Answered step by step

Verified Expert Solution

Question

1 Approved Answer

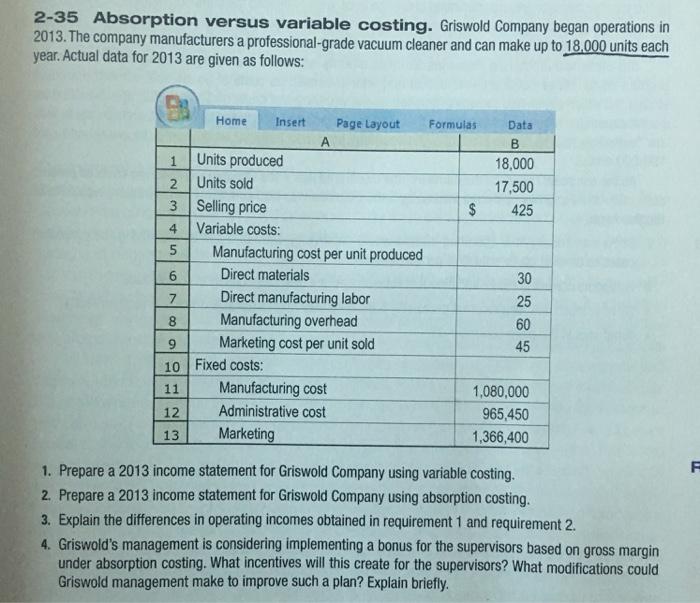

2-35 Absorption versus variable costing. Griswold Company began operations in 2013. The company manufacturers a professional-grade vacuum cleaner and can make up to 18.000

2-35 Absorption versus variable costing. Griswold Company began operations in 2013. The company manufacturers a professional-grade vacuum cleaner and can make up to 18.000 units each year. Actual data for 2013 are given as follows: Home Insert Page Layout Formulas Data A B. 1. Units produced 18,000 2 Units sold 17,500 Selling price Variable costs: 3. 425 Manufacturing cost per unit produced 6. Direct materials 30 Direct manufacturing labor Manufacturing overhead Marketing cost per unit sold 25 8. 60 45 10 Fixed costs: 11 Manufacturing cost 1,080,000 12 Administrative cost 965,450 13 Marketing 1,366,400 1. Prepare a 2013 income statement for Griswold Company using variable costing. 2. Prepare a 2013 income statement for Griswold Company using absorption costing. 3. Explain the differences in operating incomes obtained in requirement 1 and requirement 2. 4. Griswold's management is considering implementing a bonus for the supervisors based on gross margin under absorption costing. What incentives will this create for the supervisors? What modifications could Griswold management make to improve such a plan? Explain briefly. %24

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer 3 The income under variable costing method is 1225650 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635e14e56d95a_181295.pdf

180 KBs PDF File

635e14e56d95a_181295.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started