $50,000. Donor C stipulated that the sift and any sains on the sale of b. Donor B made a cash gift of $5,000, stipulating that it could be used only for a new program to take calm dogs to visit elderly people. c. Donor C made a gift of common stock that had a fair value of $50,000. Donor C stipulated that: (1) the gift and any gains on the sale of the stock should be maintained in perpetuity and (2) the dividends received on the investment could be used for any purpose the trustees deemed appropriate 2. Oliver's Place received dividends of $400 on the common stock donated by Donor A and $600 on the common stock donated by Donor C. 3. At year-end, the stock donated by Donor A had a fair value of $22,000, and the stock donated by Donor C had a fair value of $47,000. 4. Oliver's Place spent $3,000 on the special program designed to take calm dogs to visit elderly people. 5. Cash gifts of $12,000 were received from various donors who stipulated that the resources must be used in 2019. Note: Use a negative sign with your answers for Realized/unrealized investment gains/losses, and Net assets released from restrictions - when applicable. Otherwise do not use negative signs with your answers. Oliver's Place Statement of Activities For the Year Ended December 31, 2018 Without With Donor Donor Restrictions Restrictions Total Revenues, Gains, and Other Support: Contributions &17 7/8/2002 Total $ VIVEI TILE Statement of Activities For the Year Ended December 31, 2018 Without With Donor Donor Restrictions Restrictions Revenues, Gains, and Other Support: Contributions $ $ Contributed services Investment income Realized/unrealized investment gains/(losses) Net assets released from restrictionsdue to satisfaction of program restrictions Total revenues, gains, and other support Expenses: Care of animals expense Special programs expense Administrative expenses Total expenses Change in net assets Net assets, beginning of year $ $ Net assets, end of year $ Oliver's Place Statement of Financial Position December 31, 2018 Assets: LA Cash Contributions receivable, less allowance for uncollectibles Investments Investments restricted for endowment $ Total assets Liabilities and Net Assets: Liabilities $ Net assets: Without donor restrictions With donor restrictions: Time restricted only (for use in 2019) Purpose restricted Perpetual in nature (net of deficiency) Total liabilities and net assets $ $