Question

Prepare a 2016 Form 1040 for the individual below. Also prepare Schedules C. PERSONAL INFORMATION & WAGES Lala Chambers, a divorced single taxpayer and practicing

Prepare a 2016 Form 1040 for the individual below. Also prepare Schedules C.

PERSONAL INFORMATION & WAGES

Lala Chambers, a divorced single taxpayer and practicing attorney, lives at 9551 Oak Leaf Lane in Pine Cove, AZ 86035. Her social security number is 412-34-5670 (date of birth 2/27/1972).

Her W-2 contained the following information:

| Wages (box 1) = $83,401.55 |

| Federal W/H (box 2) = $ 9,782.15 |

| Social security wages (box 3) = $83,401.55 |

| Social security W/H (box 4) = $ 5,170.90 |

| Medicare wages (box 5) = $83,401.55 |

| Medicare W/H (box 6) = $ 1,209.32 |

In addition, Lala made alimony payments totaling $9,600 for the year to her former husband Alex, an unemployed mine worker, whose social security number is 412-34-5671. He found an old girlfriend on Facebook from high school; that is why they got divorced.

She made estimated tax payments this year of $10,000 each quarter of 2016.

HOME BUSINESS

Hint: Use Schedule C. Schedule SE is for bonus points, but is not required. She also has a home cleaning business she runs as a sole proprietorship. The following are the results from business operations for the tax year 2016:

| Gross receipts | $43,000 | ||||||||

| Business mileage: 27,000 (miles incurred ratably throughout the year) 35,000 miles total during the year 2016 Van (over 6,000 lbs) placed in service 1/01/2016, cost $27,000 | |||||||||

| Postage | (500) | ||||||||

| Supplies | (500) | ||||||||

| Phone | (1,250) | ||||||||

| Rent | (2,400) | ||||||||

| Insurance | (2,800) | ||||||||

| Van expenses | (4,500) | ||||||||

| Plastic surgery to be more attractive to customers (5,000) | |||||||||

| Business assets | Date Purchased | Cost | |||||||

| Computer | 5/18/16 | $2,200 | |||||||

1040

https://www.irs.gov/pub/irs-pdf/f1040.pdf

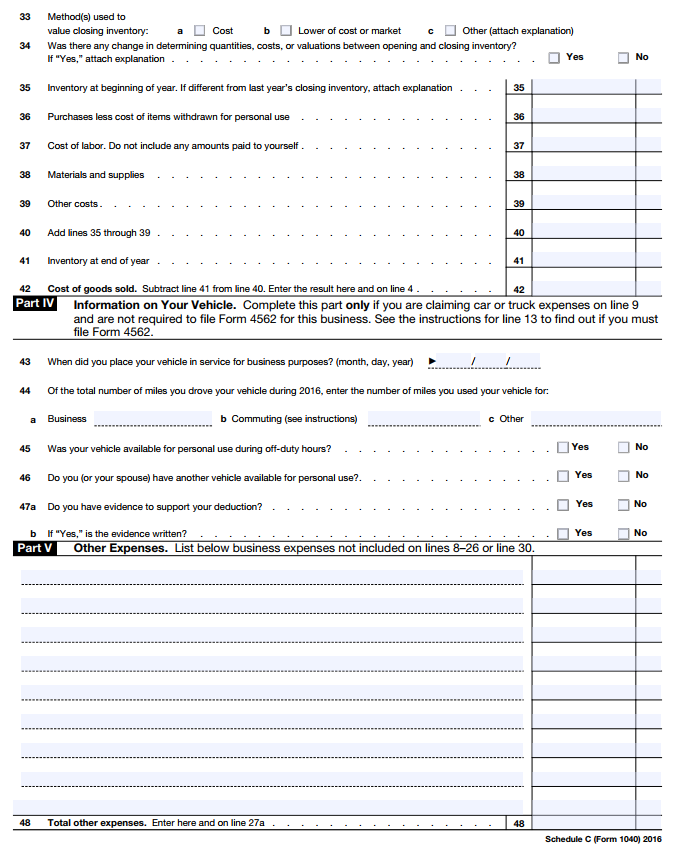

SCHEDULE C

https://www.irs.gov/pub/irs-pdf/f1040sc.pdf

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started