Question

Prepare a Business Memo on Cash Forecasting that answers the following questions: When will the company run out of cash? What solutions do you have

Prepare a Business Memo on Cash Forecasting that answers the following questions:

When will the company run out of cash?

What solutions do you have for the company to help them have enough cash for operations?

How much additional cash will the company need to generate in order to have enough to operate until year end?

If the Monthly Growth rate goes from 1% versus the prior month (current assumption for all stores) to negative 5% how long until the company runs out of cash?

How much additional cash will the company need access to in order to have enough to operate until year end?

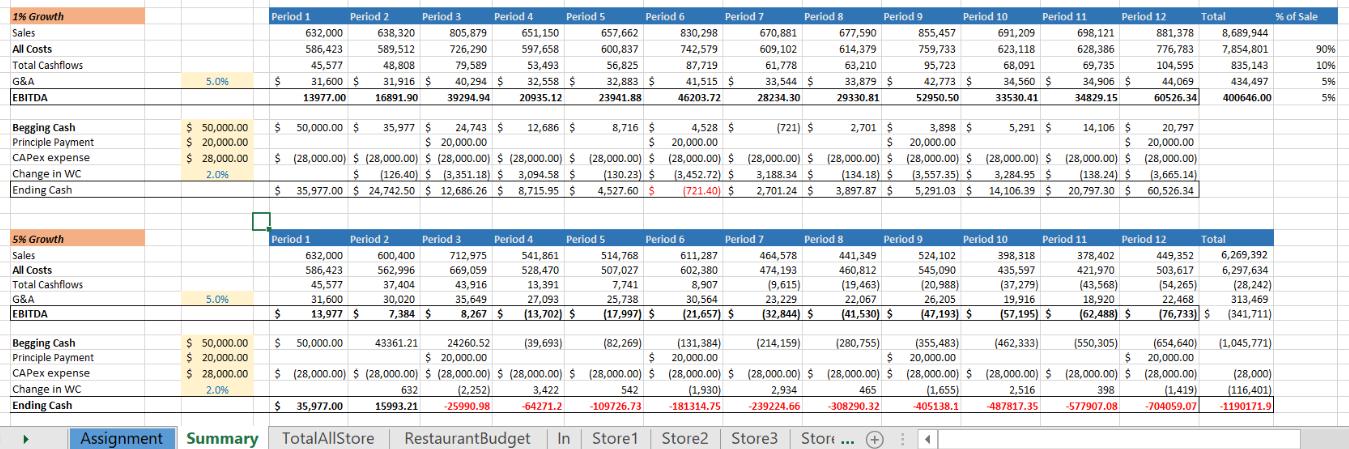

Using this summary table:

1% Growth Sales All Costs Total Cashflows G&A EBITDA Begging Cash Principle Payment CAPEx expense Change in WC Ending Cash 5% Growth Sales All Costs Total Cashflows G&A EBITDA Begging Cash Principle Payment CAPex expense Change in WC Ending Cash 5.096 5.0% Period 1 $50,000.00 $ 20,000.00 $ 28,000.00 2.0% $ 632,000 586,423 45,577 31,600 $ 13977.00 Period 1 $ Period 2 $ 50,000.00 $ 50,000.00 $ 35,977 $ 24,743 $ $ 20,000.00 $ 28,000.00 $ 2.0% 632,000 586,423 45,577 31,600 $ 50,000.00 638,320 589,512 48,808 31,916 $ 16891.90 13,977 $ Period 2 $ 20,000.00 (28,000.00) $ (28,000.00) $ (28,000.00) $ (28,000.00) $ $ (126.40) $ (3,351.18) $ 3,094.58 $ $ 35,977.00 $ 24,742.50 $ 12,686.26 $ 8,715.95 $ Period 3 600,400 562,996 37,404 30,020 43361.21 805,879 726,290 79,589 40,294 $ 39294.94 7,384 $ Period 4 Period 3 712,975 669,059 43,916 35,649 Period 5 651,150 597,658 53,493 32,558 $ 20935.12 8,267 $ 12,686 $ Period 4 541,861 528,470 13,391 27,093 (13,702) $ 657,662 600,837 56,825 32,883 $ 23941.88 Period 5 Period 6 8,716 S S (28,000.00) $ (130.23) S 4,527.60 $ 514,768 507,027 7,741 25,738 (17,997) $ (82,269) $ 35,977.00 Assignment Summary TotalAllStore RestaurantBudget In Store1 (39,693) 24260.52 $ 20,000.00 $ $ (28,000.00) $ (28,000.00) $ (28,000.00) $ (28,000.00) $ (28,000.00) $ 632 542 15993.21 (2,252) -25990.98 3,422 -64271.2 -109726.73 Period 6 830,298 742,579 87,719 41,515 $ 46203.72 Period 7 4,528 $ 20,000.00 (28,000.00) $ (3,452.72) $ (721.40) $ 611,287 602,380 8,907 30,564 (21,657) $ Period 8 670,881 609,102 61,778 33,544 $ 28234.30 Period 7 (721) $ 2,701 S $ (28,000.00) $ (28,000.00) $ 3,188.34 $ (134.18) $ 2,701.24 $ 3,897.87 $ 677,590 614,379 63,210 33,879 $ 29330.81 Period 8 464,578 474,193 (9,615) 23,229 (32,844) $ (214,159) Period 9 (280,755) 441,349 460,812 (19,463) 22,067 (41,530) $ Store ... (131,384) 20,000.00 (28,000.00) $ (28,000.00) $ (28,000.00) $ (1,930) 465 -181314.75 -308290.32 2,934 -239224.66 Store2 Store3 + Period 9 855,457 759,733 95,723 42,773 $ 52950.50 Period 10 524,102 545,090 (20,988) 26,205 (47,193) $ 4 Period 11 691,209 623,118 68,091 34,560 $ 33530.41 Period 10 14,106 S 3,898 $ 20,797 20,000.00 $ 20,000.00 (28,000.00) $ (28,000.00) $ (28,000.00) $ (28,000.00) (3,557.35) $ 3,284.95 $ (138.24) $ (3,665.14) 5,291.03 $ 14,106.39 $ 20,797.30 $ 60,526.34 5,291 $ Period 12 698,121 628,386 69,735 34,906 $ 34829.15 Period 11 398,318 435,597 (37,279) 19,916 (57,195) $ (462,333) 881,378 776,783 104,595 44,069 60526.34 Period 12 378,402 421,970 (43,568) 18,920 (62,488) $ (550,305) Total 8,689,944 7,854,801 835,143 434,497 400646.00 Total 449,352 6,269,392 503,617 6,297,634 (54,265) 22,468 (76,733) $ (28,242) 313,469 (341,711) (355,483) (654,640) (1,045,771) 20,000.00 $ 20,000.00 (28,000.00) $ (28,000.00) $ (28,000.00) $ (28,000.00) (1,655) 2,516 398 (1,419) -405138.1 -487817.35 -577907.08 -704059.07 (28,000) (116,401) 1190171.9 % of Sale 90% 10% 5% 596 596

Step by Step Solution

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started