Prepare a balance sheet

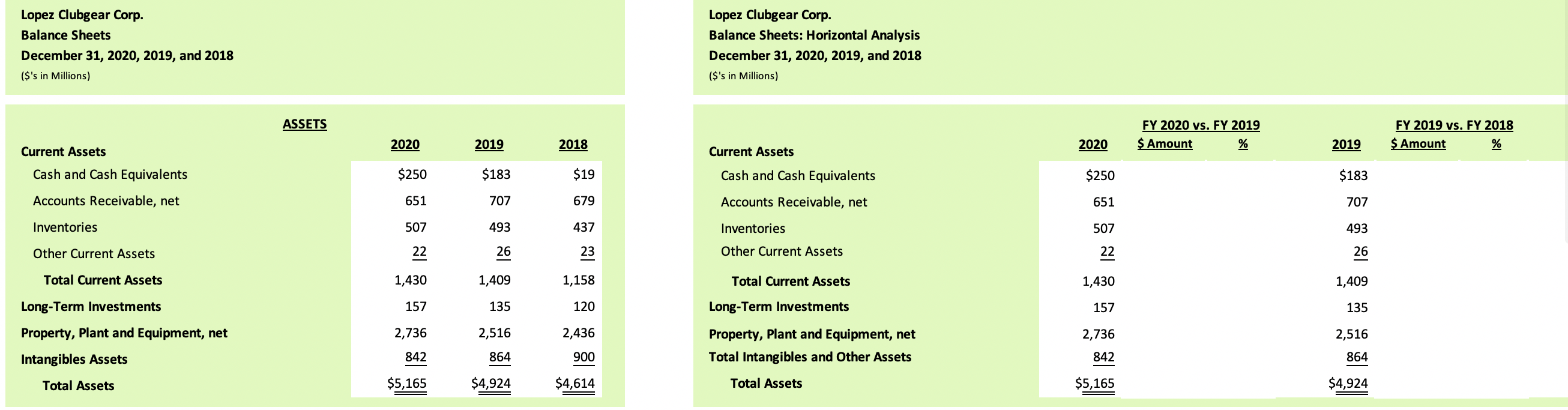

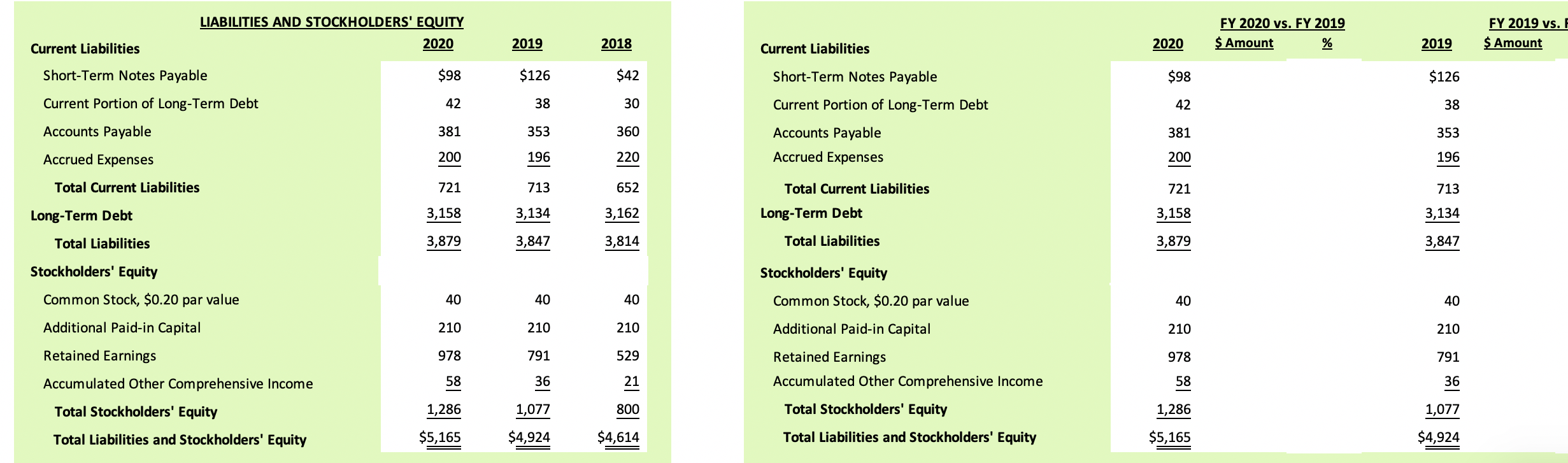

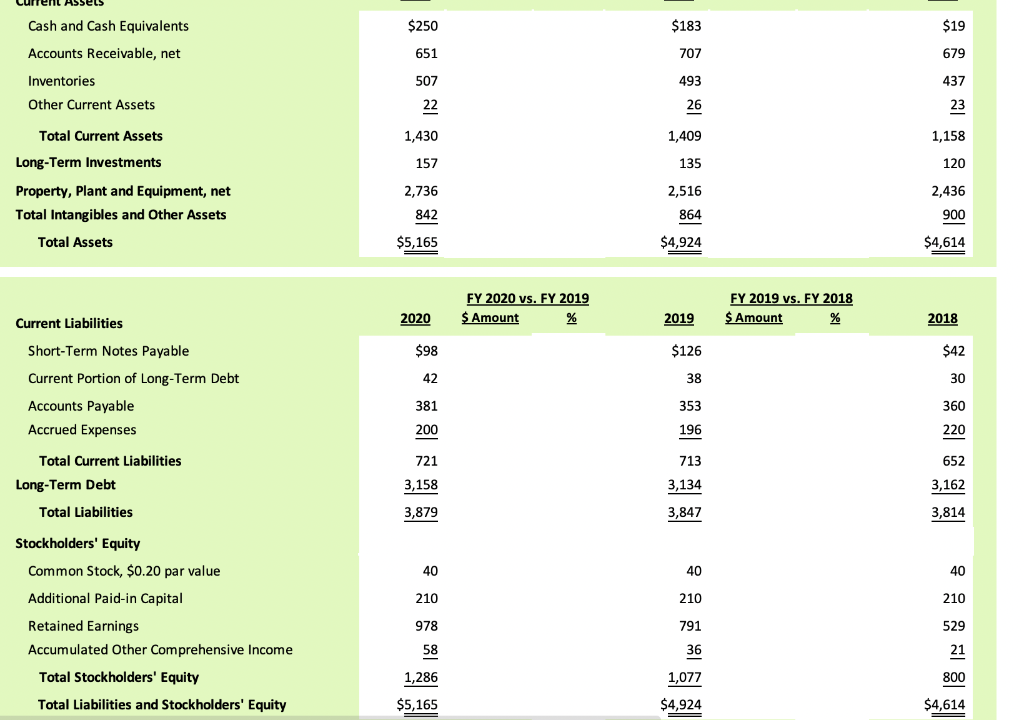

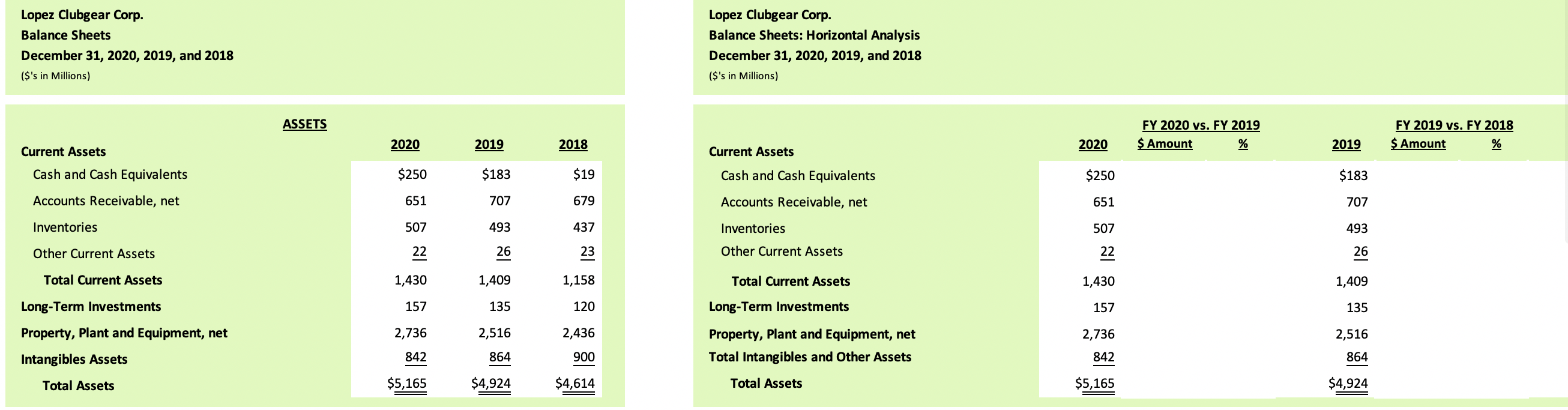

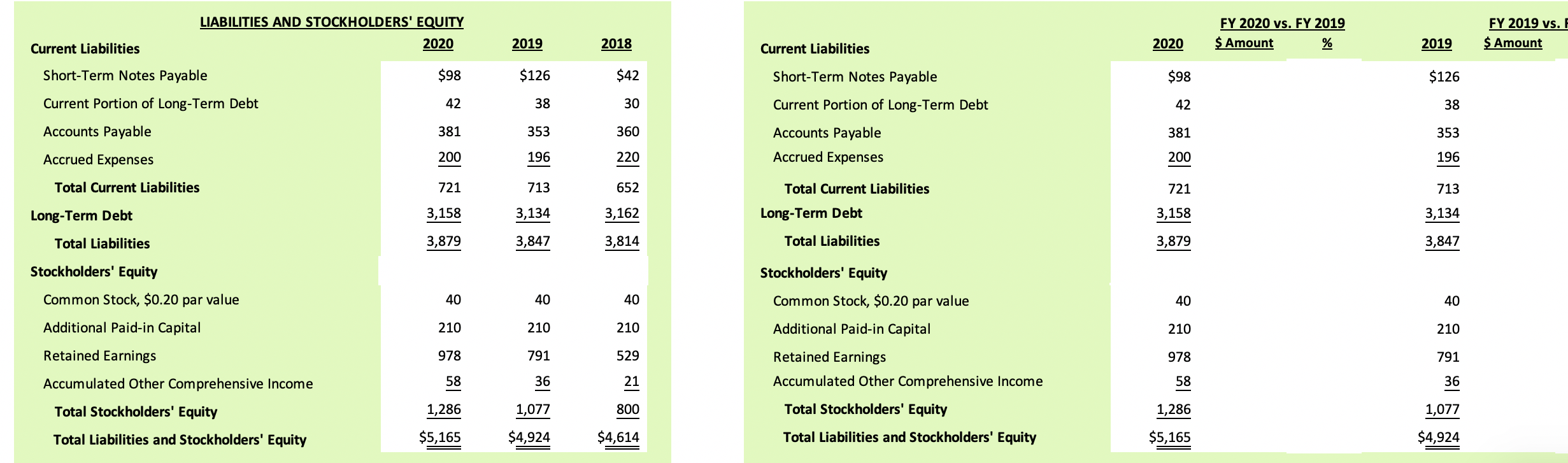

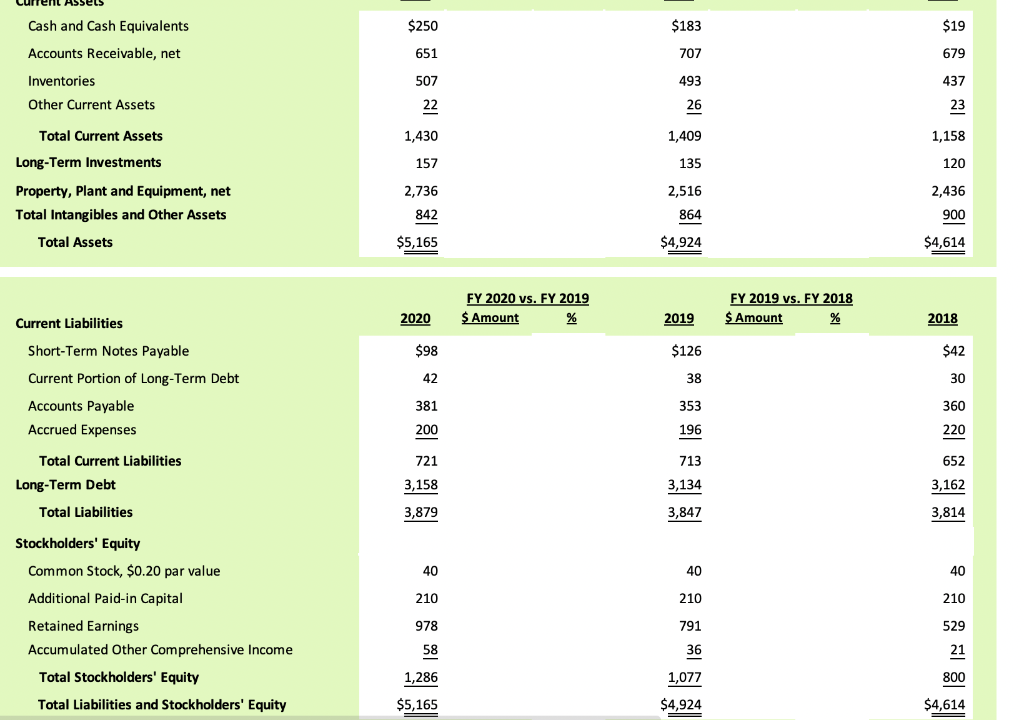

Lopez Clubgear Corp. Balance Sheets December 31, 2020, 2019, and 2018 ($'s in Millions) Lopez Clubgear Corp. Balance Sheets: Horizontal Analysis December 31, 2020, 2019, and 2018 ($'s in Millions) ASSETS FY 2020 vs. FY 2019 $ Amount % FY 2019 vs. FY 2018 $ Amount % 2020 2019 2018 2020 2019 Current Assets Current Assets Cash and Cash Equivalents $250 $183 $19 Cash and Cash Equivalents $250 $183 Accounts Receivable, net 651 707 679 Accounts Receivable, net 651 707 Inventories 507 493 437 Inventories 507 493 Other Current Assets 22 26 23 Other Current Assets 22 26 Total Current Assets 1,430 1,409 1,158 Total Current Assets 1,430 1,409 Long-Term Investments 157 135 120 Long-Term Investments 157 135 Property, Plant and Equipment, net 2,736 2,516 2,436 2,736 2,516 Property, Plant and Equipment, net Total Intangibles and Other Assets Intangibles Assets 842 864 900 842 864 Total Assets $5,165 $4,924 $4,614 Total Assets $5,165 $4,924 LIABILITIES AND STOCKHOLDERS' EQUITY 2020 FY 2020 vs. FY 2019 $ Amount % FY 2019 vs. ! $ Amount Current Liabilities 2019 2018 Current Liabilities 2020 2019 Short-Term Notes Payable $98 $126 $42 Short-Term Notes Payable $98 $126 Current Portion of Long-Term Debt 42 38 30 42 38 Accounts Payable 381 353 360 Current Portion of Long-Term Debt Accounts Payable Accrued Expenses 381 353 Accrued Expenses 200 196 220 200 196 Total Current Liabilities 721 713 652 721 713 Total Current Liabilities Long-Term Debt Long-Term Debt 3,158 3,134 3,162 3,158 3,134 Total Liabilities 3,879 3,847 3,814 Total Liabilities 3,879 3,847 Stockholders' Equity Stockholders' Equity Common Stock, $0.20 par value 40 40 40 Common Stock, $0.20 par value 40 40 Additional Paid-in Capital 210 210 210 Additional Paid-in Capital 210 210 Retained Earnings 978 791 529 978 791 Retained Earnings Accumulated Other Comprehensive Income Accumulated Other Comprehensive Income 58 36 21 58 36 Total Stockholders' Equity 1,286 1,077 800 Total Stockholders' Equity 1,286 1,077 Total Liabilities and Stockholders' Equity $5,165 $4,924 $4,614 Total Liabilities and Stockholders' Equity $5,165 $4,924 Cash and Cash Equivalents $250 $183 $19 Accounts Receivable, net 651 707 679 507 493 437 Inventories Other Current Assets 22 26 23 Total Current Assets 1,430 1,409 1,158 Long-Term Investments 157 135 120 2,516 2,436 Property, Plant and Equipment, net Total Intangibles and Other Assets 2,736 842 $5,165 864 900 Total Assets $4,924 $4,614 FY 2020 vs. FY 2019 $ Amount % FY 2019 vs. FY 2018 $ Amount % Current Liabilities 2020 2019 2018 $98 $126 $42 42 38 30 Short-Term Notes Payable Current Portion of Long-Term Debt Accounts Payable Accrued Expenses 381 353 360 200 196 220 713 Total Current Liabilities Long-Term Debt 721 3,158 652 3,162 3,134 Total Liabilities 3,879 3,847 3,814 40 40 40 Stockholders' Equity Common Stock, $0.20 par value Additional Paid-in Capital Retained Earnings Accumulated Other Comprehensive Income 210 210 210 978 791 529 36 21 Total Stockholders' Equity 58 1,286 $5,165 1,077 800 Total Liabilities and Stockholders' Equity $4,924 $4,614 Lopez Clubgear Corp. Selected Balance Sheet Items: Average Balances For the Fiscal Years 2020 and 2019 ($'s in Millions) FY 2020 FY 2019 Average Accounts Receivable Average Inventories Average Total Assets Average Accounts Payable Increase (Decrease) Amount Percent FY 2020 FY 2019 Net Earnings Net Sales Revenues Gross Margin Operating Margin Net Margin Lopez Clubgear Corp. Profitability and Performance Analysis: Efficiency For the Fiscal Years 2020 and 2019 Increase (Decrease) Amount Percent FY 2020 FY 2019 Total Asset Turnover Return on Assets (DuPont) @Fiscal Year-End 2020 2019 Amount Percent Working Capital Current Ratio Quick Ratio Lopez Clubgear Corp. Liquid Asset Management Analysis For the Fiscal Years 2020 and 2019 Increase (Decrease) 2020 2019 Amount Percent Inventory Turnover Days in Inventory Accounts Receivable Turnover Days in Accounts Receivable Operating Cycle Average Payment Period Cash Conversion Cycle Lopez Clubgear Corp. Solvency and Financial Leverage Analysis For the Fiscal Years 2020 and 2019 Increase (Decrease) Fiscal Year-End 2020 2019 Amount Percent Debt-To-Total Assets Ratio Debt-To-Equity Ratio 2020 2019 Times Interest Earned (TIE) Net Earnings Income Tax Expense Interest Expense EBIT