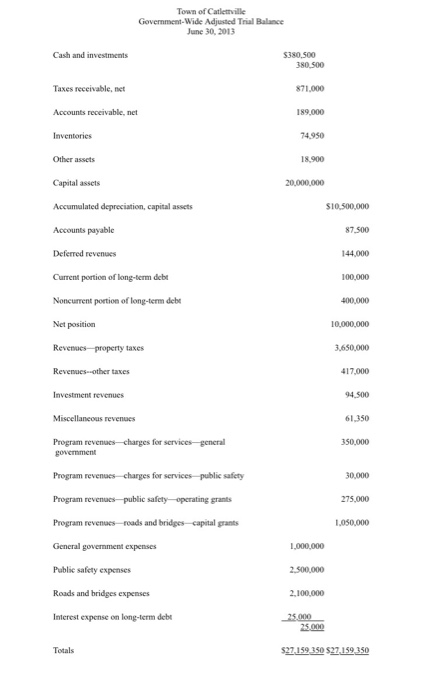

Preparation of Government-Wide Financial Statements On the following page is the government-wide adjusted trial balance for the Town of Catlettville as of June 30, 2013, the end of the fiscal year. The adjustments needed to convert accounting information from the current financial resources measurement focus and modified accrual basis of accounting to the economic resources measurement focus and accrual basis of accounting have been made. The Town government performs three functions, general government, public safety and roads and bridges. The Town has no business-type activities nor any component units. Program revenues include charges for services (related to the general government and public safety functions), operating grants (for public safety) and capital grants (for roads and bridges) General revenue sources are property taxes, other taxes, investment revenues, and miscellaneous revenues Using this information, prepare in good form (a) the government-wide statement of net position (using a classified format), and (b) the government-wide statement of activities as of, and for the year ended, June 30, 2013. There are no restricted assets or liabilities; the long-term debt (both portions) is the only debt related to the Town's capital assets. Town of Catlettville Government-Wide Adjusted Trial Balance June 30, 2013 $380.500 Accumalated depreciation, capital assets $10.500,000 Current portion of long-term debt Noncurrent portion of long-term debe Net position Program revenues charges for services public safety Program revenacs public safety operating grants Program revenaes roads and bridges capital grants 1,050,000 1,000,000 2.500,000 2.100,000 expenses Interest expense on long-term debt 27.159 350 $27.159 350 Preparation of Government-Wide Financial Statements On the following page is the government-wide adjusted trial balance for the Town of Catlettville as of June 30, 2013, the end of the fiscal year. The adjustments needed to convert accounting information from the current financial resources measurement focus and modified accrual basis of accounting to the economic resources measurement focus and accrual basis of accounting have been made. The Town government performs three functions, general government, public safety and roads and bridges. The Town has no business-type activities nor any component units. Program revenues include charges for services (related to the general government and public safety functions), operating grants (for public safety) and capital grants (for roads and bridges) General revenue sources are property taxes, other taxes, investment revenues, and miscellaneous revenues Using this information, prepare in good form (a) the government-wide statement of net position (using a classified format), and (b) the government-wide statement of activities as of, and for the year ended, June 30, 2013. There are no restricted assets or liabilities; the long-term debt (both portions) is the only debt related to the Town's capital assets. Town of Catlettville Government-Wide Adjusted Trial Balance June 30, 2013 $380.500 Accumalated depreciation, capital assets $10.500,000 Current portion of long-term debt Noncurrent portion of long-term debe Net position Program revenues charges for services public safety Program revenacs public safety operating grants Program revenaes roads and bridges capital grants 1,050,000 1,000,000 2.500,000 2.100,000 expenses Interest expense on long-term debt 27.159 350 $27.159 350