Answered step by step

Verified Expert Solution

Question

1 Approved Answer

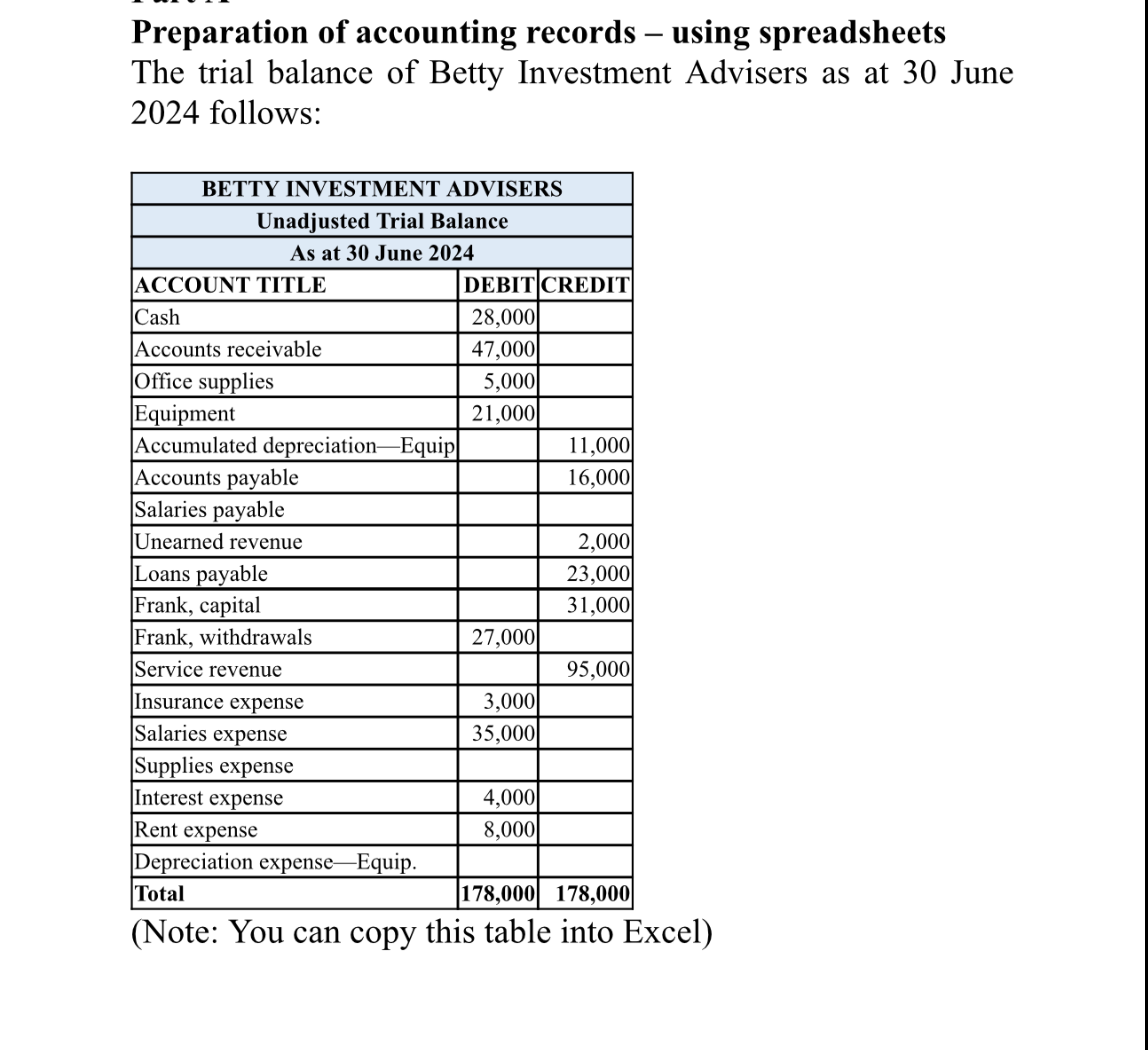

Preparation of accounting records using spreadsheets The trial balance of Betty Investment Advisers as at 3 0 June 2 0 2 4 follows: BETTY INVESTMENT

Preparation of accounting records using spreadsheets

The trial balance of Betty Investment Advisers as at June follows:

BETTY INVESTMENT ADVISERS

Unadjusted Trial Balance

As at June

ACCOUNT TITLE DEBIT CREDIT

Cash

Accounts receivable

Office supplies

Equipment

Accumulated depreciationEquip

Accounts payable

Salaries payable

Unearned revenue

Loans payable

Frank, capital

Frank, withdrawals

Service revenue

Insurance expense

Salaries expense

Supplies expense

Interest expense

Rent expense

Depreciation expenseEquip

Total

Note: You can copy this table into Excel

Required:

Formulate five adjustments with special attention to dates and months and journalise the adjusting entries in Excel. Ensure that these adjustments vary from each other and cover a range of transaction types. Examples of different types of adjustments include accrued service revenue, depreciation, accrued salary expense, expired prepaid rent, supplies used, and unearned revenue. Before making the adjusting entries in AQpage provide the details of each adjustment. After detailing the adjustments, prepare the adjusting entries formulas are not required

Using your Unadjusted Trial Balance and adjusting entries prepared above, prepare the tencolumn worksheet in Excel for the period ended on June Use formulas to generate all figures in the worksheet from the data section. Use the IF function for the Profit or Loss and also to check that the debit and credit columns balance.

Using the tencolumn worksheet prepared above as your data prepare the income statement, statement of changes in equity and classified balance sheet in Excel. Use formulas to generate all of the figures in the financial statements.

Note : Please give all answers in excel spreadsheet only. Preparation of accounting records using spreadsheets The trial balance of Betty Investment Advisers as at June follows:

tableBETTY INVESTMENT ADVISERSAs at June ACCOUNT TITLE,DEBIT,CREDITCashAccounts receivable,Office supplies,EquipmentAccumulated depreciationEquip,,Accounts payable,,Salaries payable,,Unearned revenue,Loans payable,,Frank capital,Frank withdrawals,Service revenue,,Insurance expense,Salaries expense,Supplies expense,,Interest expense,Rent expense,,Depreciation expenseEquip.,,Total

Note: You can copy this table into ExcelNote: You can copy this table into Excel

Required:

Formulate five adjustments with special attention to dates

and months and journalise the adjusting entries in Excel.

Ensure that these adjustments vary from each other and

cover a range of transaction types. Examples of different

types of adjustments include accrued service revenue,

depreciation, accrued salary expense, expired prepaid rent,

supplies used, and unearned revenue. Before making the

adjusting entries in AQpage provide the details of

each adjustment. After detailing the adjustments, prepare

the adjusting entries formulas are not required

Using your 'Unadjusted Trial Balance' and adjusting

entries prepared above, prepare the tencolumn worksheet

in Excel for the period ended on June Use

formulas to generate all figures in the 'worksheet' from

the 'data' section. Use the IF function for the 'Profit' or

'Loss' and also to check that the debit and credit columns

balance.

Using the tencolumn worksheet prepared above as your

'data', prepare the income statement, statement of changes

in equity and classified balance sheet in Excel. Use

formulas to generate all of the figures in the financial

statements.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started