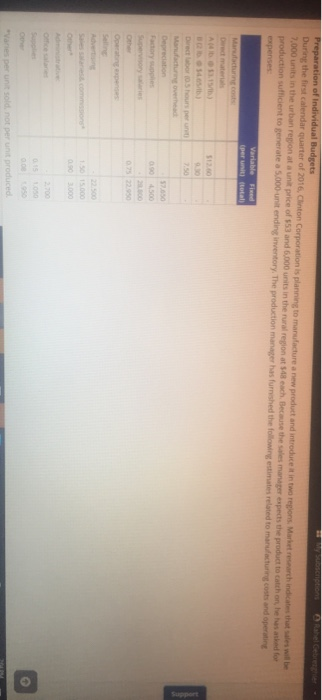

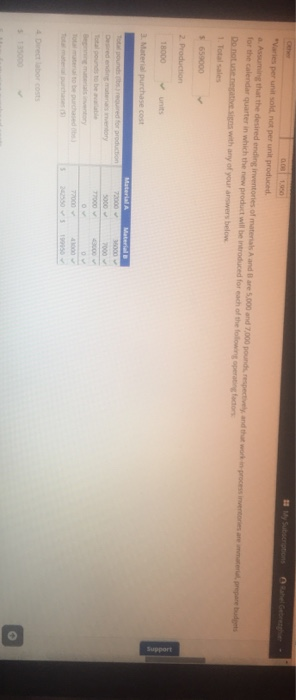

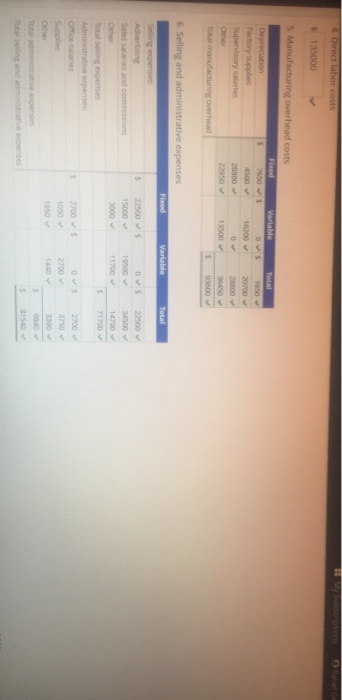

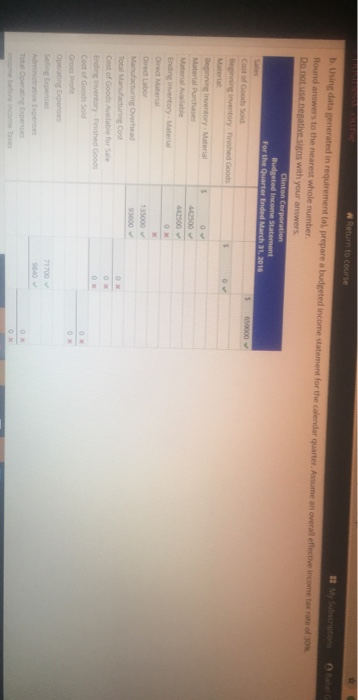

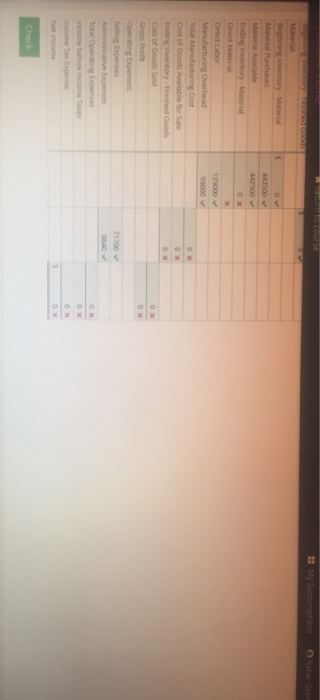

Preparation of Individual Budgets Dus the calendar Quarter of 2016nton Corporation is planning to manufacture new product and introduceti regions Marke t 7,000 units in the urban region at ang price of 53 and 6.000 units in the rural region at each Because the sales manager aspects the product to catch on heated for production sufficient to generate a 5.000 unit ending inventory. The production manager has furnished the following estimates related to manufacturing costs and oper expenses Variable (per un Fire total Maracun pe the Manufacturing De ce "Varies per un sold not per un produced of the calendar quarter in which the new product will be produced Do not e ven with any of your wer below the 639000 2 Production 18000 units Material purchase cost Maria A Droduction 1 Direct labor costs $135000 5. Manufacturing overhead costs Fixed Depron Factory ples 4500 supervisory sales Variable Total OS250 10300 0 00 Total manufacturing overhead 6. Selling and administrative expenses Fixed Variable Total 15 expenses Aves ales com Othe otalseng expenses Admirative pees 272500 5 15000 3000 0 9500 1700 522500 34500 1 4700 soodang 1950 3090 Totalmente en t eses A Return to course bUsing data generated in requirement al prepare a budgeted income statement for the Calendar quarter. Assume an overall effective income taxe Round answers to the nearest whole number Do not use negative signs with your answers. Clinton Corporation Budgeted income statement For the quarter Ended March 31, 2016 Cost of Goods Sold inventoryshed Goods Material wentory M ental Material purchases Material be Ending vertory Material Direct Matera Direct Labor Maructuring overed Tot Manufacturos Cost of Good labore Enseneryshed Goods Costo Opera Totatoes 13 My Sutriscriptions are Getir Mater ventory - Material Direct Me Man Overhead Total Manufacture cost Cost foods for Sale Ching Inventory Fished Good Cost of Goods Sold GOSTO Operaens penses Sene Expenses 71700 Operating expenses Come come ones Preparation of Individual Budgets Dus the calendar Quarter of 2016nton Corporation is planning to manufacture new product and introduceti regions Marke t 7,000 units in the urban region at ang price of 53 and 6.000 units in the rural region at each Because the sales manager aspects the product to catch on heated for production sufficient to generate a 5.000 unit ending inventory. The production manager has furnished the following estimates related to manufacturing costs and oper expenses Variable (per un Fire total Maracun pe the Manufacturing De ce "Varies per un sold not per un produced of the calendar quarter in which the new product will be produced Do not e ven with any of your wer below the 639000 2 Production 18000 units Material purchase cost Maria A Droduction 1 Direct labor costs $135000 5. Manufacturing overhead costs Fixed Depron Factory ples 4500 supervisory sales Variable Total OS250 10300 0 00 Total manufacturing overhead 6. Selling and administrative expenses Fixed Variable Total 15 expenses Aves ales com Othe otalseng expenses Admirative pees 272500 5 15000 3000 0 9500 1700 522500 34500 1 4700 soodang 1950 3090 Totalmente en t eses A Return to course bUsing data generated in requirement al prepare a budgeted income statement for the Calendar quarter. Assume an overall effective income taxe Round answers to the nearest whole number Do not use negative signs with your answers. Clinton Corporation Budgeted income statement For the quarter Ended March 31, 2016 Cost of Goods Sold inventoryshed Goods Material wentory M ental Material purchases Material be Ending vertory Material Direct Matera Direct Labor Maructuring overed Tot Manufacturos Cost of Good labore Enseneryshed Goods Costo Opera Totatoes 13 My Sutriscriptions are Getir Mater ventory - Material Direct Me Man Overhead Total Manufacture cost Cost foods for Sale Ching Inventory Fished Good Cost of Goods Sold GOSTO Operaens penses Sene Expenses 71700 Operating expenses Come come ones