Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PREPARATION OF INCOME TAX RETURN INDIVIDUAL TAXPAYER SCENARIO: . You are single, registered with the BIR with TIN nos. 123987456, employed as accounting manager

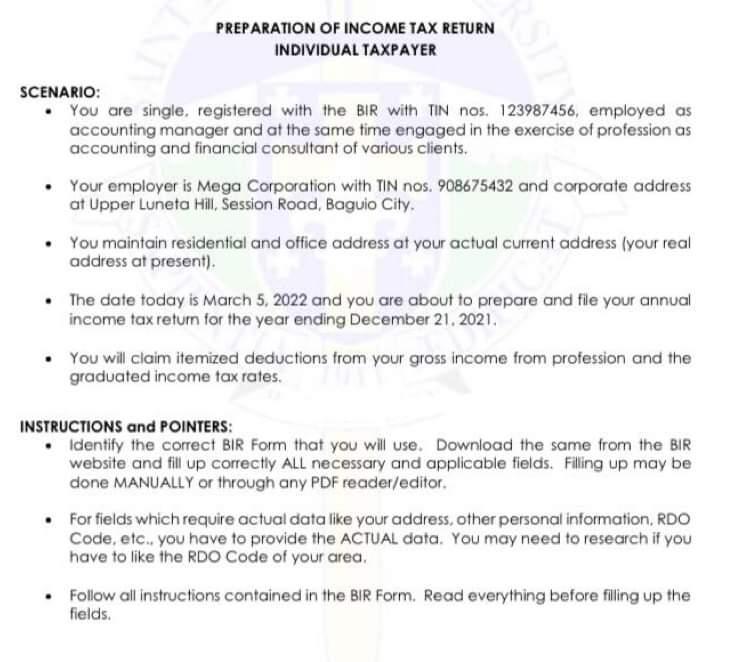

PREPARATION OF INCOME TAX RETURN INDIVIDUAL TAXPAYER SCENARIO: . You are single, registered with the BIR with TIN nos. 123987456, employed as accounting manager and at the same time engaged in the exercise of profession as accounting and financial consultant of various clients. Your employer is Mega Corporation with TIN nos. 908675432 and corporate address at Upper Luneta Hill, Session Road, Baguio City. You maintain residential and office address at your actual current address (your real address at present). The date today is March 5, 2022 and you are about to prepare and file your annual income tax return for the year ending December 21, 2021. You will claim itemized deductions from your gross income from profession and the graduated income tax rates. INSTRUCTIONS and POINTERS: Identify the correct BIR Form that you will use. Download the same from the BIR website and fill up correctly ALL necessary and applicable fields. Filling up may be done MANUALLY or through any PDF reader/editor. For fields which require actual data like your address, other personal information, RDO Code, etc., you have to provide the ACTUAL data. You may need to research if you have to like the RDO Code of your area. Follow all instructions contained in the BIR Form. Read everything before filling up the fields. 2021 DATA ON COMPENSATION INCOME taken from the BIR form 2316 which your employer provided to you: Basic salary Overtime pay Holiday pay Cost of living allowance Mandatory contributions to SSS, PHIC, etc De minimis within ceiling Excess de minimis 13th month pay 14th month pay Other benefits and bonuses Fees Rental expense The employer CORRECTLY withheld the income tax from compensation. No income tax still due and payable remaining. 2021 DATA ON YOUR PRACTICE OF PROFESSION and other income: 1st Quarter 2nd Quarter 3rd Quarter 75,000 66.000 50,000 10,000 10,000 10,000 Transportation expenses Taxes licenses Rental income (vacant property considered as and capital asset) Interest income from bank time deposits 2,000 8.000 25,000 3,000 2,000 25,000 2,000 2,000 25,000 P732,000 34,000 56,000 70,000 38,000 30,000 none 65,000 65,000 35,000 3,000 4th Quarter 55,000 10,000 2,000 2.500 25,000 3.000 3.000 Income taxes for the 1st THREE QUARTERS have been correctly computed and paid within due dates. 3,000

Step by Step Solution

★★★★★

3.56 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Mixed Income Earners Sample Tax Computations under TRAIN Tax Rules for Individuals Earning Income Both from Compensation and from SelfEmployment The pertinent item on taxation of individuals with inco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started