Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare a 6-month cash flow statement (for the period January 2022 to June 2022) for Ms Zinhle, from the business information provided below. You

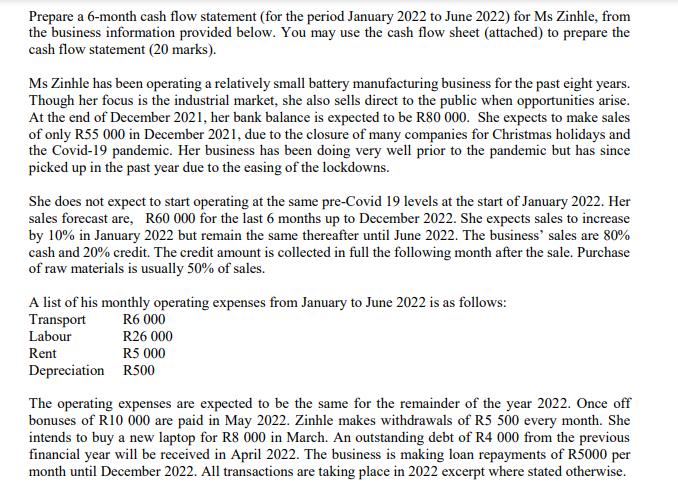

Prepare a 6-month cash flow statement (for the period January 2022 to June 2022) for Ms Zinhle, from the business information provided below. You may use the cash flow sheet (attached) to prepare the cash flow statement (20 marks). Ms Zinhle has been operating a relatively small battery manufacturing business for the past eight years. Though her focus is the industrial market, she also sells direct to the public when opportunities arise. At the end of December 2021, her bank balance is expected to be R80 000. She expects to make sales of only R55 000 in December 2021, due to the closure of many companies for Christmas holidays and the Covid-19 pandemic. Her business has been doing very well prior to the pandemic but has since picked up in the past year due to the easing of the lockdowns. She does not expect to start operating at the same pre-Covid 19 levels at the start of January 2022. Her sales forecast are, R60 000 for the last 6 months up to December 2022. She expects sales to increase by 10% in January 2022 but remain the same thereafter until June 2022. The business' sales are 80% cash and 20% credit. The credit amount is collected in full the following month after the sale. Purchase of raw materials is usually 50% of sales. A list of his monthly operating expenses from January to June 2022 is as follows: Transport Labour R6 000 R26 000 Rent R5 000 Depreciation R500 The operating expenses are expected to be the same for the remainder of the year 2022. Once off bonuses of R10 000 are paid in May 2022. Zinhle makes withdrawals of R5 500 every month. She intends to buy a new laptop for R8 000 in March. An outstanding debt of R4 000 from the previous financial year will be received in April 2022. The business is making loan repayments of R5000 per month until December 2022. All transactions are taking place in 2022 excerpt where stated otherwise.

Step by Step Solution

★★★★★

3.32 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Ten Ring Ltd Journal Entries Date Dr Cr Dr Cr Note Cash inflo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started